Another path

“If you don’t like the road you’re walking, start paving another one.” — Dolly Parton

After last week’s currency driven rally, the spot auction eased between half and one percent, in line with stronger AUD. The five-year low in the exchange rate was unable to simulate the market out of it’s tight trading range that has held for the last two years.

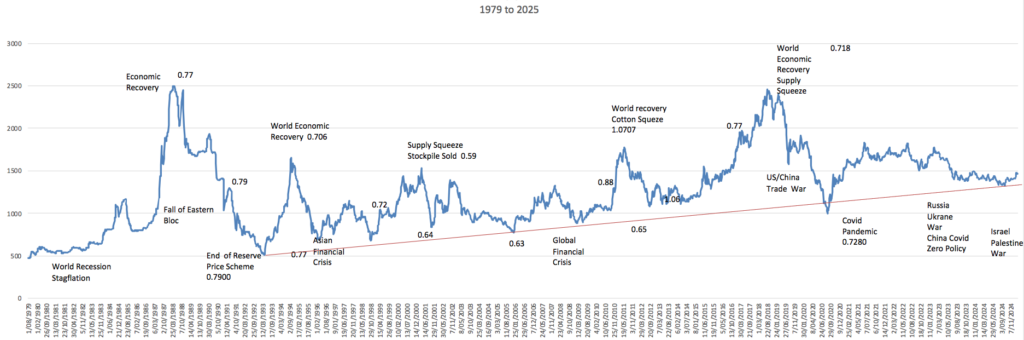

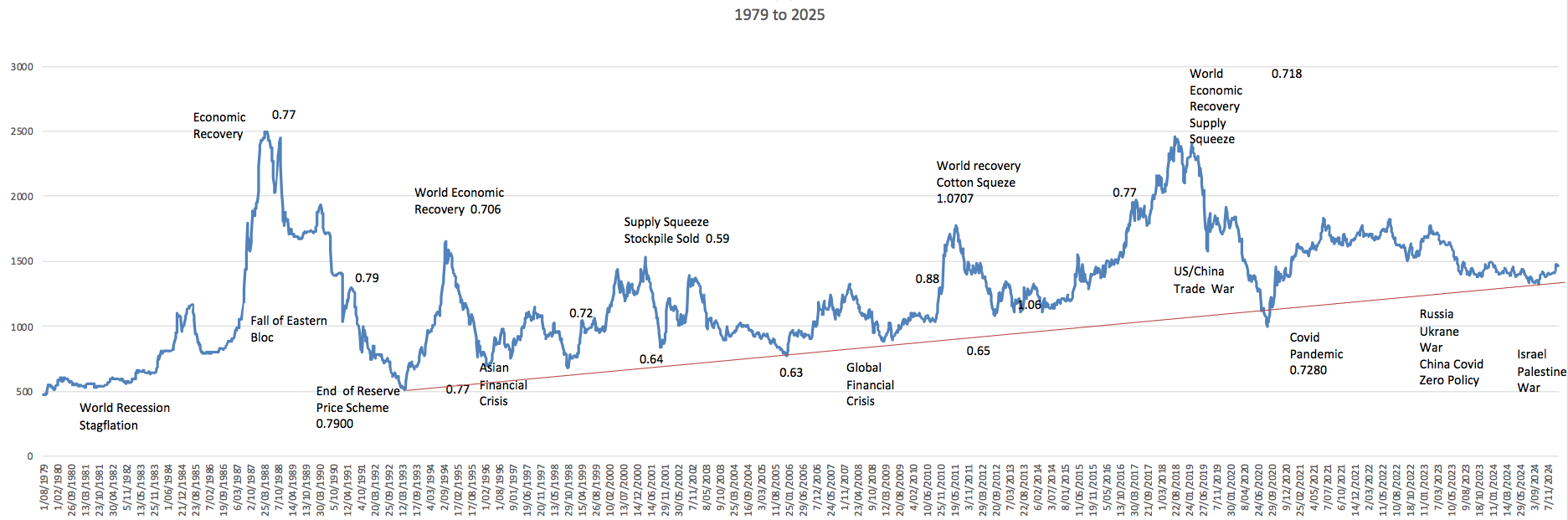

Historically the USD/AUD is not the driver of the market. A stronger USD will aid any rally and support any weakening demand. The 2011 spike in the market occurred while the AUD rose from 80 cents to 107 to the USD. The fall from that peak followed while the Aussie headed its way back to 75 cents. The supply/demand balance of the fibre is the driver. Global uncertainty and lack of consumer confidence is stifling demand and leading to a “just in time mentality” across the pipeline.

Demand creation, marketing, the stabilising of global politics and economics will come as will the return of consumer confidence. What is needed now is better forward price signals. Without those signals the downward supply spiral will continue. Cashflow pressure have seen clearance rates be maintained at over 90% throughout the season at auction. There is little or no buffer stock. A more robust and liquid forward market participation is required to provide those signals.

While the cost of production in general rise and harvesting remains problematic, growers will continue to examine alternative land use. Processors need to give growers the incentive to stay in the business of growing wool. Realistic forward bidding will supply that signal. Growers need to populate the sell side by indicating what price level will keep them growing wool to get a fair return for the labour and rewarding the processor, exporter and/or trader by hedging part of their production.

At the current price point and the general economic landscape, the spread between buyer and seller is likely to be wide. The only way to narrow that gap is to increase participation through improved awareness and education.

The investment put in across the pipeline in genetics, sustainability and technology from farm to factory, fashion house and consumer will be for nought if we can’t maintain supply.

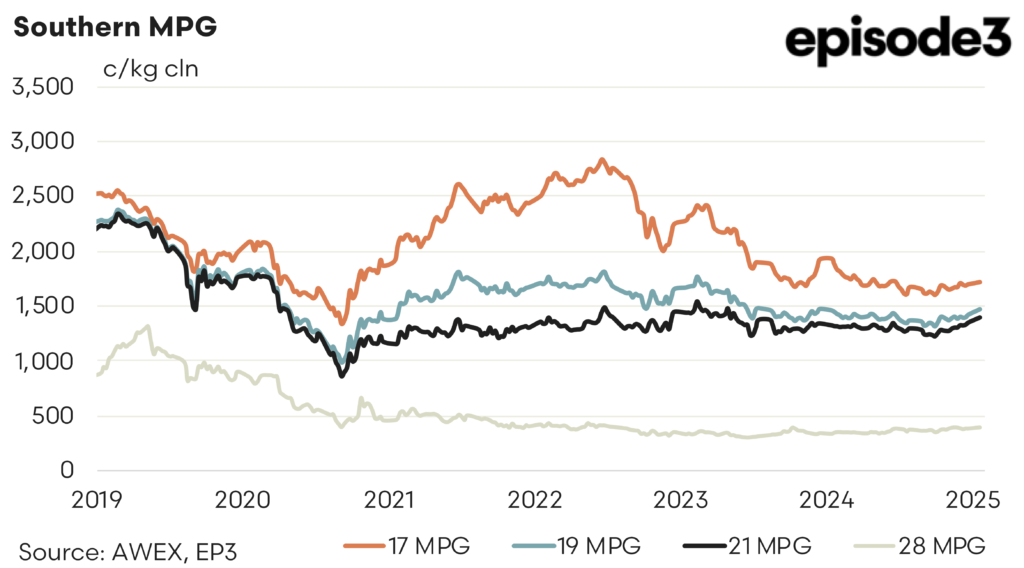

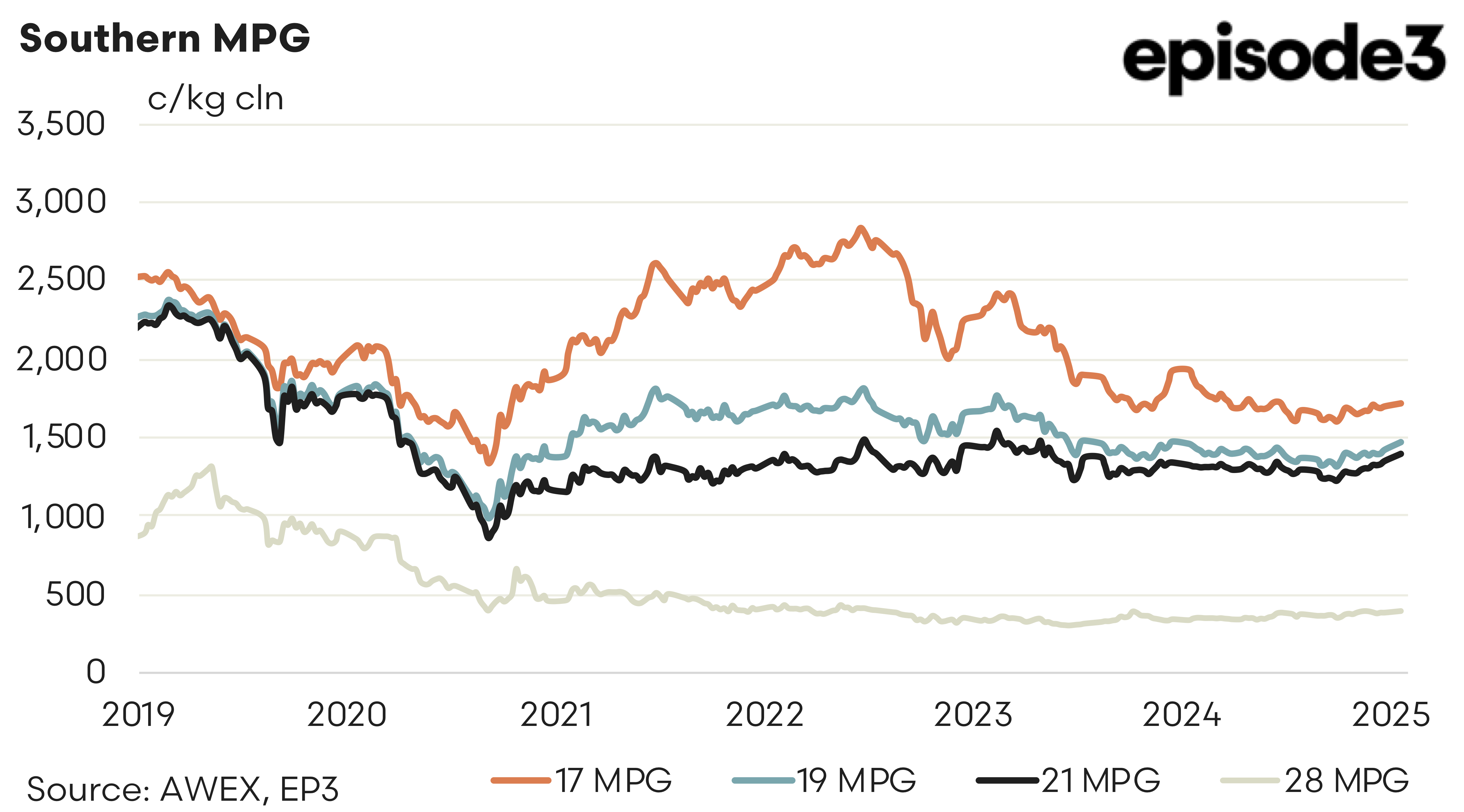

Only trade this week was 19.0 micron for February 2025 at 1490 (cash 1463)

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.