Oh, behaviour

Market Selling Psychology

There are a lot of drivers of markets that we can easily discuss. These are mainly around supply and demand. As an example, how much grain will be produced and how much is going to be consumed.

We don’t often think about one which can be hard to quantify when it comes to marketing grain – it’s human behaviour.

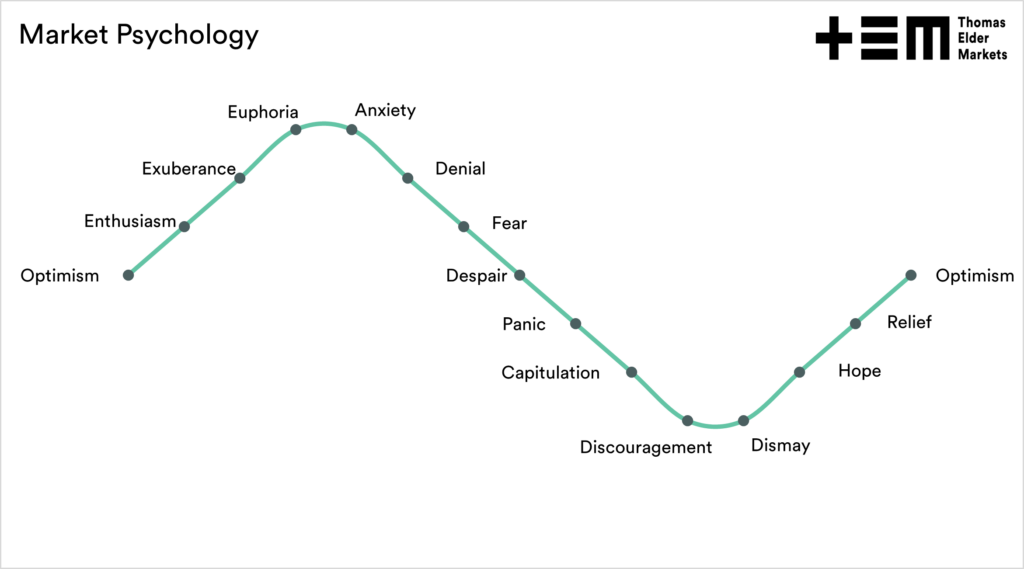

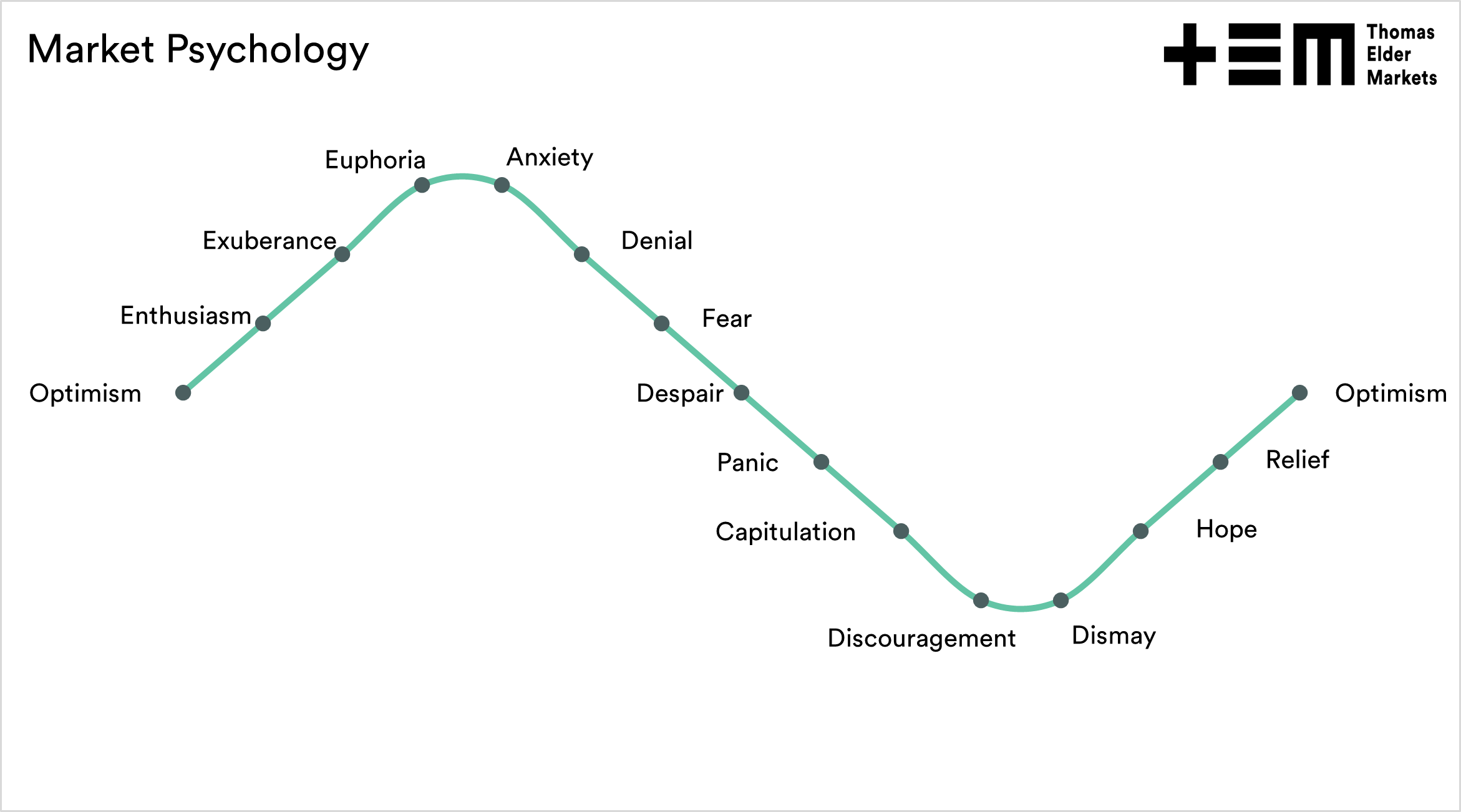

As humans, we are not perfect, and we get to feel the highs and lows of the market. The chart below is one of the first ones we show to our clients, as we believe it is of paramount importance.

This old text box chart represents our feelings as we travel through the market.

I have seen many market participants, both buyers and sellers, fall into traps in the market through their ‘feelings’. For example, when the market is rising, the grower stops seeing the potential for market falls; they feel a euphoria.

Often, I tend to see farmers stop selling as the market is rising.

“No point selling now; it’s only going to keep rising”.

Unfortunately, what often happens, especially in a market rallying strongly, is that we go over the peak before we start selling. Unless you are good (or lucky), it is almost impossible to pick the top of the market.

Instead of selling on the way up, we sell on the way down – averaging down instead of up.

It is important to note that markets cycle up and down. Ignore anyone that says the following, as it is nonsense on stilts :

- This is the new norm.

- It’ll never fall.

Many markets have been very bullish in recent times. A good example is the wheat market during the past month. Since the middle of May, wheat futures have fallen A$119/mt.

It’s not up to me to tell you when to sell (or buy) in the EP3 articles; it is just to provide information and ideas on the market.

I implore you to consider this chart when it comes to marketing your produce; at an individual level, it’s probably one of the most important ones for getting your mind right. When thinking of markets, take a look and think, where are we on this chart?