Market jerks

Wool Market Update 20th September 2024

“It isn’t the ups and downs that make life difficult; it’s the jerks.” – Charlie Chaplin.

Another testing week for the spot auction. The market again faced the headwinds of a stronger AUD and uncertain global condition. Tuesday’s spot auction was surprisingly solid with the EMI rising 0.4 pct in Aussie Dollar terms and almost 2 pct in USD. Wednesday saw some of those gains given back as the weight of the dollar driven mostly by anticipation of the US Federal Reserve cutting interest rates. The rate cut of 0.5% has pushed the AUD further to an 18-month high.

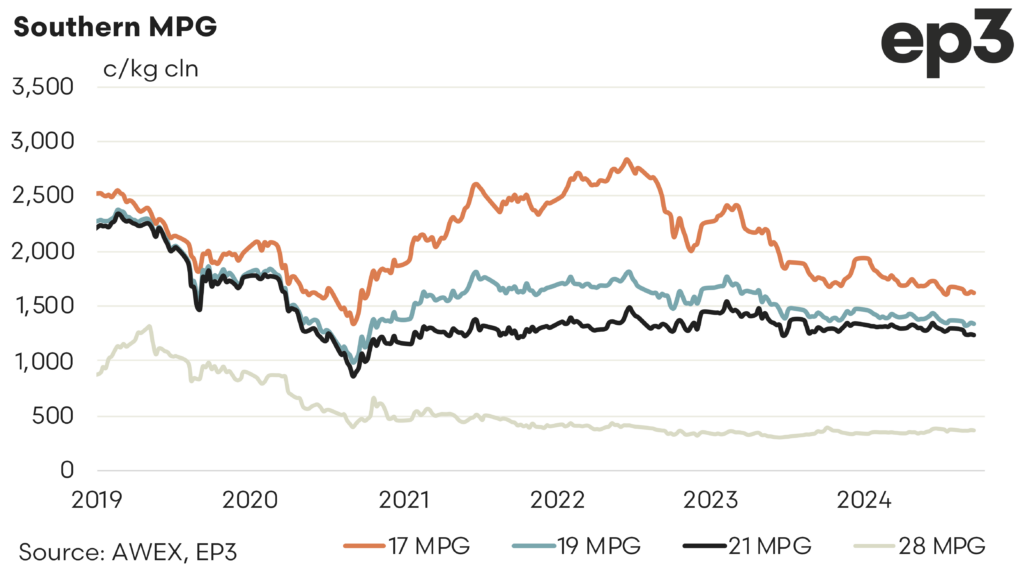

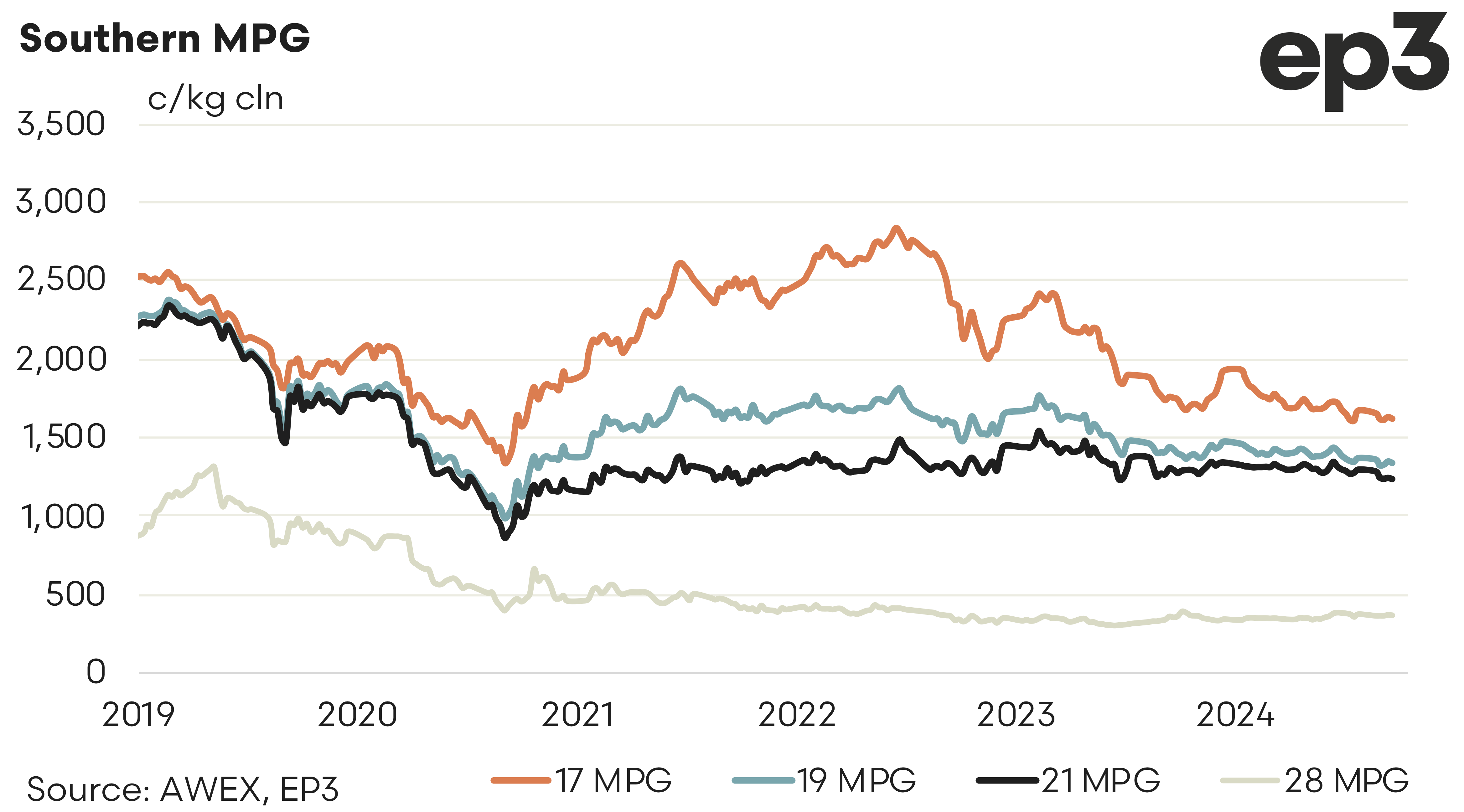

The forward market was a little more active with both buyers and sellers looking to gain some certainty by hedging positions. Bids and offers were generally scattered across the nearby months out to December with most looking flat to market for cover. Only trades occurred in 18.5 microns with October and November trading at 1400 and 1405 respectively. December remains bid flat to cash. 19.0 at 1350 and 21.0 at 1260

Latter months continue to be well bid but restricted to the fourth quarter 2025 and into 2026. 19.0 bid November and December 2025 at 1450 (cash 1357). January 2026 showing an even higher premium with 19.0 bid at 1500 (143 cents over cash) and 19.5 at 1450 (131 cents over cash).

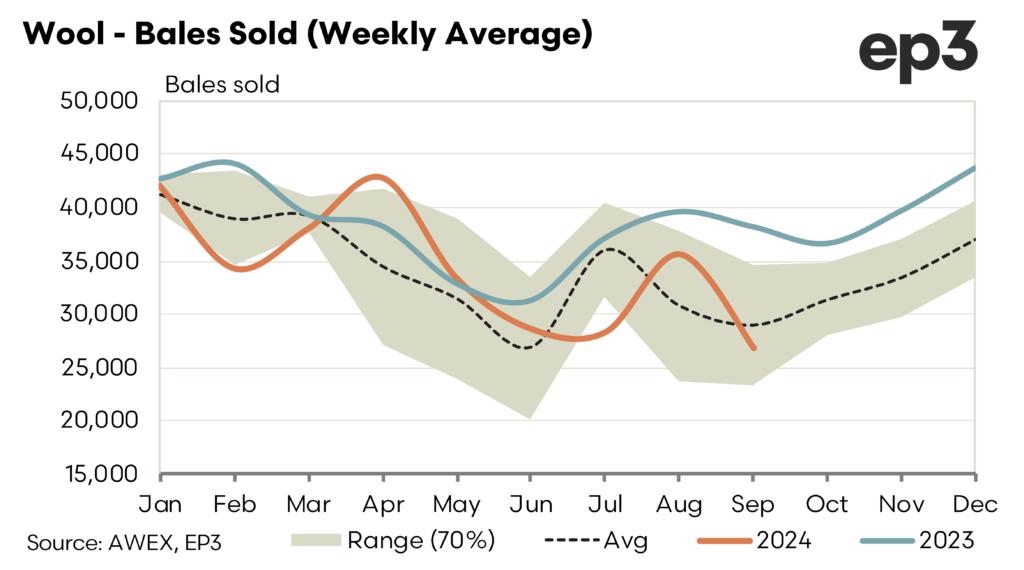

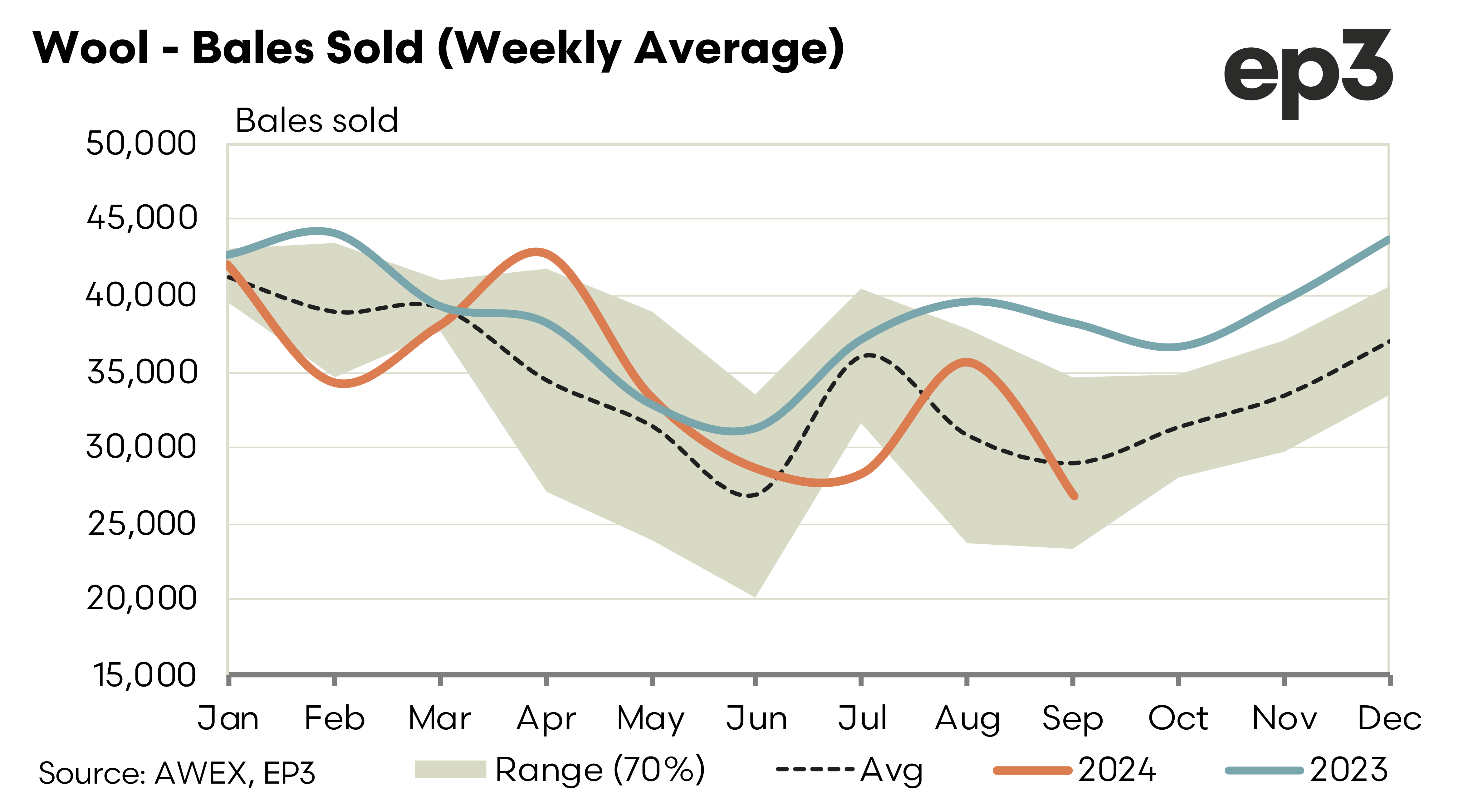

Next week’s 34,000 bales are unlikely to provide any downward pressure. Traders will continue to look for opportunities to balance their books providing intermittent openings for growers to hedge. The main drivers will continue to come from the currency movements, tepid demand, and the general malaise of the markets. Ups and downs will continue punctuated by the jerks of politics.

This report is provided by Southern Aurora Markets, please subscribe to their service or contact them for a chat about any price risk management needs in fibre markets.