Don’t look back in anger

The Snapshot

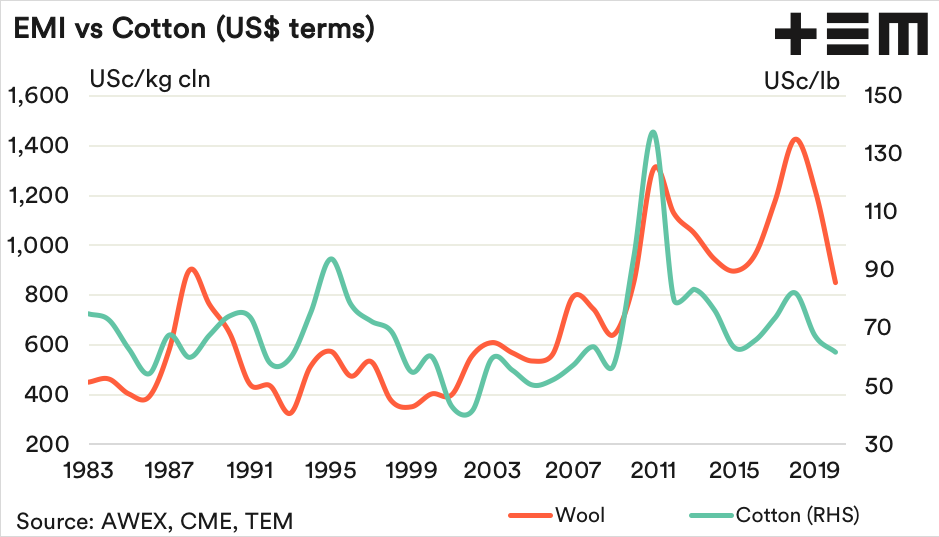

- In US$ terms the current downtrend in the EMI is 40% off the 2018 peak, which is worse than the 2011-2015 downtrend (31%), but not as bad as the 1988-1993 sell off (64%).

- Cotton never managed a recovery from the 2011-2015 downtrend which saw prices ease 54%.

- The wool price index is 39% above the base level, compared to cotton at 3% above the base. Meanwhile, the polyester price index is 54% under the base set in 2003.

The Detail

In US$ terms the current downturn in the Eastern Market Indicator (EMI) is down by about 40%, comparing the 2018 annual average of 1427.5 USc/kg cln to the current annual average of 851.3 USc/kg.

The previous downturn that occurred during 2011 to 2015 saw the EMI come off 31%, in US dollar terms, so the current correction is worse than that. However, there was a tougher downturn during the late 1980s that saw wool prices ease 64%.

Furthermore, comparing the current price correction for wool to that for cotton shows that cotton prices never really recovered from the 2011 to 2015 sell off. This event saw a 54% fall in cotton prices with cotton dropping from 137.4 to 63.3 USc/lb.

Price trends in cotton and wool show some similarity as both commodities are influenced by similar demand and supply factors that determine price outcomes for global fibre markets.

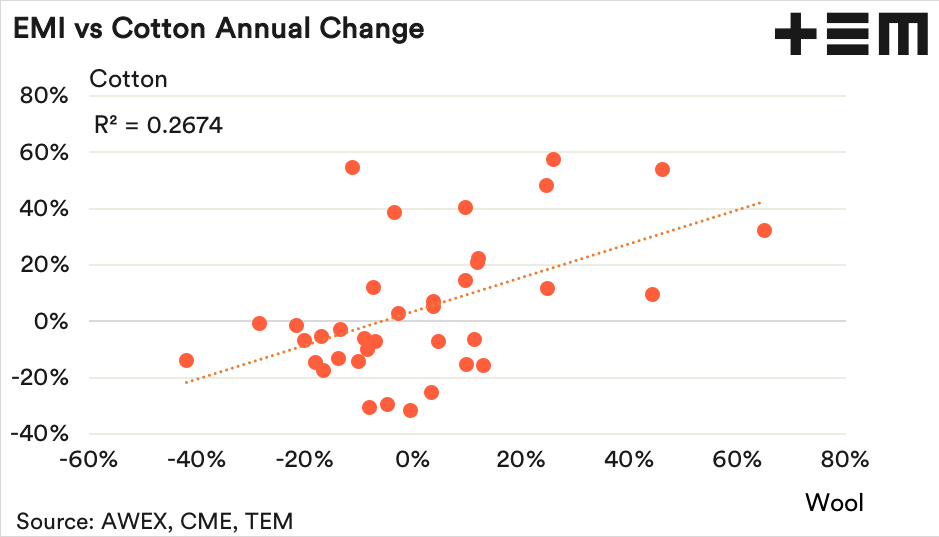

Comparing the annual average price change in US$ terms for cotton and the EMI shows a Pearson R-squared coefficient of 0.2674, which would be considered a moderate degree of correlation.

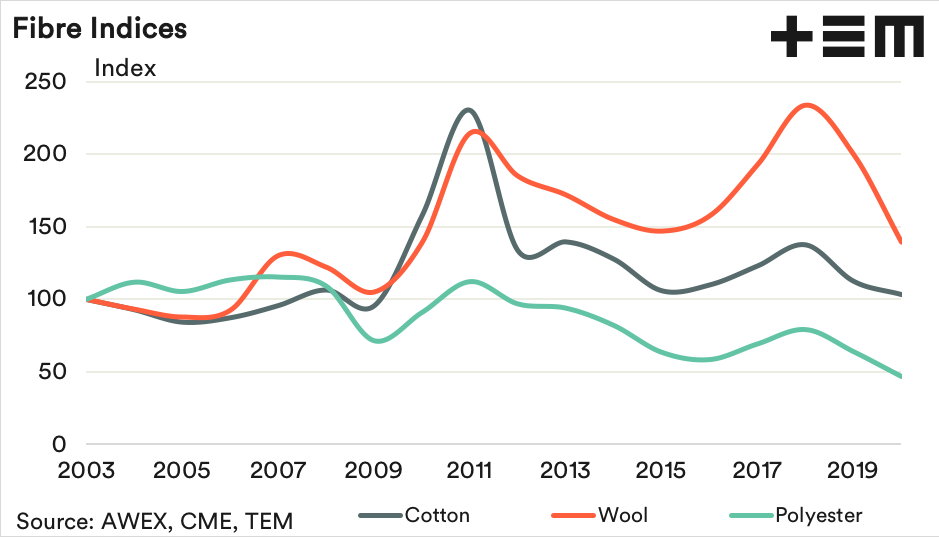

Analysis of cotton, wool and polyester annual average prices converted to an index, using 2003 as the base year, shows a similar level of trend direction. Interestingly, wool prices have fared relatively well compared to cotton and polyester over the past two decades.

The wool price index is 39% above the base level, compared to cotton at 3% above the base. Meanwhile, the polyester price index is 54% under the base set in 2003.

Looking back at the historic trends wool producers can take some comfort in the fact that wool prices have held up reasonably well, comparatively speaking, with cotton and polyester. Although, the devil’s advocate question is does that mean that the wool market still has more room to fall?