Waiting for an investor like you

Independent Contributor

Overseas Investment

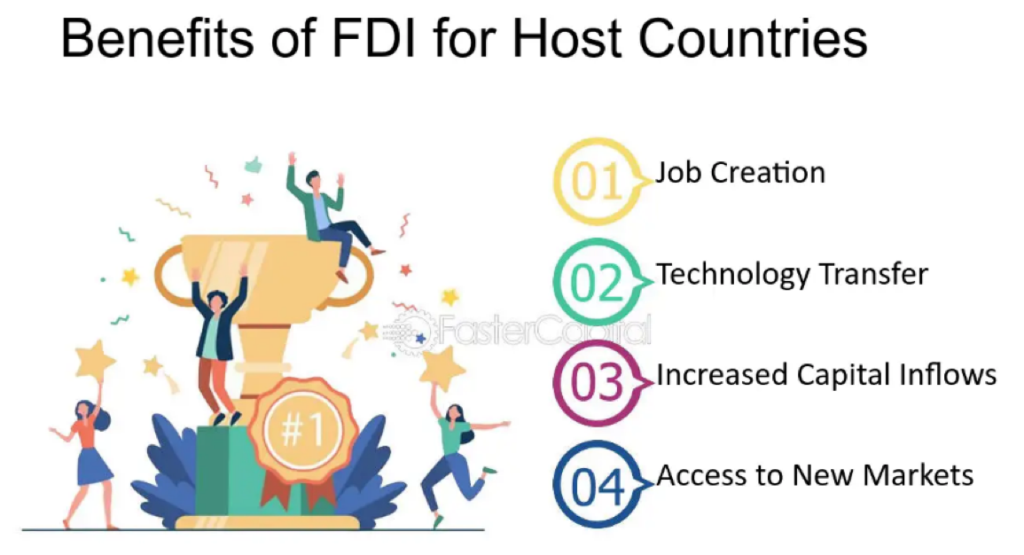

A common point of discussion is the positives and negatives of overseas investment (Foreign Direct Investment or FDI) and its influence on a country’s sustainability. Agriculture is often the more emotive of industries, commercial and industrial property seen as ‘black and white’ due to the generally lower environmental and people risk associated with their Opco’s.

Climate change is having an impact in the commercial sector too, with many buildings experiencing insurance premium hikes, and the more recent ‘brown’ discounts and ‘green’ premiums linked to carbon emissions offsetting.

With less corruption and perceived political stability, Australia and New Zealand are still top places to invest, especially for risk averse pension funds, often land is seen as an inflationary hedge or a place to park money when bank investment rates or government bonds are similar to the inflation rate or lower…..

The point here is if your bank investment rate is less than inflation you are in fact losing money, and with a growing middle-class population developing a taste for mackers and ice cream, quality protein producing farms would seem safe long term.

Many of the superfund risk analysis models are going to like us, apart from those who understand the people risk involved in agriculture and there are many of them, for example some won’t touch dairy as the difference between a good manager and not so engaged manager can be 10% EBIT or 0% EBIT on today’s Milk Price. Dryland cropping has the same risk in unreliable rainfall areas and frost risk areas.

Those who oppose overseas investment are rightly proud Australians/Kiwis who purchase Australian/NZ made and have worked hard. Sometimes there are cultural differences that affect the welcoming of overseas capital, Indian and Asian values or business acumen often don’t seem as aligned to ours as North American or European Investors.

But the real question is why aren’t the next generation stepping up and borrowing heavily to work in their own agriculture businesses?

That is the reality…..I know many skilled managers running corporate farms, overseas owned who are well paid, $120-160K including house and vehicle, they have a good level of autonomy and are often resourced better than many family-owned operations.

Good resourcing as in infrastructure, machinery, and staff. This means than can get their work done on time and have structured time off, some family operations are guilty of pushing the old John Deere tractor or quad bike past the 10,000 hours or 30,000km and this leads to break downs, break downs lead to longer hours, more mistakes…..more mistakes lead to mobs or herds ‘breaking out’ more…..this leads to staff turnover and fodder wastage…..and it all flows to the bottom line…..

Poor corporates can have the same issues, but with an allergy to bad ESG publicity it’s become less likely. Now if you were 24, jakarooed for a couple of years, studied a bit of Ag…..what would you rather do?

- Work yourself into a well-resourced managers job for a corporate.

- Consider a cruisy city gig where you and your partner both earn 80-100k working 38hrs a week.

- Borrow $5,000,000 to pay out a couple of siblings, help the olds retire and take over the family farm…..now with a $350,000 interest bill which is effectively your EBIT most years…..and work 60-80 hours a week.

It ain’t rocket science…..

The reality is that since the 2018-19 drought the risk has been too high for many, with the exception of the neighbour buying, many family farming legacies have finished mainly because the overseas buyers, sometimes JV’s with minority Australian partners, have the ability to inject the capital required to farm with less risk. This means better infrastructure, as in good cropping machinery so crops are sown and harvested on time, or modern rotary dairies for one person to milk 700 cows instead of two milking 300 in an aging swing over or herring bone.

Combine this with only 20% of Gen Z and millennials wanting to own their own business, (UBS Investor Watch) down from 40% of Gen X and 50% of boomers means we need overseas investment.

At 30 June 2023, according to the Foreign Ownership Report, 13% of Australian land is held by overseas owners, although a quarter have a resident equity partner.

The countries that own the greatest slice of Australian farmland are

- China highest with 2.1%.

- UK own 2%

- Canada 0.8%

- Netherlands and the United States, both with 0.6%

The biggest investor is Canada’s PSP Investments – the pension for the Canadian public service and the world-famous Royal Canadian Mounted Police – who has put together a huge portfolio of farmland assets over the past ten years now worth $7.5 billion in Australia alone.

With just 13% in foreign ownership, I suggest an invasion is unlikely. The current rate keeps capital circulating and farm values strong, this generally helps more than hinders succession or retirement planning…..a key factor in Sustainability.