Against the wind

“An airplane takes off against the wind not with it” – Henry Ford

An interesting week for all concerned. The two big races have come and gone with results mixed to say the least. The was run and won by a rank outsider but provided the feel-good story of the week. The USA election delivered a result that has the world a little apprehensive.

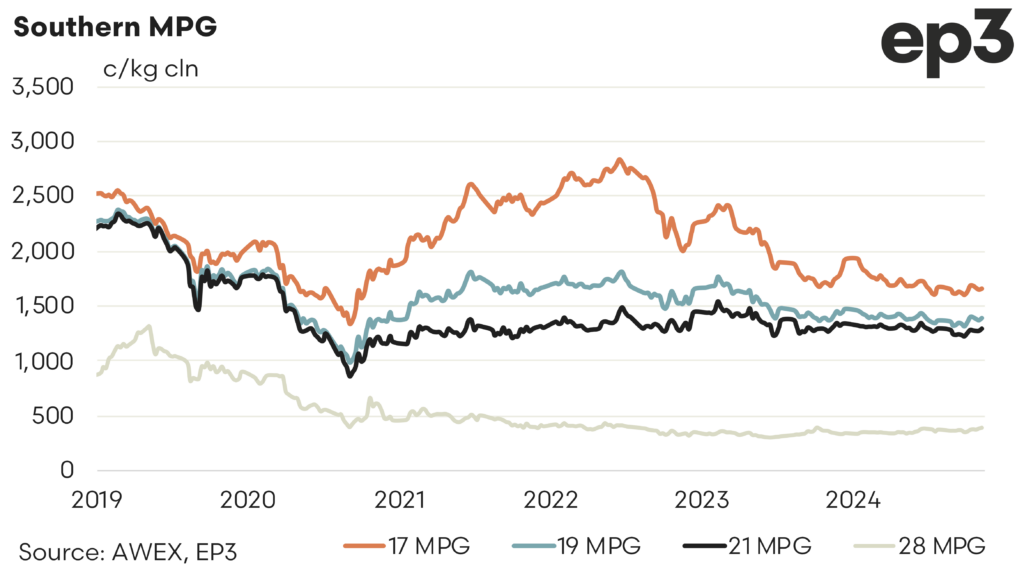

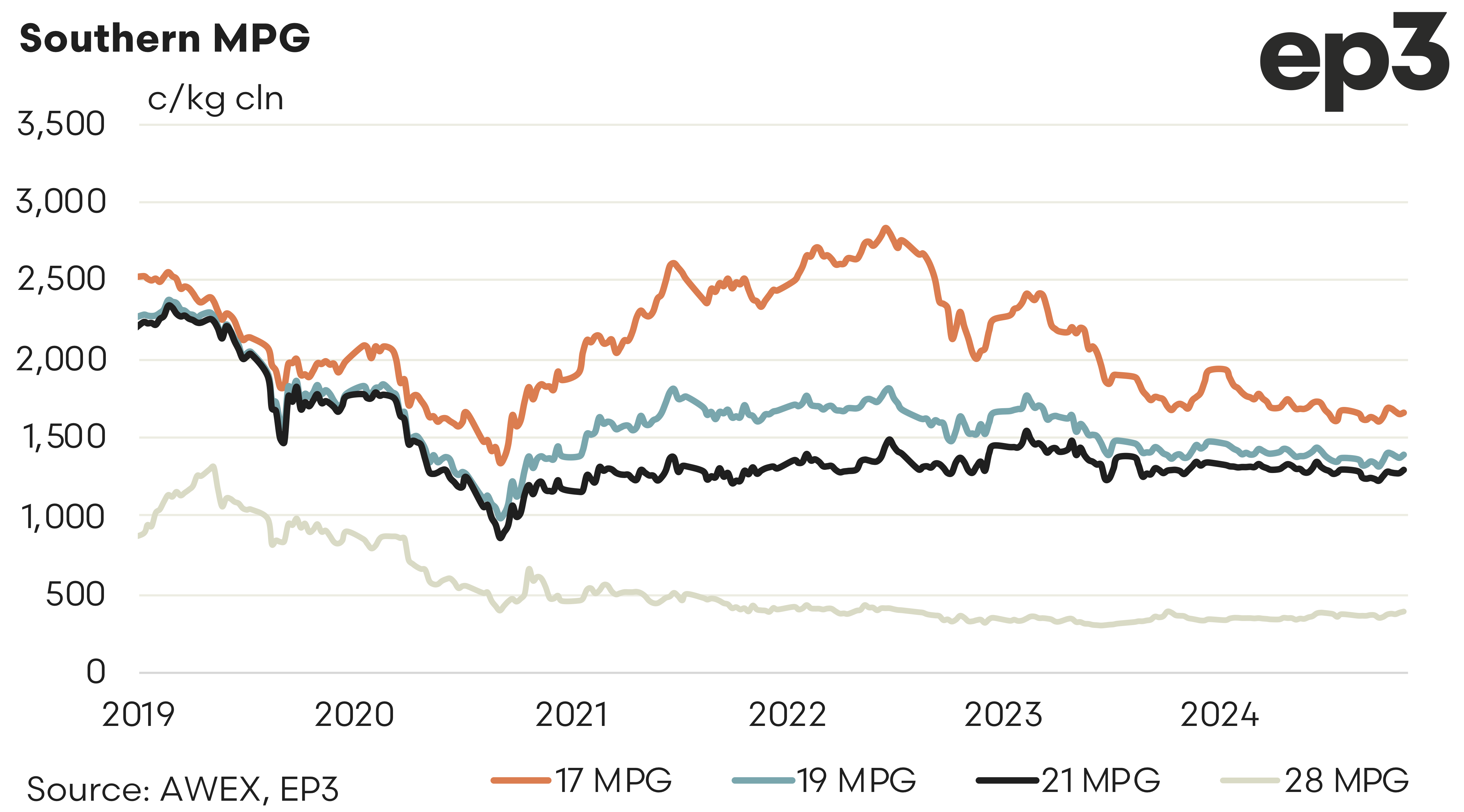

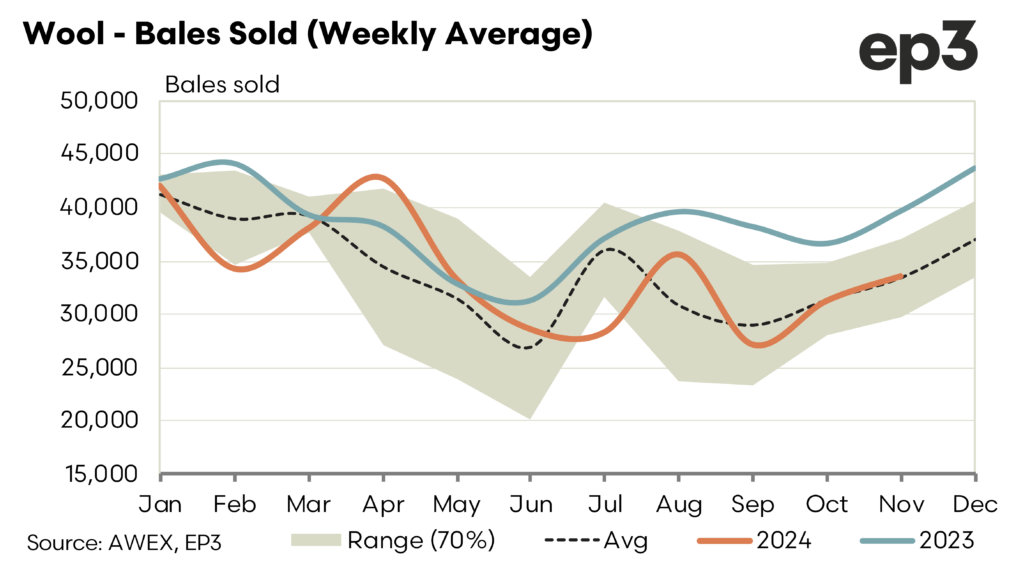

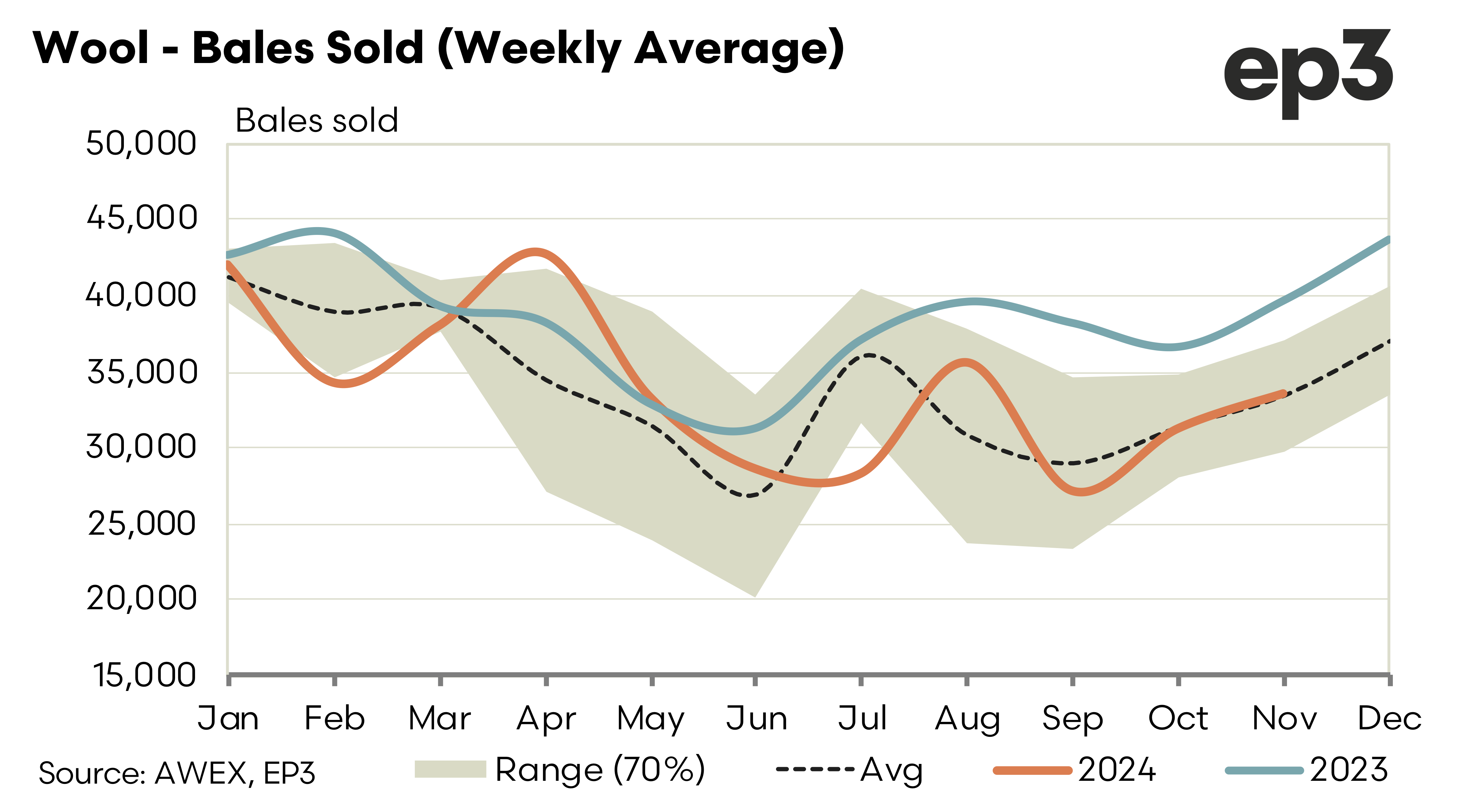

The spot auction had a varied week selling over three days due to the public holiday in Melbourne. It was a positive result with most micron groups posting gains. Middle microns, 19.0 to 21.0, and Crossbreds fared best gaining between 1.5 to 2 per cent. These gains were against a backdrop of a strong USD confirming the long-held view that currency movements modify the loses or gains on commodity markets but do not define direction.

The forward markets had an interesting week. Trade early in the week was focused on the latter months of 2025. Most micron groups traded with maturities varying from April through to November 2025. Premiums ranged from 30 to 100 cents. The highest premiums being for the later dated maturities. Later in the week the front months came to the fore. 19.0 traded December at 1425 (a 24-cent premium). Interest remains across November and December at plus 10 to spot and January and February at 30 cents over cash. The latter part of 2025 and into 2026 remain bid in limited quantities at 50 cents plus to cash.

What the future holds is anyone’s guess with USA policies as hard predict as the man himself. This was highlighted by the movements in the cotton market. Flat Wednesday ahead of the election, Down Thursday coming under pressure from a rising US dollar and falling oil prices. Friday, cotton found support attributed to US economic optimism post Trump re-election. Uncertainty the only common denominator in the time being.

Hedging levels are likely to remain in place with interest in place from spot to February and again in the latter part of 2025. Auction flows continue to be steady. With passed in rates around 5 percent hopefully the premiums in the forwards will attract attention.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.