A strong finish or a happy ending?

Wool Market Update 14th July

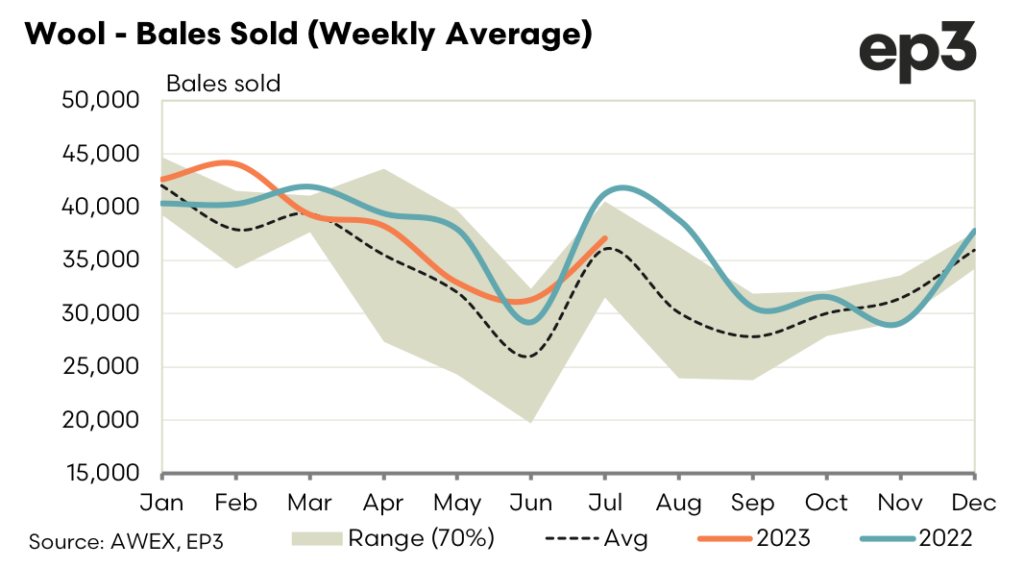

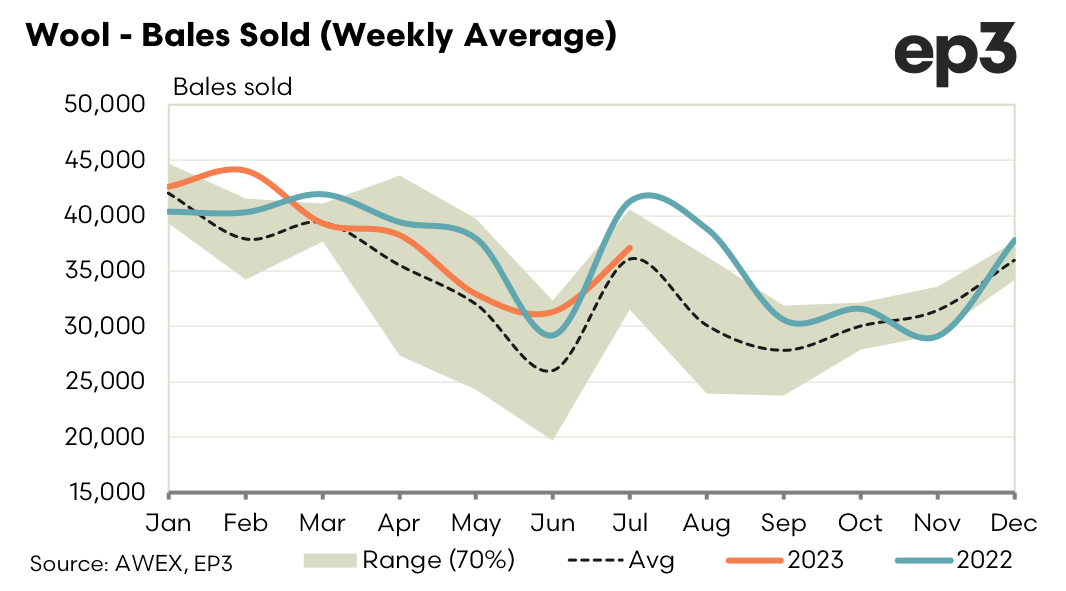

A strong finish to the spot auction market as we move into the three-week recess. The last two weeks has seen a rebound in all merino qualities of more than 5%.

The bounce was not unexpected but quoting Winston Churchill – “I always avoid prophesying beforehand because it is much better to prophesy after the event has already taken place.”

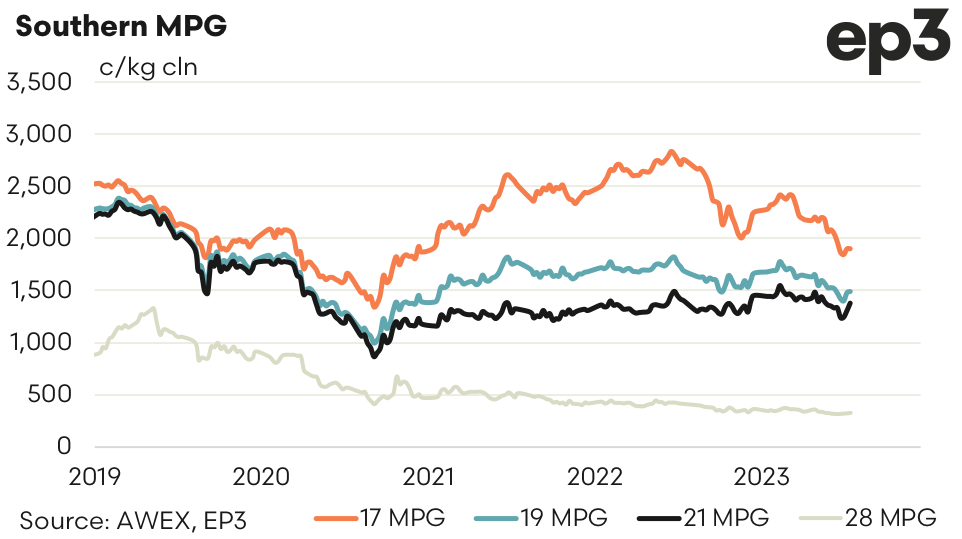

Prices had retracted more than 20% since the February highs with 19.0 micron falling 360 cents and 21.0 falling 290 cents. The rally has seen prices improve 84 and 139 cents respectively.

On the forward markets trades were again light with August trading close to cash for 19.0 micron. 21.0 micron traded at a discount of 3%. This was likely due to tight supply of the 21 micron which saw rise of over 10% in the last fortnight.

So, what does that mean for the new season?

If we look at the price movements for the past decade the picture is no clearer. Seasonality will likely count for little. The long-term cycle trend seems to hold sway. Considering the 19.0 micron prices the possibility of continued rally will depend on the macro-economics rather than the seasonal supply variations.

With just two more sale weeks before the three-week recess hopefully we will see enough demand inspired by gap in supply and an advantageous currency to encourage forward bidding into the spring.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.