Against the wind

Wool Market Update 23rd August 2024

“When everything seems to be going against you remember the airplane takes off against the wind, not with it” – Henry Ford

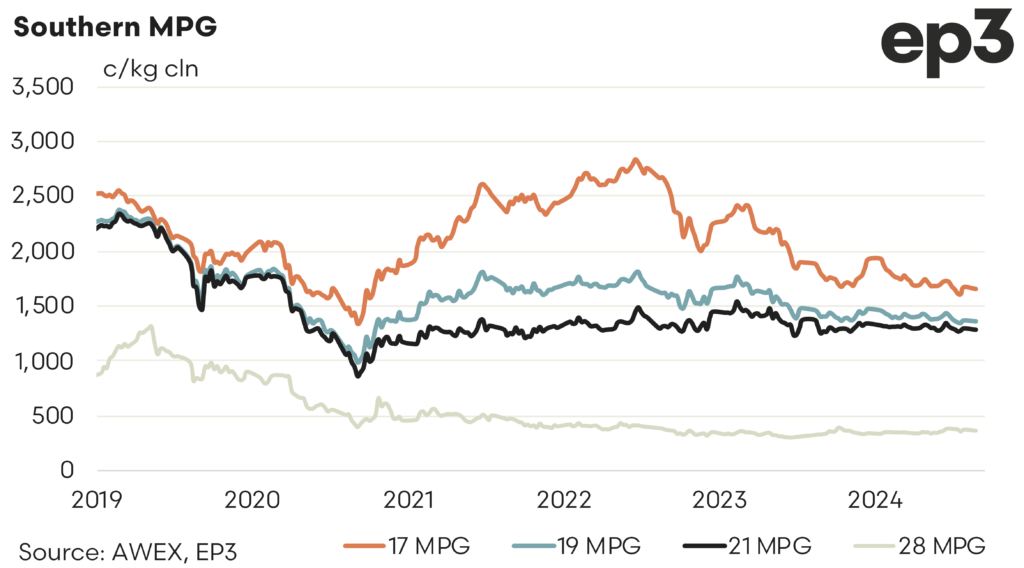

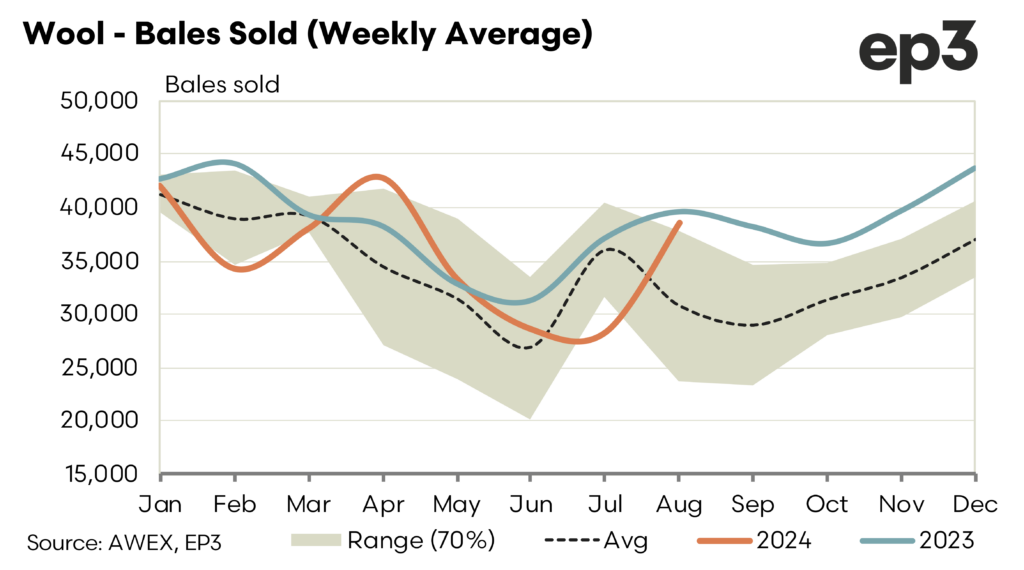

Trading conditions remained relatively flat of the recess although reports of sporadic interest helped along by a weaker Aussie dollar gave a glimmer of hope for the start of the regular season. The stronger Aussie/weaker USD dash those hopes and we returned to a pattern that has dogged the market for the eighteen months or more. Tepid demand, short term focused, indent dominated and hypersensitive to currency fluctuations. Prices fell across the board between 1 and 2% in Australian Dollar terms but rose slightly in USD. Finer wools were most affected in the merino types but medium merinos and fine crossbreds couldn’t avoid a slight downturn. Coarser crossbreds held up well rising a few cents for the week.

With the focus on the short-term delivery window the forward market continues to be ignored therefore providing little or no real signals to either producers or processors. This is a potentially deadly and unhealthy position for a market to be in. Recent active messaging by industry peak bodies have yet to bare fruit. With the most recent production forecast having volumes down by as much as 10% processors and end users need signal their intent. The light trading that has occurred for 2025 and into early 2026 has occurred at 100 to 130 cents above current spot levels. This needs to return to stimulate confidence. Producers need to follow suit by either hedging some of their clip should the opportunity arise or posting target levels.

The only bids of consequence are in January 2026. 19.0 microns bid at 1500 (130 over spot) and 19.5 at 1450 (120 over spot). The spot market hasn’t traded above 1500 and 1450 since 6th June 2023. Although an imperfect indicator at least positive. Hopefully we will see more encouraging signs soon.

No trades on the forwards this week.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.