Risky Business

Risk Management for Agriculture

The importance of forward markets and the value of price risk management to the Australian agricultural landscape has been highlighted over the last five years. The need has been cited by almost ever peak industry body, but the wool industry is one of the few that have been addressing the key issues of product development education and extension.

Understanding risk management is what separates the trader from the gambler. Growers of all commodities inherently take on multiple levels of risk. They have no choice as they move through the production cycle. How they manage that long position is the key to success.

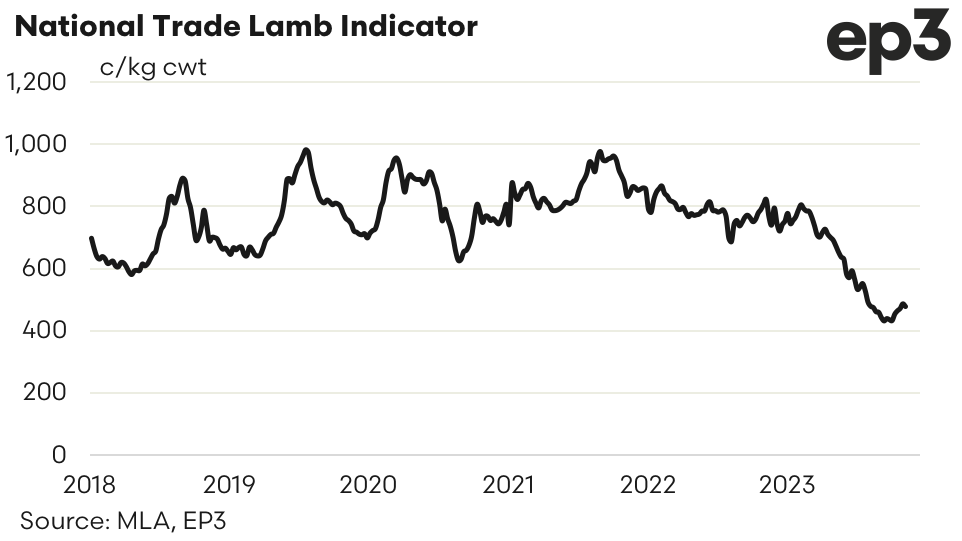

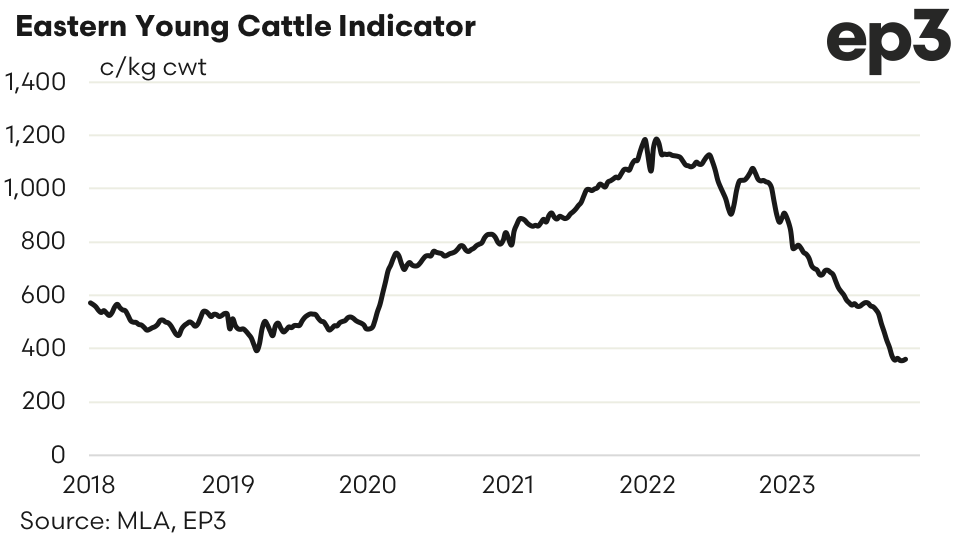

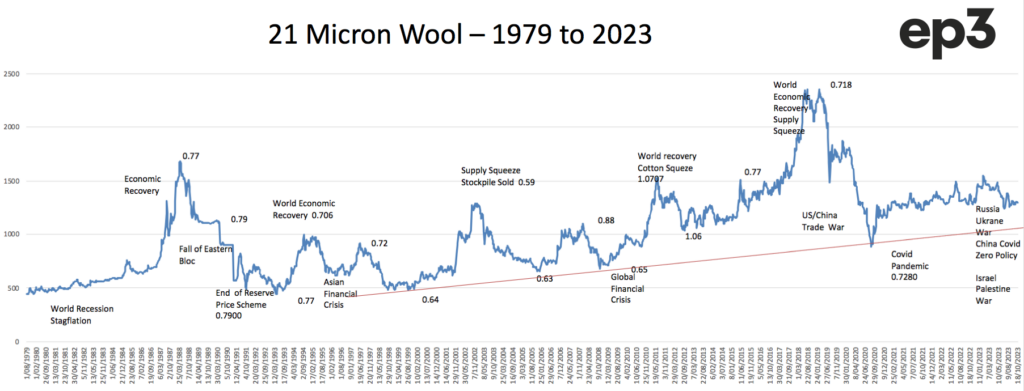

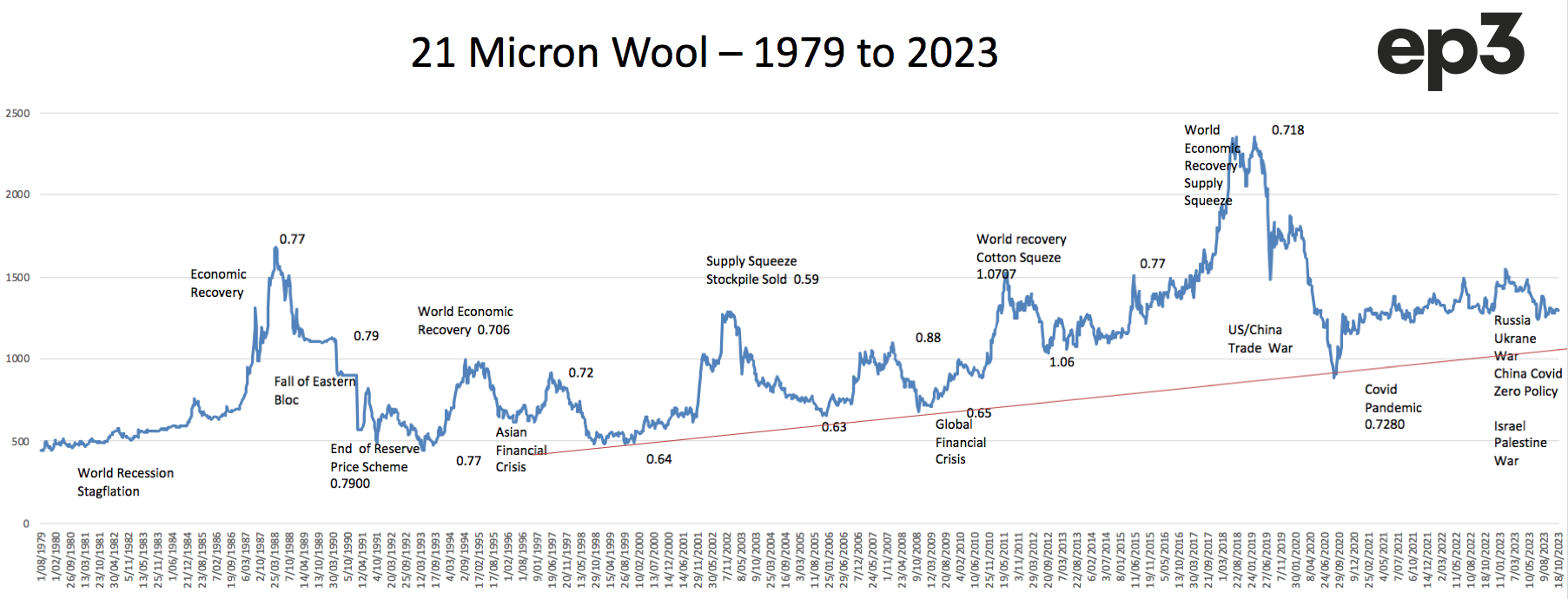

The charts below show the price movement of the major indicators in the beef, lamb, and wool industries. The price fluctuations in beef and lamb have been dramatic and the lack of forward markets have placed an enormous impost on growers.

In wool, just like any commodity, the role of a reliable forward market should be to provide trustworthy and transparent price signals and better risk management across the supply chain. An efficient forward market also guarantees the supply of wool into the pipeline allowing for efficiency in machinery optimisation and flow of product to the consumer. In times of high volatility in the auction market, substantial amounts of wool are withdrawn then added to the weekly volumes which is challenging for buyers to plan purchases. If a larger proportion of the market was locked into forward contracts, then the auction would become the balancing market for pipeline management.

The change in the manufacturing base to China and the exporter/trader landscape has had some impact on the strength and liquidity of the forward market. A more ‘just in time’ philosophy from the dominant Chinese mills has reduced appetite and need for exporters to be hedging their long-term positions. From the sell side, the overhang of the perceived protection of the reserve price scheme and the resultant stockpile masking the market dynamics also hindered growth.

These challenges, nor the relatively benign volatility at present, should not lessen the necessity to improve the understanding of price risk management and its role in ensuring a healthy landscape going forward. The long-term graph below emphasises the frequency of the external influences on markets.

The current Israel/Palestine conflict further underlines these concerns. To that end an all-industry approach has been undertaken to provide better resources. These include a Risk Management Course for growers on the Woolmark Learning Centre and upcoming webinars/seminars organised in conjunction with your wool broker.

The current macro-economics are not positive, but the existing spot and forward prices do give pause. That said, with the current forward prices relatively flat to spot auction some insurance against further decline could be warranted.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in agricultural markets.