Improving outlook

Wool Market Update 15th September

“Those who have knowledge, don’t predict. Those who predict, don’t have knowledge.” – Lao Tzu, 6th century BC Chinese Poet

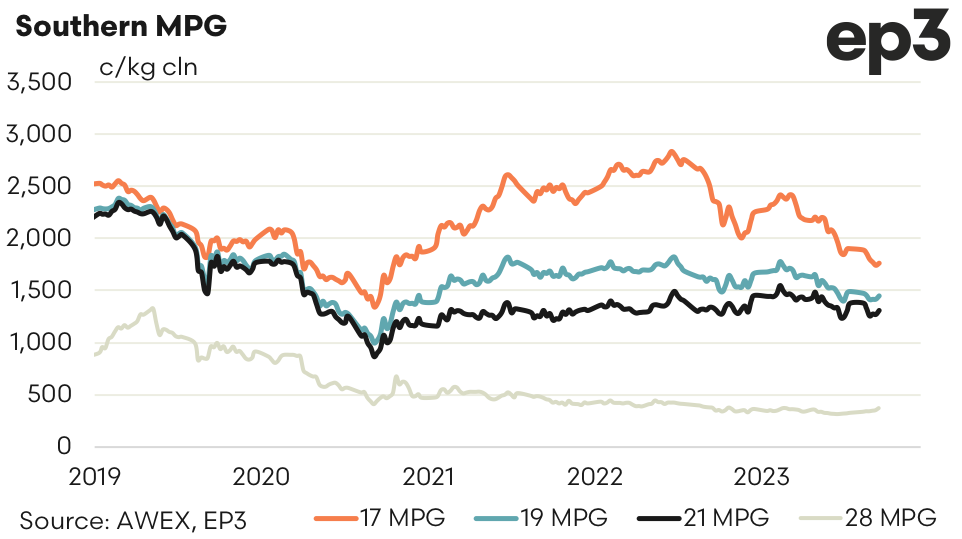

The spot auction continued its recovery this week with the EMI reclaiming half of the early season losses. Having lost 61 cents during August and early September the market has improved 30 cents over the last three auction days.

The forward market still endures sluggish volumes even as it keeps pace with the cash. This is likely due to the current demand maintaining its focus in the prompt window. The exception being interest from the buy side throughout the first half of 2025 with levels lifting to 1470 for 19.0 microns on the back of a firmer spot auction. In the spot market 19.0 microns closed the week at 1450 so the forwards present a slight premium.

The medium-term window, October to December, is showing little interest from the buy side. Sellers have set levels across the medium merino market (19/20/21) throughout Oct and November around 10 to 20 cents above cash. A continuation of current rally could prig the interest of buyers around these levels. Current offers for 19.0 in October are 1455 to 1470 which is around $1800 a bale. For 21.0 the range of offers are 1325 to 1350 or around $1350 per bale.

This rally also could aid the sell and replace strategy mentioned last week. Growers holding wool at present might consider selling, reducing holding costs and improving cash flow, and replacing their long position with a paper trade.

As for next week it is difficult to be optimistic although some of Wednesday’s weakness can be put down to selection and a slightly stronger Australian Dollar. Still the macro economics of our major trading partners will drive the direction. As suggested prior, it is fine to be optimistic but always have a Plan B. Hopefully spring will deliver another rally to hedge off.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.