A quiet lift

Wool Market Update 7th June 2024

“The monotony and solitude of a quiet life stimulates the creative mind” – Albert Einstein

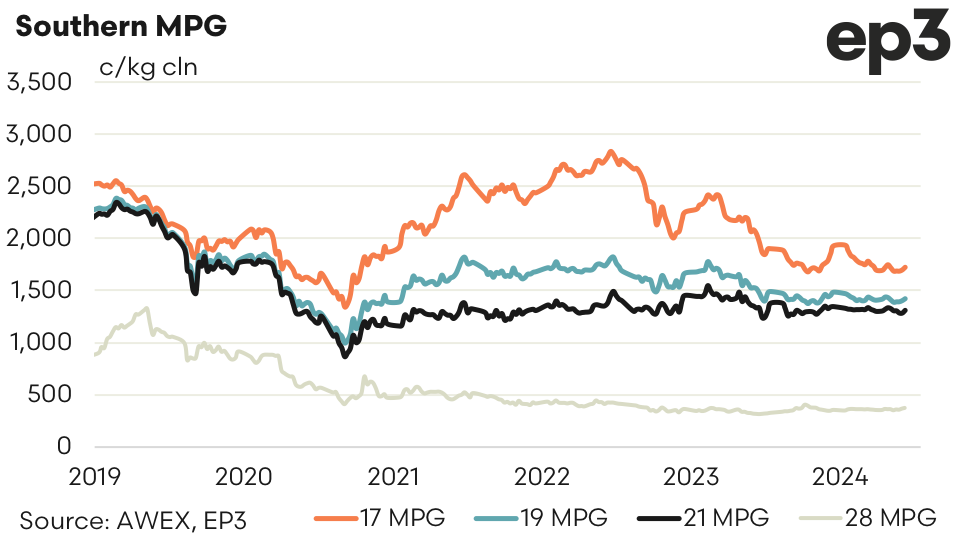

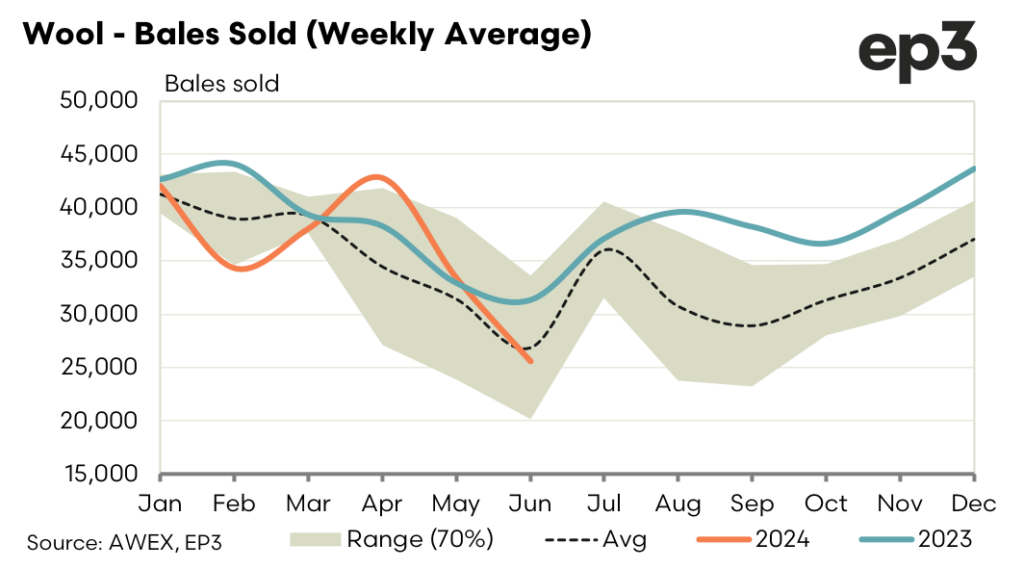

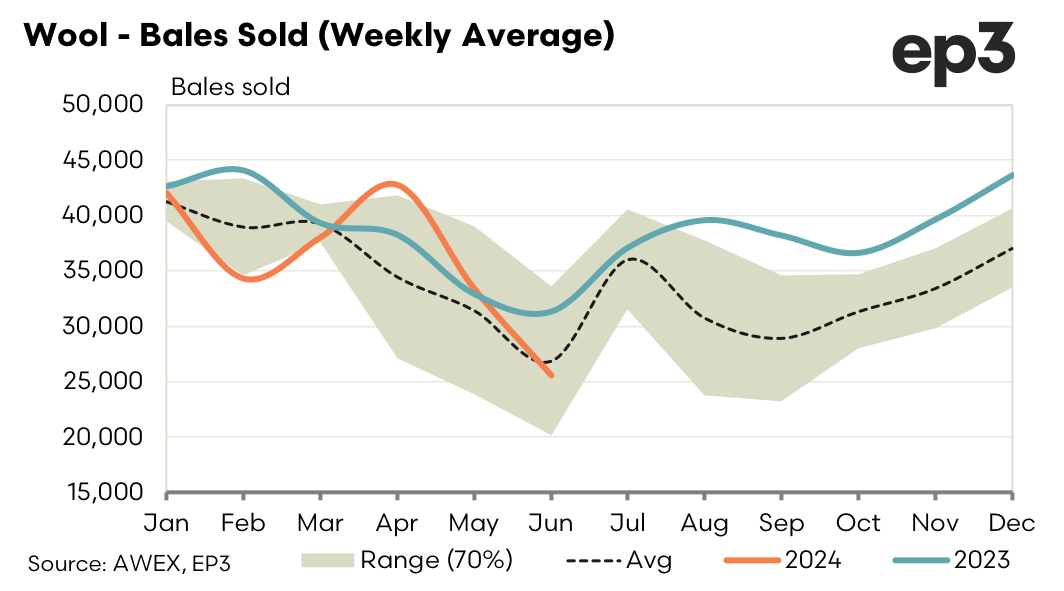

A solid week for the auction. All microns showed improvement of between 1 and 2 per cent for the week with the modest supply (27,000) matching the limited demand. Indent orders continue to dominate activity leading to the market being range bound and influenced by the foreign exchange particularly USD. Passed in rates remain low (5%) with growers accepting the unexceptional prices the spot market.

The forward market had a limited lift reflecting the “just in time” nature of export market at present. Strong forward indications had been restricted to the latter part of 2025 into 2026 and 2027 where premiums of around 100 cents to spot are offered. This week’s trades focused on the early part of the new season out to December 2024. 19.0 micron traded December at a 1460 (a 40-cent premium to cash) and 19.5 traded September at 1415 (a 30-cent premium). These trades triggered grower interest which saw limited offers posted at similar premium levels for 19.0 and 19.5 from July to December. These offers have yet to generate further action from the exports and processors indicating the concerns around medium term consumer confidence and the geopolitical situation. Notwithstanding the restrained volume the trading did highlight the importance both buyers and sellers having levels in the market to give all participants in the pipeline, if not certainty, an indication of future direction.

With supply again limited to around 33,000 bales next week the market is likely to remain range bound driven again by the indents and currency vagaries.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.