Learn, live, hope

Wool Market Update 19th April 2024

“Learn from yesterday, live for today, hope for tomorrow. The important thing is not to stop questioning.” — Albert Einstein

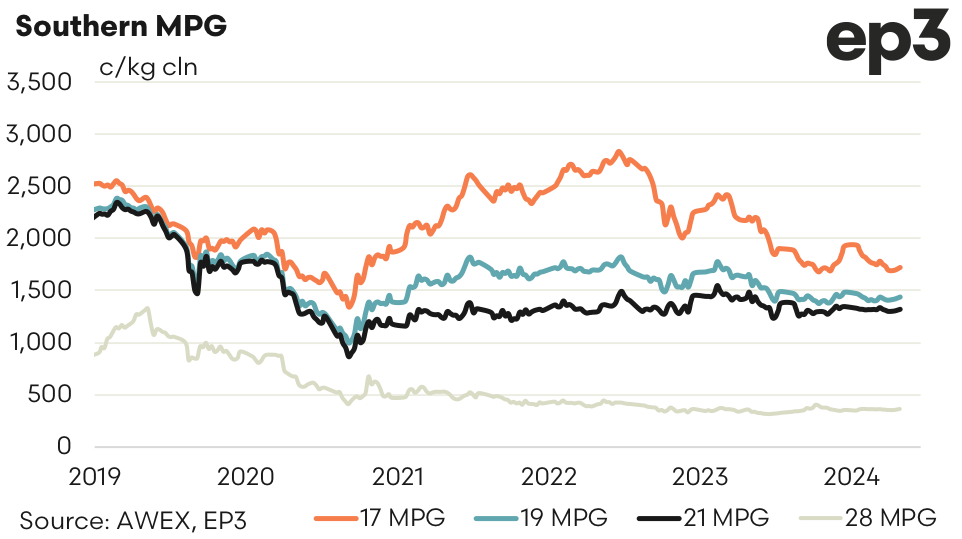

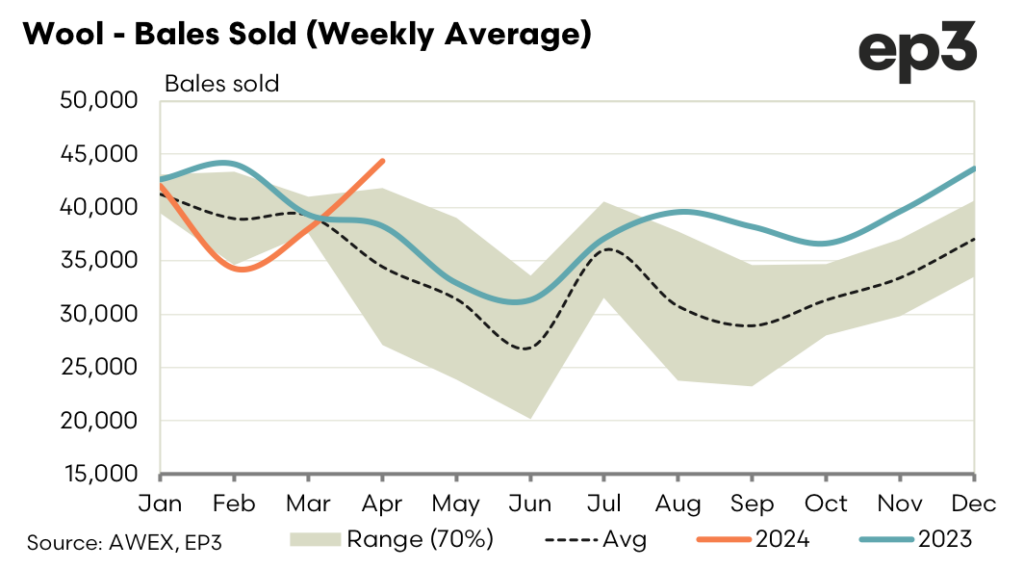

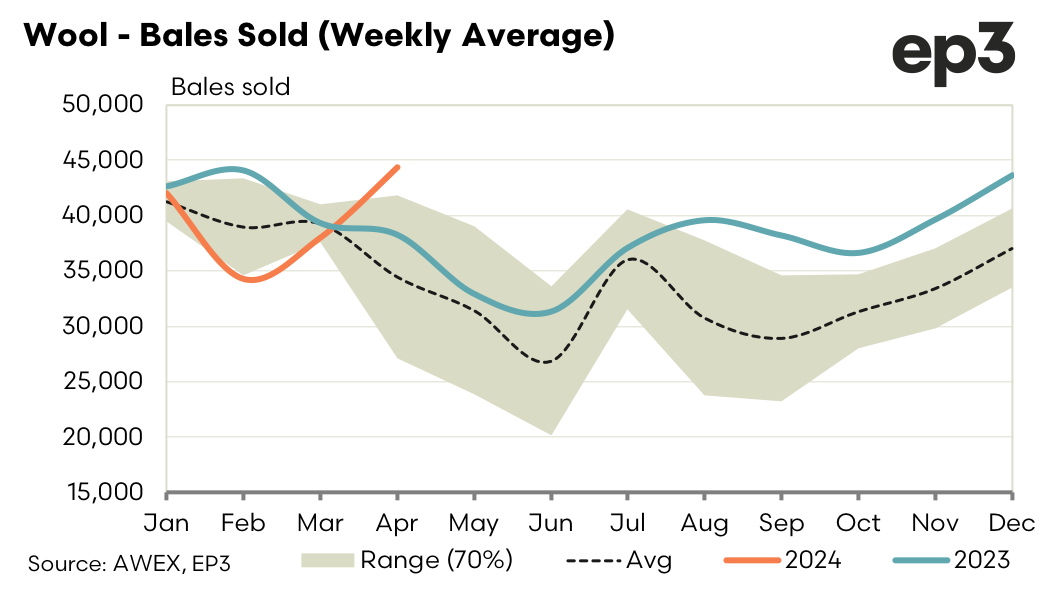

Another solid week for the auction market. Prices rose for the fourth consecutive session helped by a continuing strong USD. Finer wools were the chief beneficiary with 19.0 and finer rising 20 to 40 cents over the week. This is too be expected as they have been most affected by falling prices that has beset the market since the new year open.

Forward markets continue to trade premiums to spot. Sellers accepted the premiums on offer early in the week with 19.0 executed at 1445 for May and 1440 for June. 21.0 micron traded at 1335 for the same months.

Trading volumes remain frustratingly low but with some of the bid/offer spreads tightening participants have reasonable indications of current market sentiment. For example, June is bid at 1435 and offered at 1440 for 19.0 micron hence showing a 20-cent premium to cash. Also, in June 21.0 micron is bid 1325 and offered 1335 therefore a 30-cent premium to spot.

Volumes remain light and bidders continue to dominate sellers. Key functions of a forward market should be to give participants an indication of price and demand and supply the mechanism for both buyers and sellers to gain some degree of certainty in the future.

Bidding should remain positive into next week. Buying level are focused at and above cash for maturities where growers have shown interest in wanting to hedge part of their production. Valuing certainty over the fear of lost opportunity is the key message in these tentative times.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.