An impossible challenge?

“People say nothing is impossible, but I do nothing every day.” ― A.A. Milne, Winnie-the-Pooh

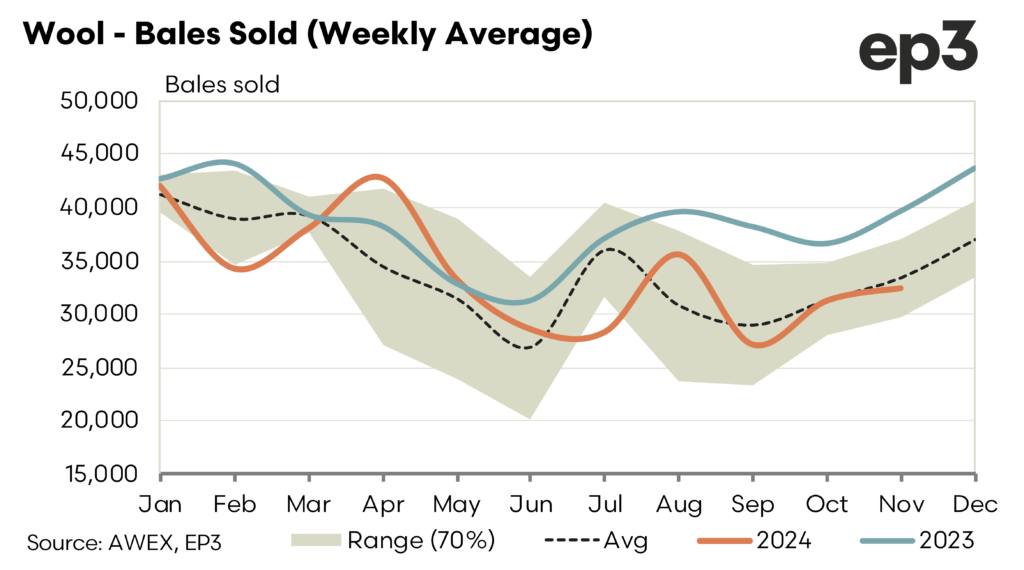

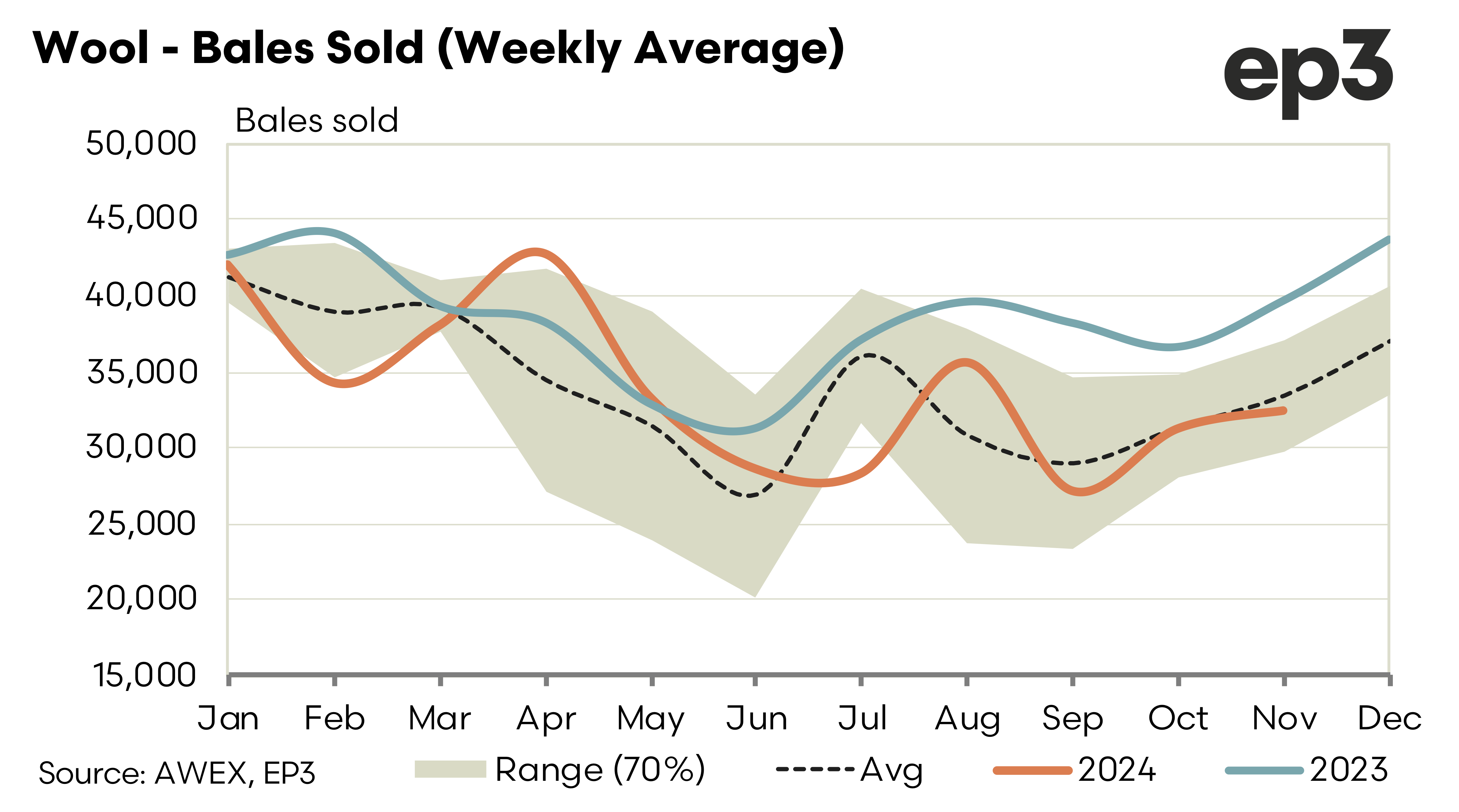

Another week where the spot and forward market continue their meandering ways. At auction passed in rates remain low and wool is flowing through the pipeline. The positive side is that there is little build up in stocks to dampen any recovery in price when better demand does come. This is balanced by the fact that season to date testing (July to present) is down 20% and prices have oscillated in a very tight range.

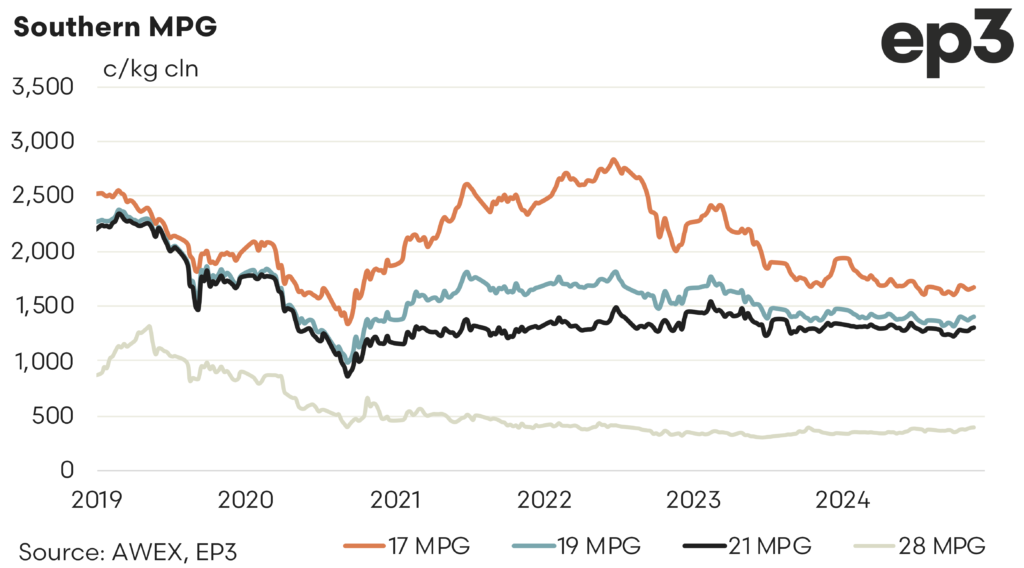

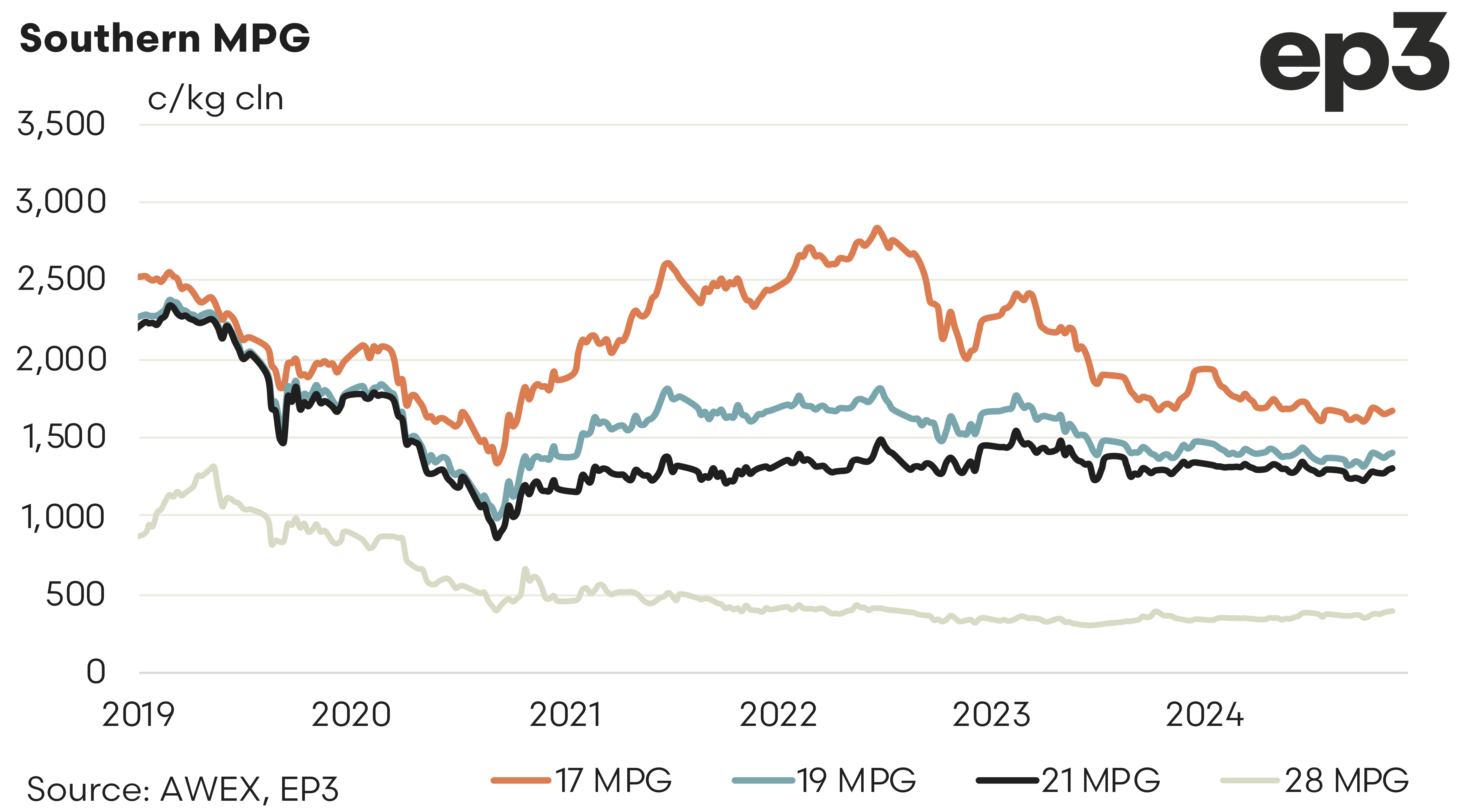

19.0 micron opened July 1379, high 1418, low 1331, average 1373, Currently 1412. For 21.0 micron a similar story opened July 1296, high 1311, low 1232, average 1276, Currently 1311.

Demand remains the key. The blip caused by the positive reaction to the US elections has somewhat abated. Most commodities are in a wait and see mode with little to play out until the new year. Demand out of our key markets remains intermittent at best.

The forward market posted only one trade for the week with November 2025 traded at 1475 (63 cents over spot). General the forward market is better bid than offer but remains frustratingly illiquid. More activity is required before we can put faith in the robustness of the forward curve. Bidding currently presents a curve that is flat to Christmas, a 20 cent (1.5%) premium in early 2025, 40 cent (3%) premium in late 2025 and an 80 cent (6%) premium into 2026.

It is difficult to see too much change next week. Supply remains steady at their seasonal lower levels. The roster for the next three weeks, year on year, still coming in around 15 to 20% down. Bidding in the forwards should hold until the auction opening Tuesday.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.