Herd instinct

Wool Market Update 11th August

“The herd instinct among forecasters makes sheep look like independent thinkers.”

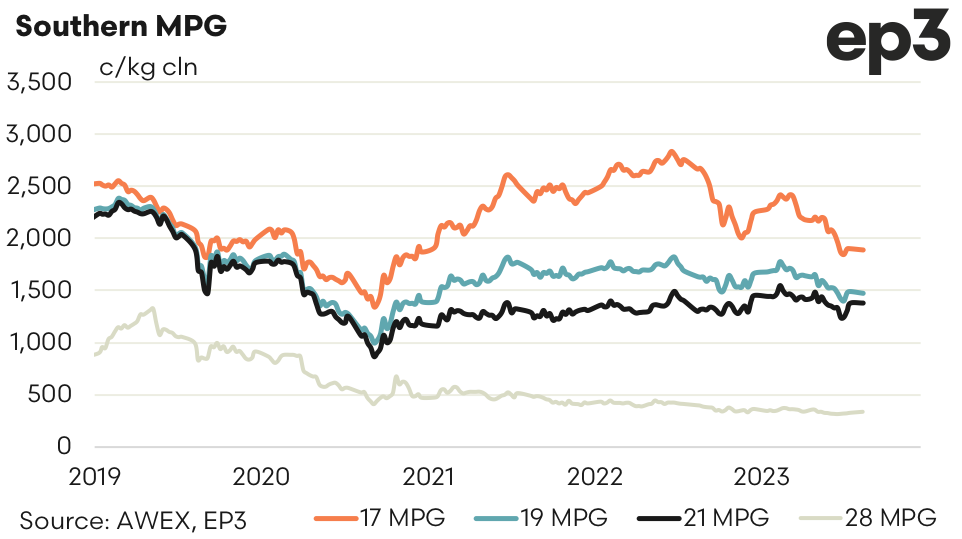

The auction market returned from recess on Tuesday steady but closed with all merino qualities losing between 10 and 20 cents. The fall was somewhat muted by a strong USD. The Eastern Market Indicator fell only 3 cents in AUD terms but 16 cents US.

The forward market was again only lightly traded with buyers non-committal other than attaining cover in the nearby window. The 21 MPG contract traded August at 1350 and September 1340 against closing cash of 1381.

Most forecasters are predicting that the general global economic conditions will continue to be the driver of the market with relief unlikely until sometime in 2024. This would mean that wool market will follow the pattern of the last two season saw prices not return to their opening levels until well into the New Year.

GDP figures from China remain challenging with any stimulus talk for their textile sector not on the horizon. The strong USD may provide some short-term impetus, but this should be viewed as an opportunity to place some short- and medium-term hedge positions.

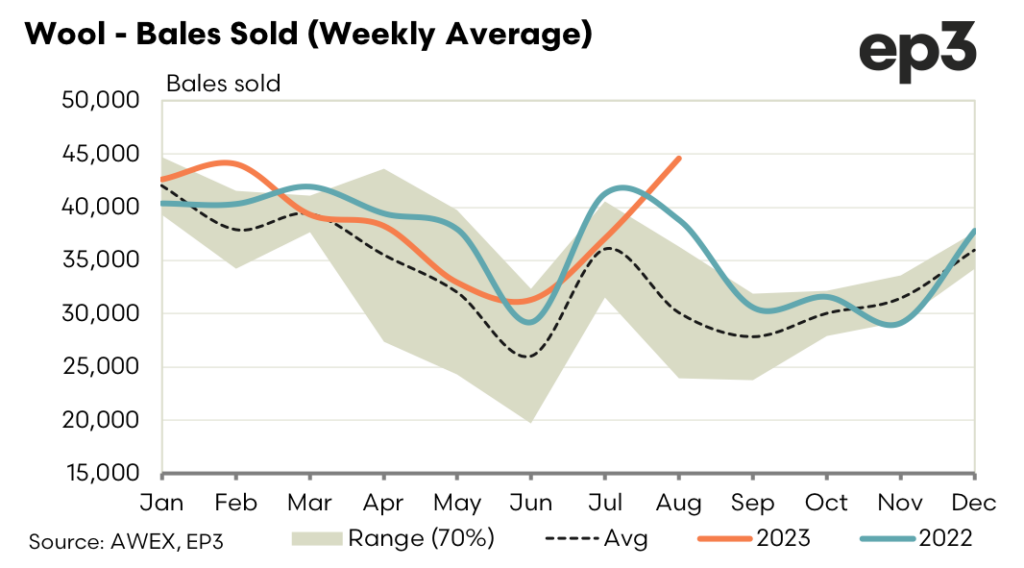

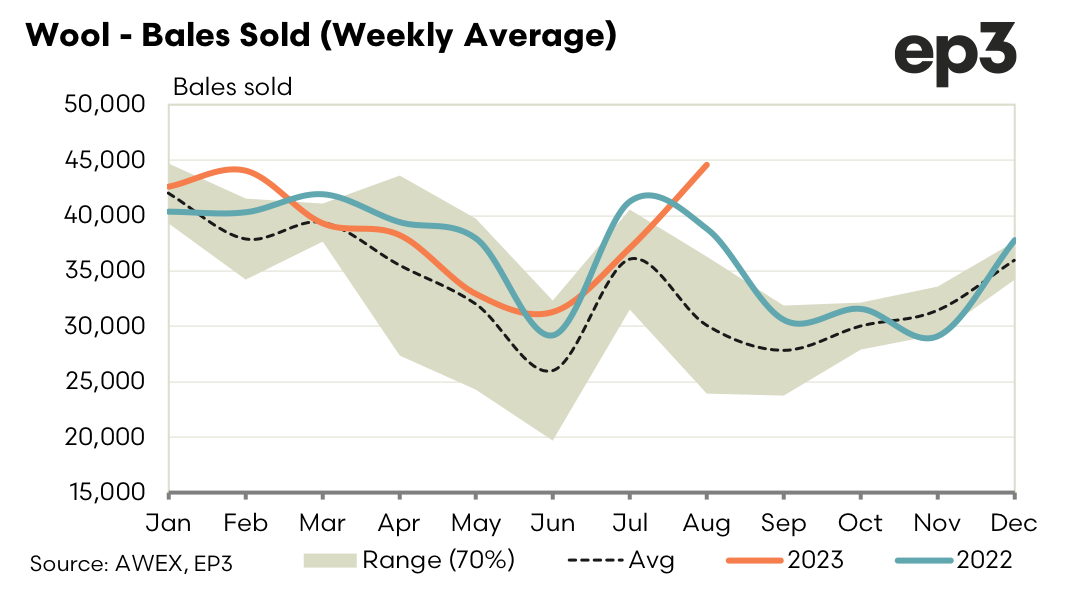

With 45,000 bales rostered for next week it is hoped that the strong dollar will stimulate enough demand to keep the market steady.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.