Retail lamb price reflects winter saleyard peaks

Quarterly Food Inflation Update - September 2025

Australian food inflation moderated through the September 2025 quarter, offering consumers modest relief after a year of elevated grocery costs. The latest data show mixed trends, while some categories eased, others remained stubbornly high compared with 2024 levels, suggesting that the fight against food-related inflation is not yet over.

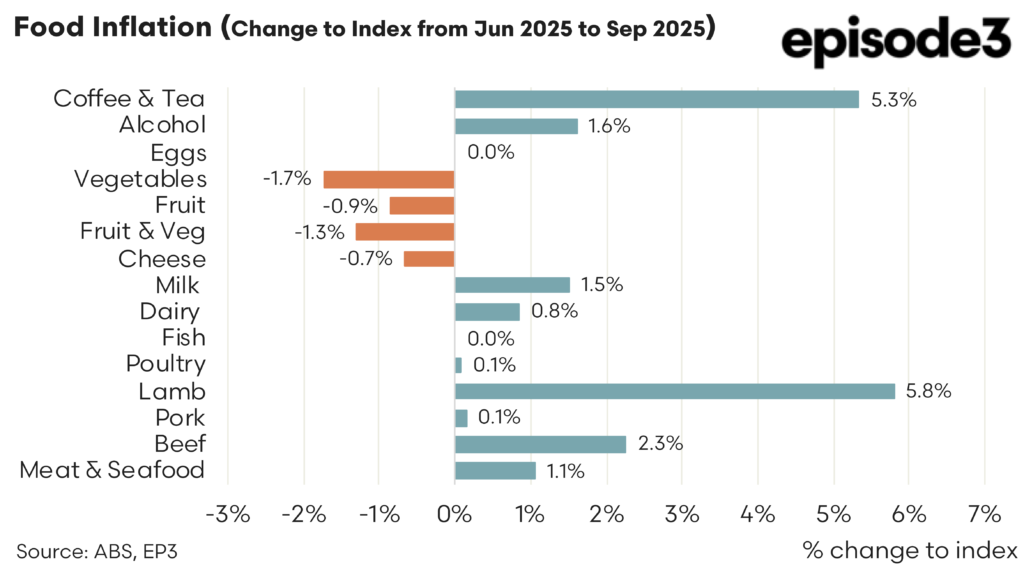

Quarterly Movements

Between June and September 2025, several fresh food categories recorded price declines. Vegetables fell 1.7%, fruit slipped 0.9%, and the combined fruit and vegetable category dropped 1.3%. Cheese also softened 0.7%, continuing a gentle retreat that has characterised much of the year as milk production improved and input costs stabilised.

In contrast, some categories edged higher. Coffee and tea rose 5.3% over the quarter, reflecting higher global coffee bean prices and currency-related import pressures. Alcohol gained 1.6%, while milk was up 1.5%, and beef rose 2.3%. Lamb jumped 5.8%, a continuation of seasonal shifts and tighter livestock supply conditions in the domestic market. Most other proteins were steady: poultry +0.1%, pork +0.1%, fish unchanged. Overall, the quarterly data show a mild easing in produce prices but an upswing in meat and beverage categories.

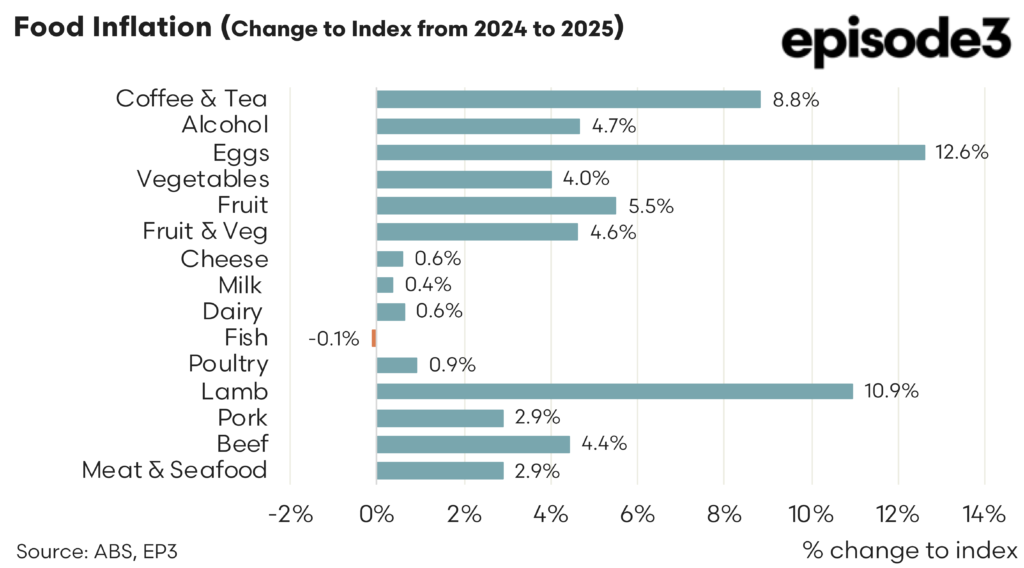

Year-on-Year Results

Despite the quarterly cool-down, annual food inflation remains elevated for key staples. Eggs are up 12.6% from 2024, by far the largest increase. This has been driven by supply constraints, feed cost volatility, and biosecurity measures limiting flock recovery. Lamb prices climbed 10.9% year-on-year, maintaining double-digit gains as processors contend with tight supply and solid export demand.

Coffee and tea also remain strong performers, up 8.8% year-on-year, while alcohol rose 4.7%. Fruit (+5.5%) and vegetables (+4.0%) reflect weather-linked swings in supply and transport costs. In contrast, dairy has been subdued: milk (+0.4%) and cheese (+0.6%) show minimal movement. The fish category is -0.1%, suggesting greater price stability in protein sectors less affected by weather and feed cost cycles. Pork (+2.9%), beef (+4.4%) and poultry (+0.9%) register moderate gains.

These figures paint a picture of divergence with consumers paying far more for eggs, lamb, and café-style items such as coffee and fruit, while staples like milk, cheese, and fish remain relatively steady.

The quarterly declines in fresh produce prices signal improving seasonal supply after winter, helping offset the inflation seen in protein and beverage categories. However, the persistence of double-digit annual inflation in eggs and lamb underscores the uneven pace of recovery across food sectors.

The broader takeaway is that while food inflation may have passed its peak, the cost of everyday meals, especially those built around animal proteins and café-style luxuries, remains high compared with a year ago. Consumers may feel some relief at the checkout for fruit and vegetables, but brunch staples are still leading the inflation table.