Market Morsel: Europe re-awakes

Market Morsel

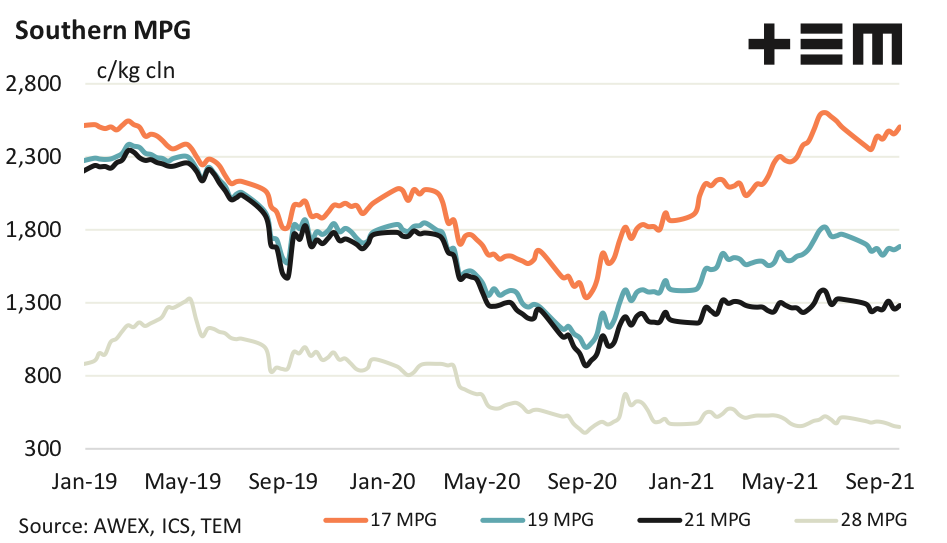

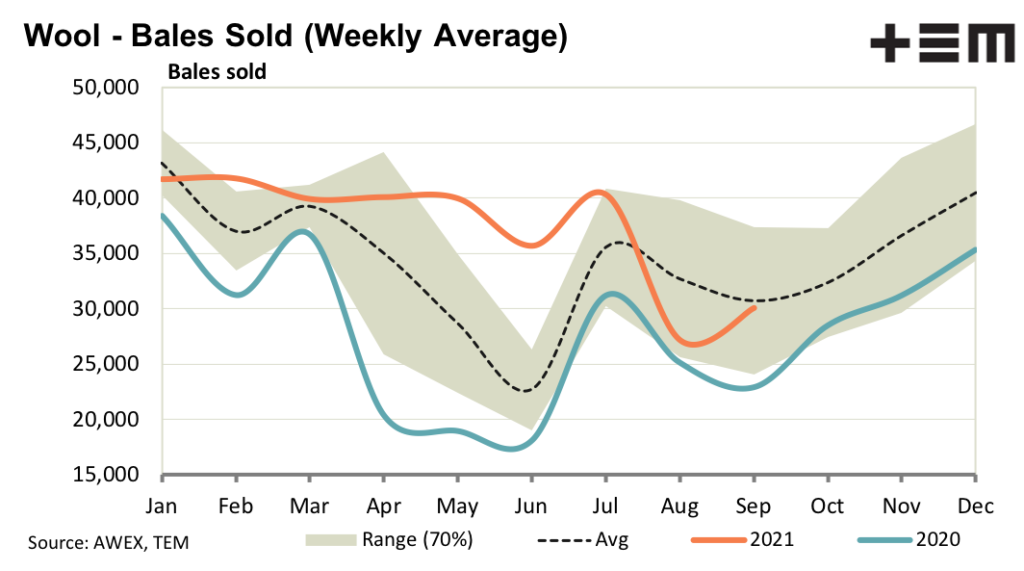

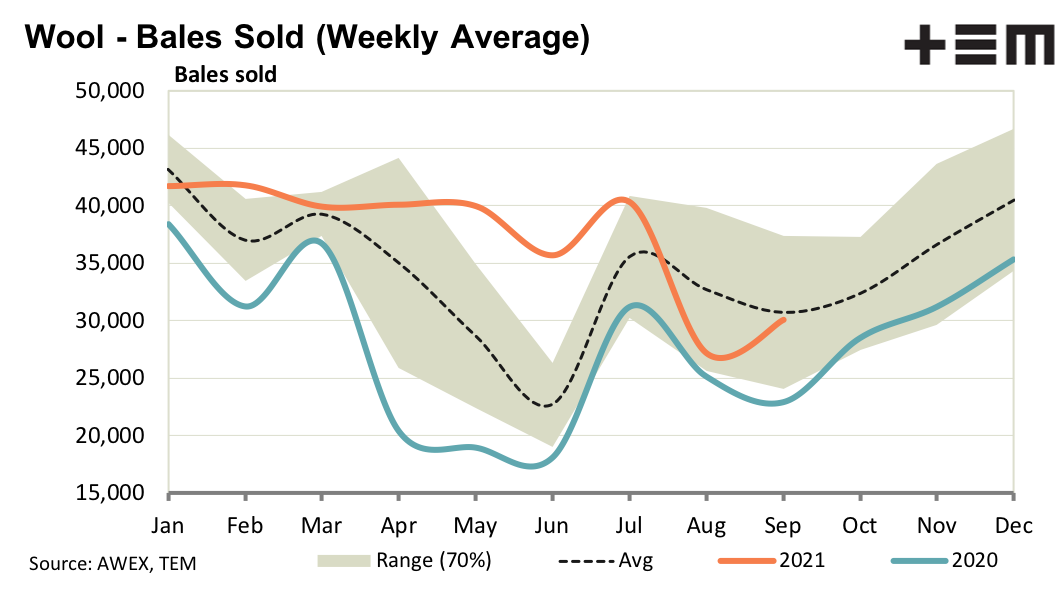

Merino prices in the greasy wool market continue to generally drift sideways, although some of the finer micron indicators have firmed in recent weeks. Demand for the better specified fine merino wool is being driven by a re-awakening of European demand after a tough year due to the pandemic. The volume of wool being offered remains self constrained but still well above the levels of a year ago.

As such farmer stocks are building at a much slower rate than in the middle of 2020. A slowing Chinese economy, exacerbated by the problems in the building industry, is causing the supply chain focussed on Chinese retail sales to be cautious. It is early yet in the new northern hemisphere Autumn/Winter season so useful signals about retail demand are yet to become available. Despite the myriad of issues about in the world, solid forward bids for 19 and 21 micron extend out to the autumn of 2023.

17 Micron

When New Zealand wool is included some 9% of 17 micron fleece sold this week was RWS accredited . For 16 micron is was 26% and for 15 micron 22%. As such it was not surprising to see premiums for good accredited fleece wool to ease. These best style wools are selling for around 108-110% of their point of micron MPG. It should be noted that faulty RWS accredited wool generally receives a standard faulty price.

19 Micron

Price for the bulk of the merino market continues to drift sideways, with the reluctance of growers to sell if it falls and a lack of demand, especially at this time of the season, capping any propensity to rise. A positive note in the current market is the forward bids out to early 2023 near current auction levels.

21 Micron

The eastern Australian merino fibre diameter continues to fall. As mentioned last week this flags (subject to confirmation next month) a swing in supply which will take some of the pressure off broad merino prices by reducing the year on year increase in volume as seen in the past year. Large discounts fro high vegetable fault broad merino look to be part of the consequence of big year on year increases in supply.

28 Micron

The 28 to 21 MPG ratio is falling to new lows. Hopefully a stabilised merino micron distribution, with little change in the broader merino volumes, will take some pressure off the crossbred market.