Do away with fear

Wool Market Update 22nd March 2024

“I have learned over the years that when one’s mind is made up, this diminishes fear; knowing what must be done does away with fear.” — Rosa Parks

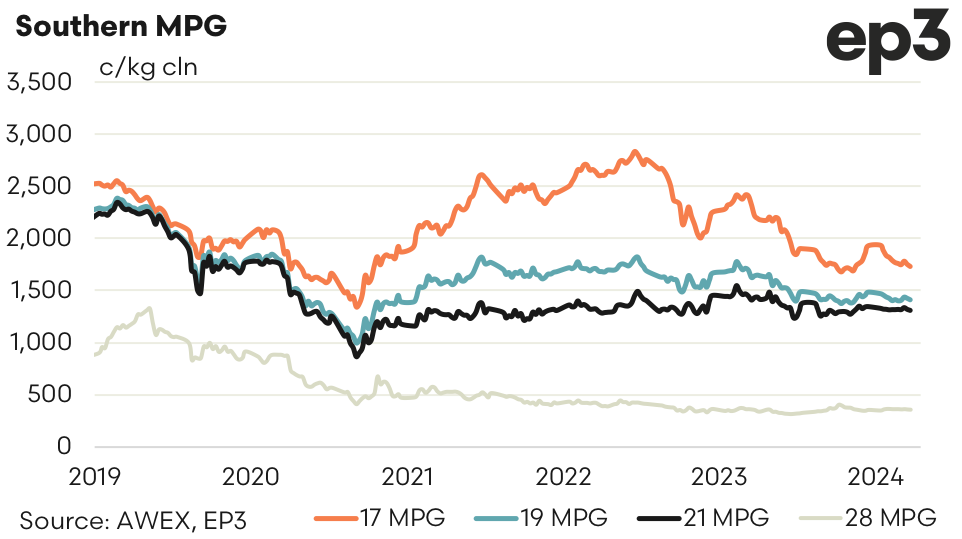

The auction series opened with the largest single day fall since last August. The reaction on the forward market were for sellers to snap up available bids. Trading was predominately at a premium to spot. The exception was the 21.0-micron contract that was executed at 1300 for April and May (cash 1312). Trading was spread over 12 months to March 2025.

The spot auction stabilised on Wednesday suggesting sellers may have reacted a bit quickly. The lack of new bidding to return to the forwards might suggest the market remains vulnerable. Even so as Ice Hockey great Wayne Gretzky would say “You miss 100% of the shots you didn’t take”. Sellers now have some forward certainty and buyers have hedged some forward positions. So, what is ahead?

The macro-economic situation remains tentative at best. Uncertainty reigns and consumer confidence low. This is balanced by most price levels lingering at or below long-term averages. Seasonally, it is also a mixed bag. If we look at the post easter price action over the last 14 years the market has become dearer as we move to the end of the season in June on five occasions, moved cheaper on five and sideways on four. In this ambiguous circumstance the strategy for those in long positions (growers and stockholders) should be looking to establish target levels to take advantage of any price rallies when buyers will be looking to hedge their risk.

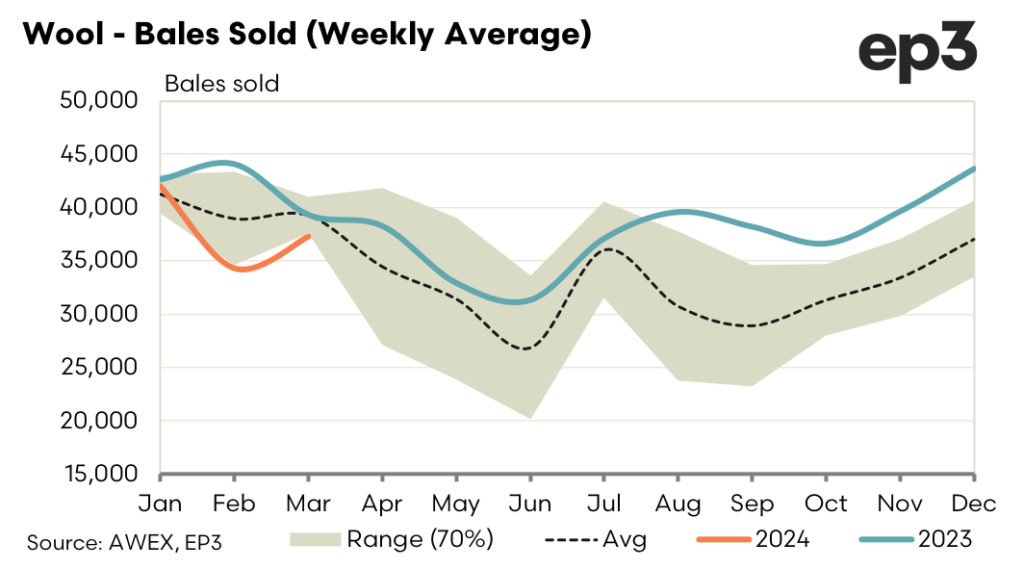

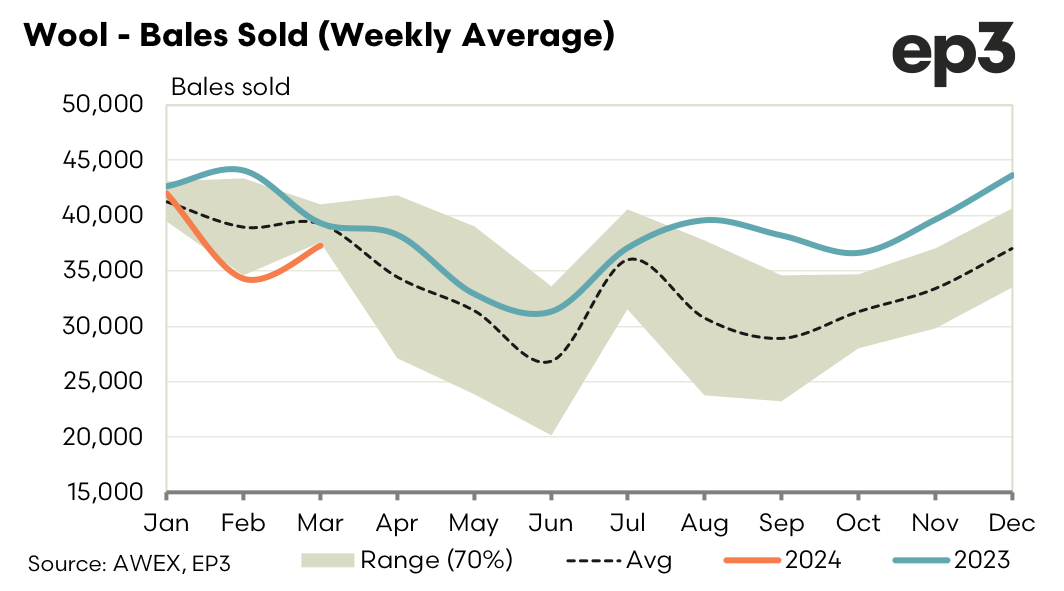

We approach the final sale prior to the one-week easter recess with 50,000 bales on offer. Hopefully the need to cover forward export commitments will see further support to stabilise prices.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.