Great expectations

Wool Market Update 1st March 2024

“When you have expectations, you are setting yourself up for disappointment” – Ryan Reynolds

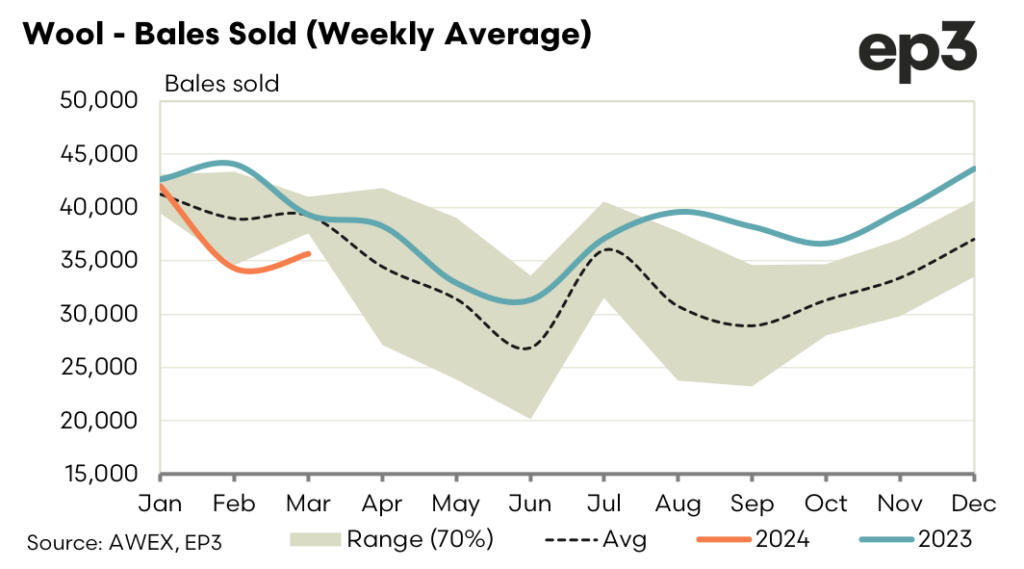

The spot market delivered the most positive start that we have seen since the opening day of the auctions for the year. 18.0 microns and broader all rose between 5 and 15 cents with the super fines and the crossbreds a little easier. Expectations were that after the Lunar New Year demand may now finally lift. The forward market mirrored this view with the bids generally flat to spot out to June. The 19.0 contract was bid at 1415 for March and June a 5 to 10 premium.

Wednesday disappointed in the spot with offshore interest muted at best seeing the market generally losing the gains of Tuesday. Buyers persist with solid bidding in the forwards as they look to hedge their sales.

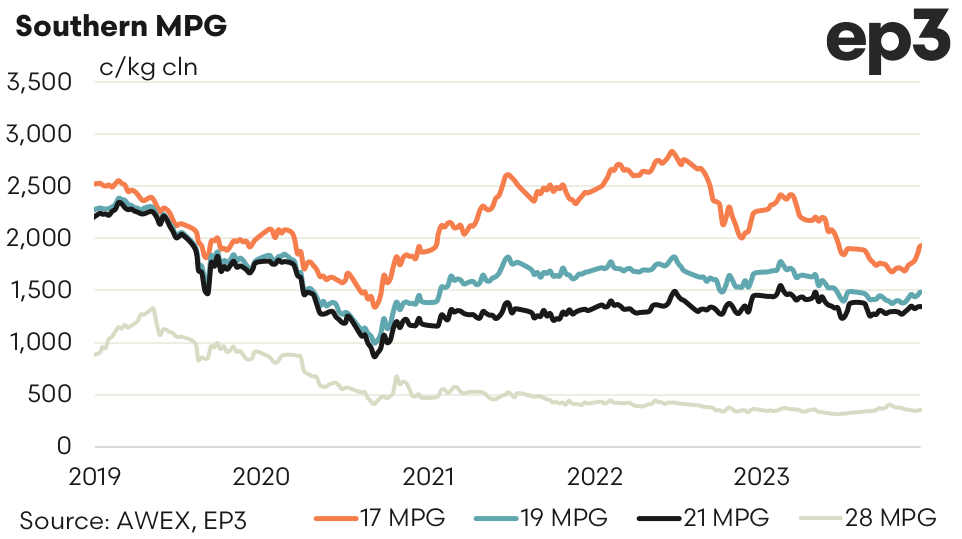

Fine wools have lost around 100 cents since Christmas and medium wools 30 to 60 over this 8-week period. It is difficult to see where the change in the pattern will come while the main global drivers remain in neutral. Opportunities for hedging remain in place March to June highlighted by 19.0 at 1415 (cash 1407) and 19.5 at 1375 in May (cash 1375).

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.