Lincoln hustle

Wool Market Update 27th September 2024

“Things may come to those who wait, but only things left by those who hustle.” – Abraham Lincoln.

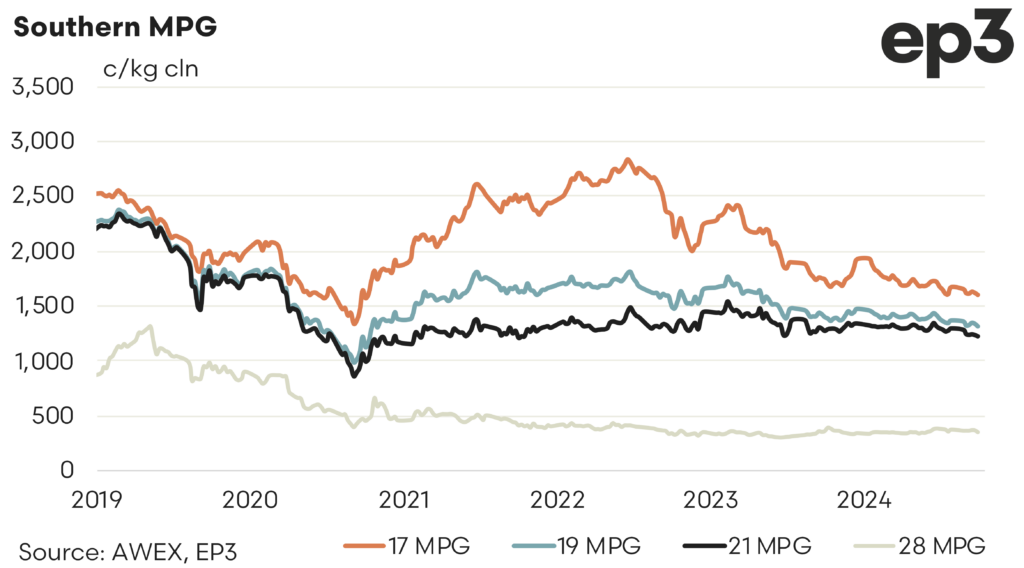

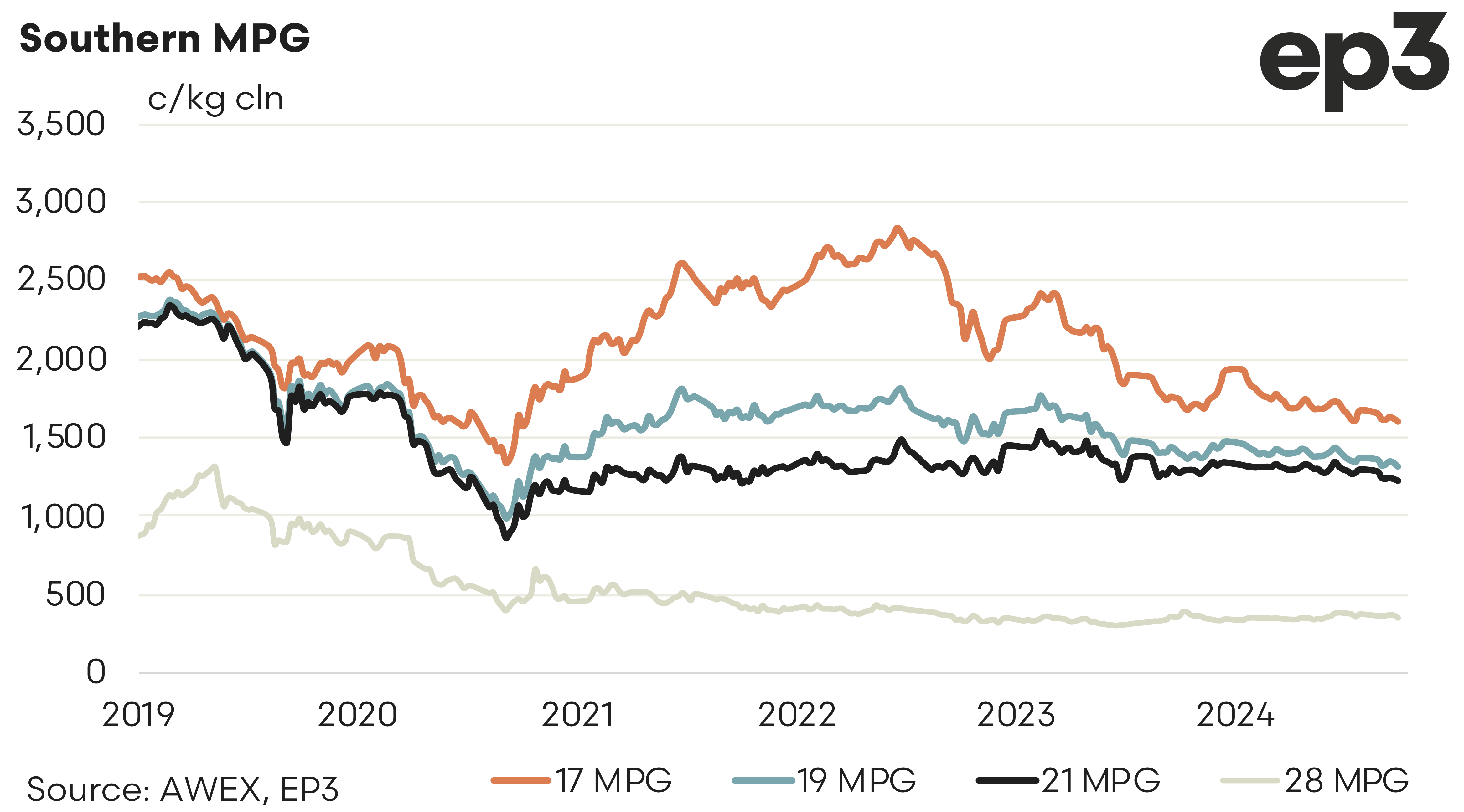

Same drivers, same result. Sedate demand, strong AUD again saw the spot auction continue its sluggishly decline. The dollar strengthened 1.5% percent since last week which led to most qualities falling similar amounts.

The forward market was a little more active with both buyers and sellers again looking to share the risk. Most of the activity was in the final quarter of the year with October, November, and December all trading. The coverage of microns was also extensive (18.0, 19.0, 19.5 and 21.0). Trades tended to be executed at the prevailing spot with buyers happy to hedge some of their forward sales. Sellers also chipped away at the restricted volume on the bid at significant premiums in late 2025 and early 2026. 19.0 micron traded at 1450 for November 2025 and 1500 for January 2026. For the time being 25t remain on the bid. (10t Dec 19.0 1450, 10t Jan 19.0 1450, and 5t Jan 19.5 1450).

Global signals remain mixed. Positive rhetoric from China on economic stimulus on the horizon is matched by sluggish European financial indicators. USA Fed action to stimulate the economy is a positive but most commentators are focused on the November elections.

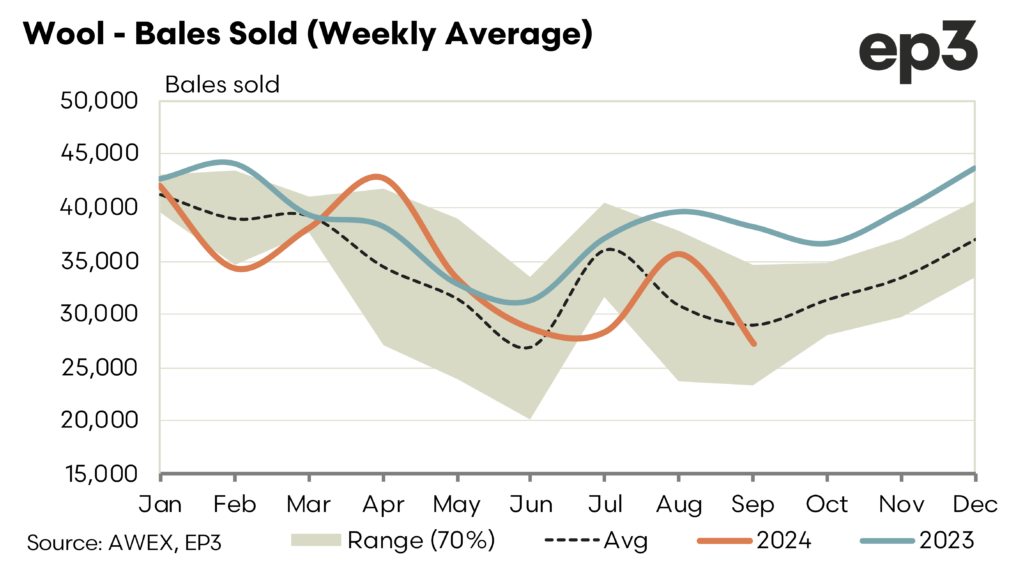

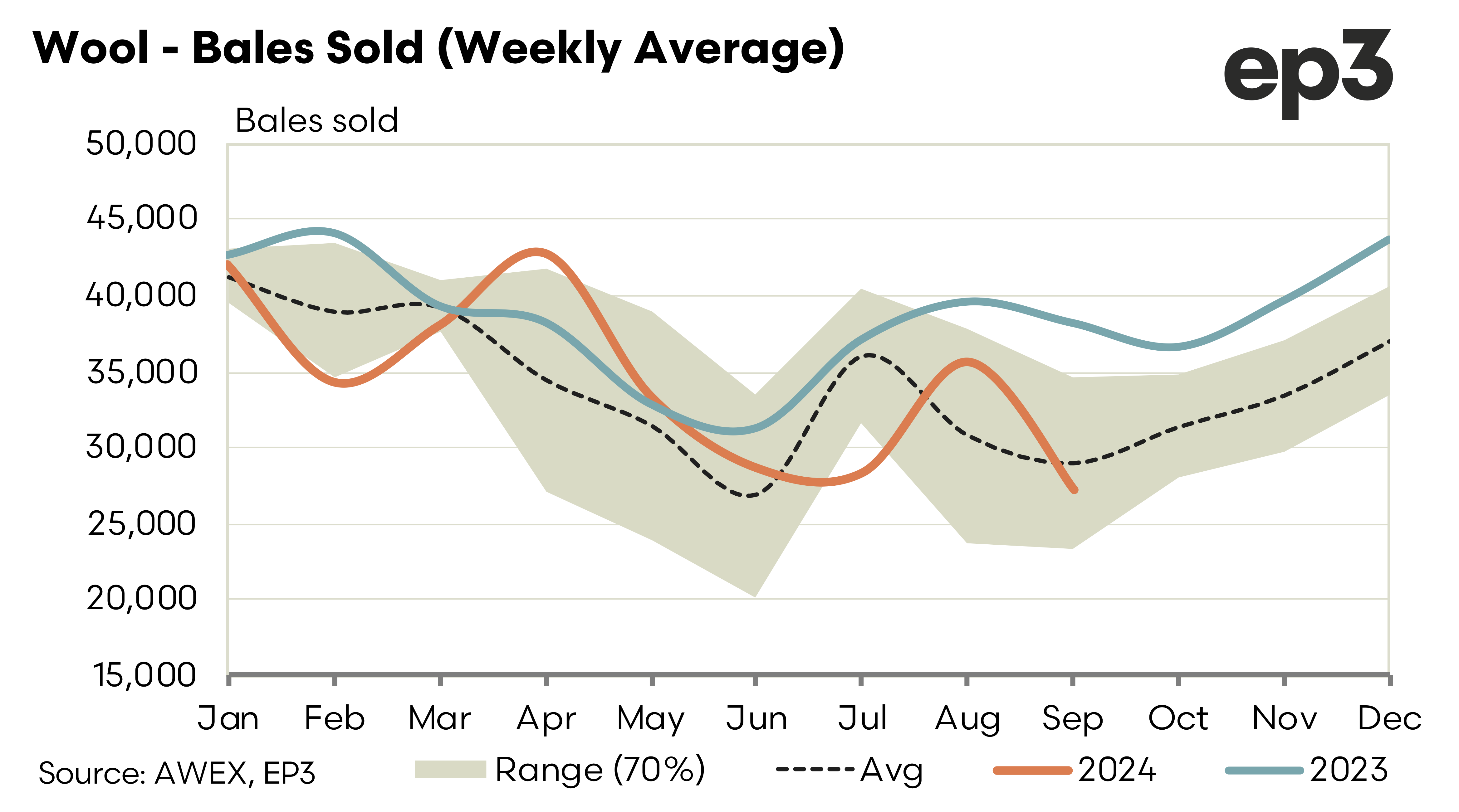

With 32,000 bales on offer next week direction will again come from the dollar and spot demand. Early commentary from the Nanjing Wool Conference was unexceptional with buyers remaining hesitant.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.