Infinite hope

Wool Market Update 25th October 2024

“We must accept finite disappointment, but cannot lose infinite hope” – Martin Luther King Jr

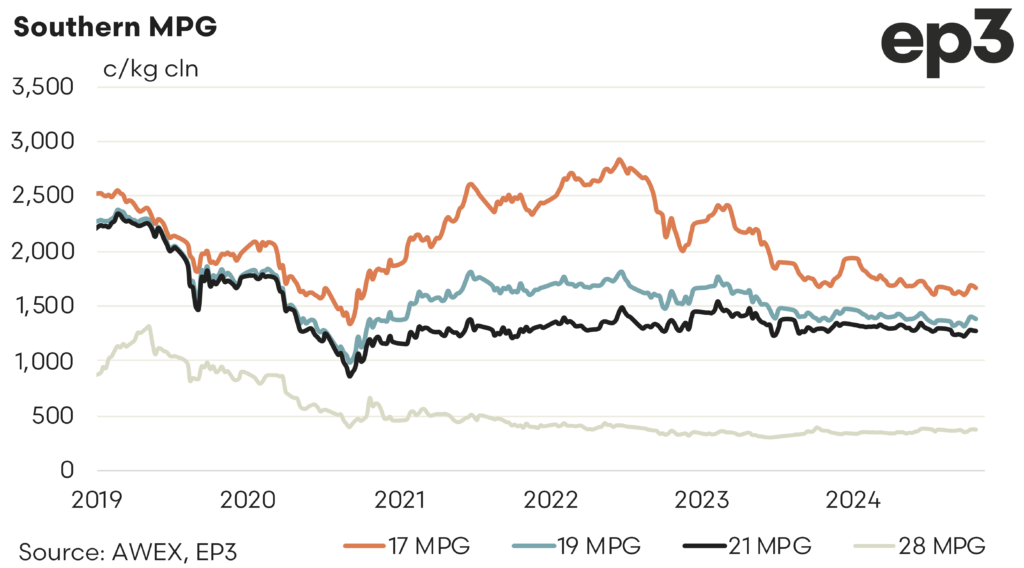

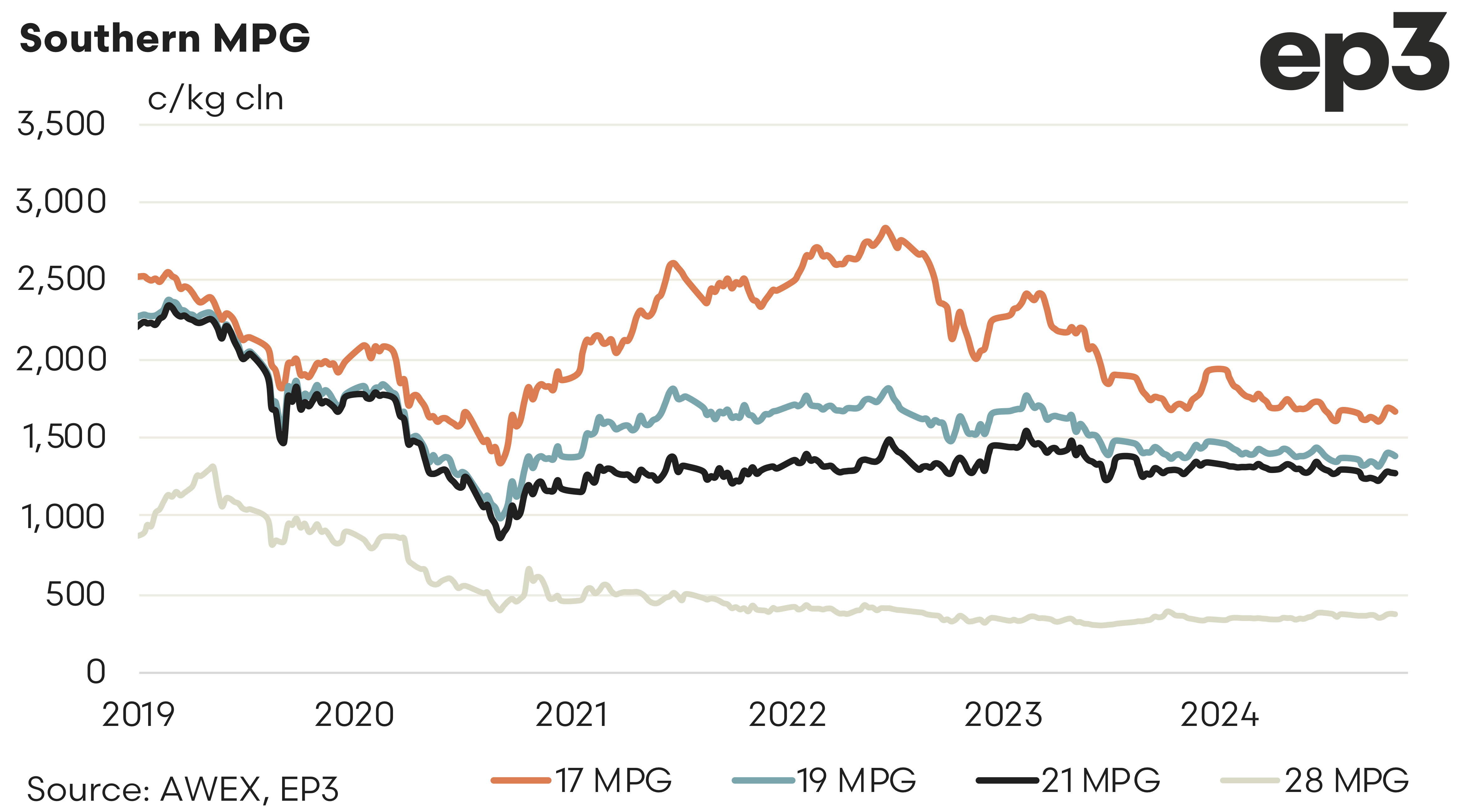

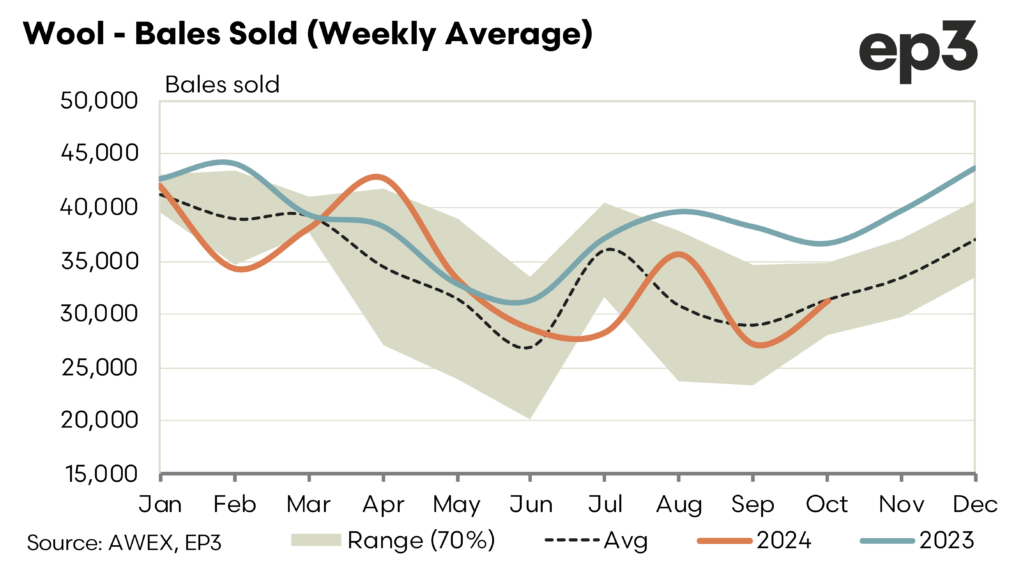

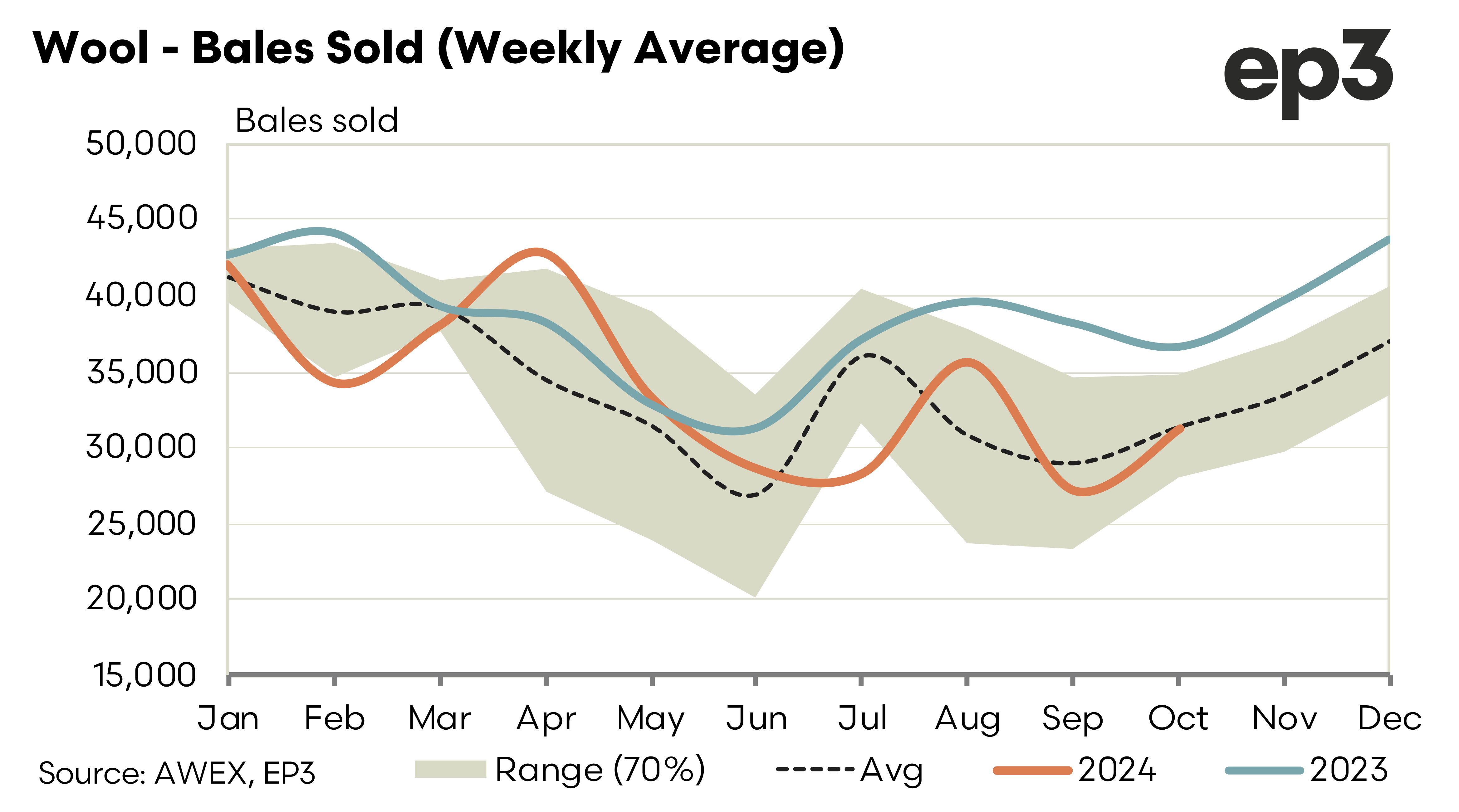

The least said about this week the better. Another melancholy for the spot market. Tight selection saved more significant losses. Prices faded between half and one percent with finer types once again most affected. The rally in prices in early October now appears a distant memory. Expectation that the widely reported Chinese Government stimulus package, coupled with a strong USD, would provide the remedy to the woes of the market were short lived.

Forward markets started the week bid out to Christmas flat to cash. Upon attracting an offer slightly over spot traded at want seemed a modest premium to cash traded November at 1425 for 19.0 micron. Failing to find further interest buyers retreated to see how the spot behaved. Disappointment followed and the market was left sparsely bid and offered. This calendar year has been highlighted sharp short-lived rallies, six in total, coupled with an equal number of decays. The result a deterioration of between 5 and 18% with ultra-fine wools most effected. The other feature has been the lack of action on the forwards when rallies do occur.

The forward market closes the week sporadically bid and offered. The exception remains in late 2025 and early 2026 with 19.0 bid 60 and 100 cents, respectively over spot at 1450 and 1500. The message that growers need strong consistent signals needs to be heeded along the pipeline. Conversely growers need to do their part by providing pointers themselves.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.