Hopelessly disappointed

Wool Market Update 16th June

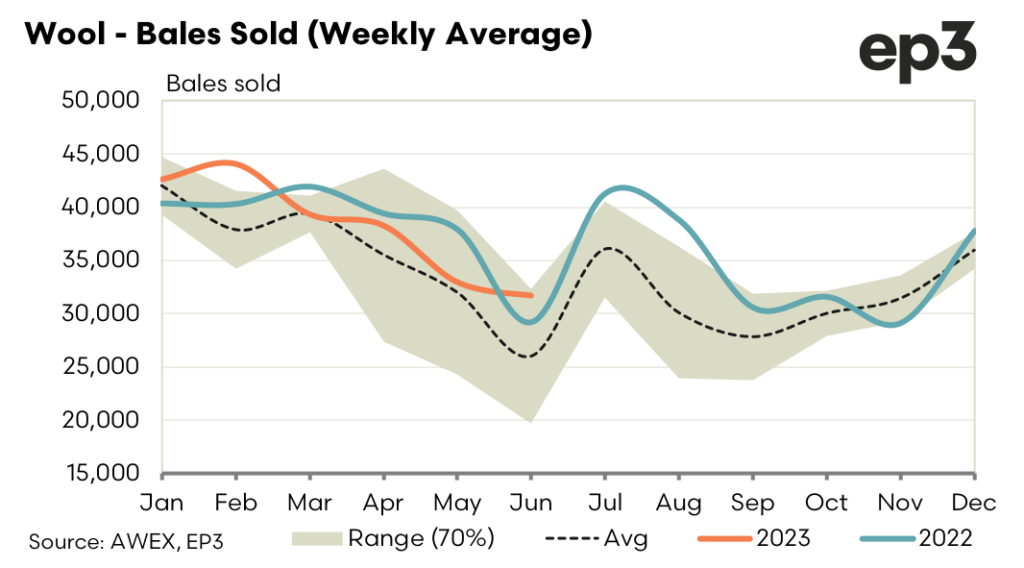

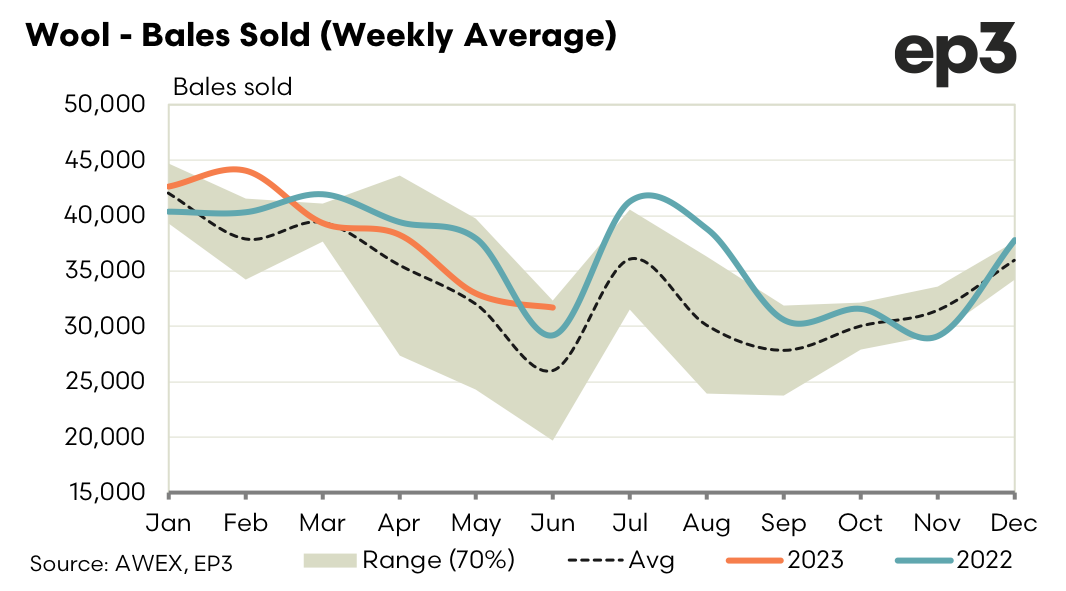

Disappointment continues for the spot auction market. The steady decline that started in February has continued to the point where the chartists are looking for the next level of support. The geopolitical uncertainty and macro-economic outlook have dogged most agricultural commodities for most of this year.

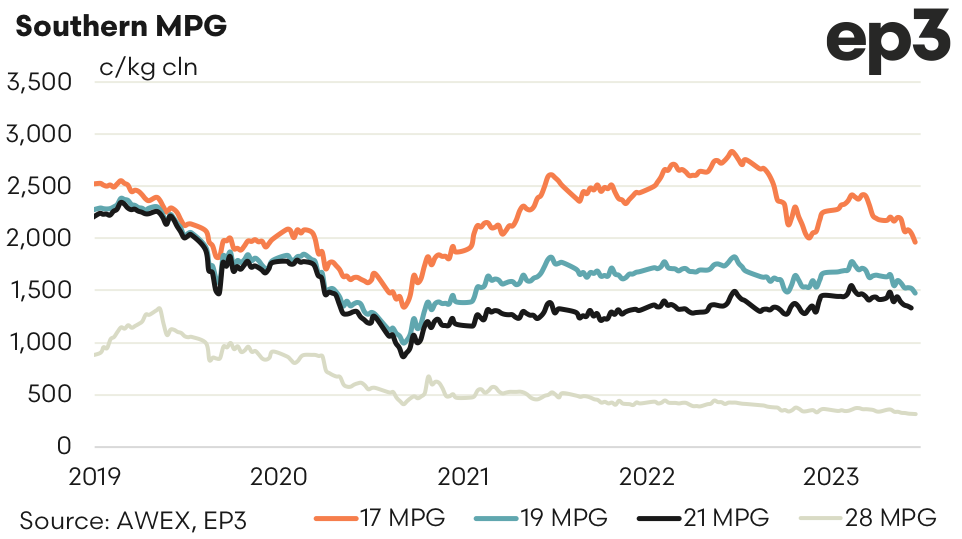

The strong USD of the last fortnight has accelerated the AUD decline of wool prices with the local currency strengthening nearly 5%. The 19.0-micron price guide (MPG) peaked for the year at 1776Ac/1238USc at a time when the AUD/USD rate was 0.6970. Since then, the market has fallen to 1471Ac or 1000USc. The root cause remains the lack of customer and consumer confidence in these tentative times.

The forward market remains quiet with all the activity centred around 2024. Early in the week the first and second quarters of 2024 traded at 1550 a 2% premium to the opening cash. The 50-cent fall in the spot market saw the 2024/25 levels retract 30 cents to 1520 and traded at this level for May and September.

With most micron categories breaking or sitting on long term support levels predicting the short and medium direction of the market is proving problematic. Current lack of bidding levels into the new season indicates the lack signals coming from offshore. We will likely need to see stability in the spot market before any confident bidding and offering returns to the forwards. In the meantime, the premiums bid in 2024/25 provides the only hedge opportunities.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.