Market Morsel: A contained market

Market Morsel

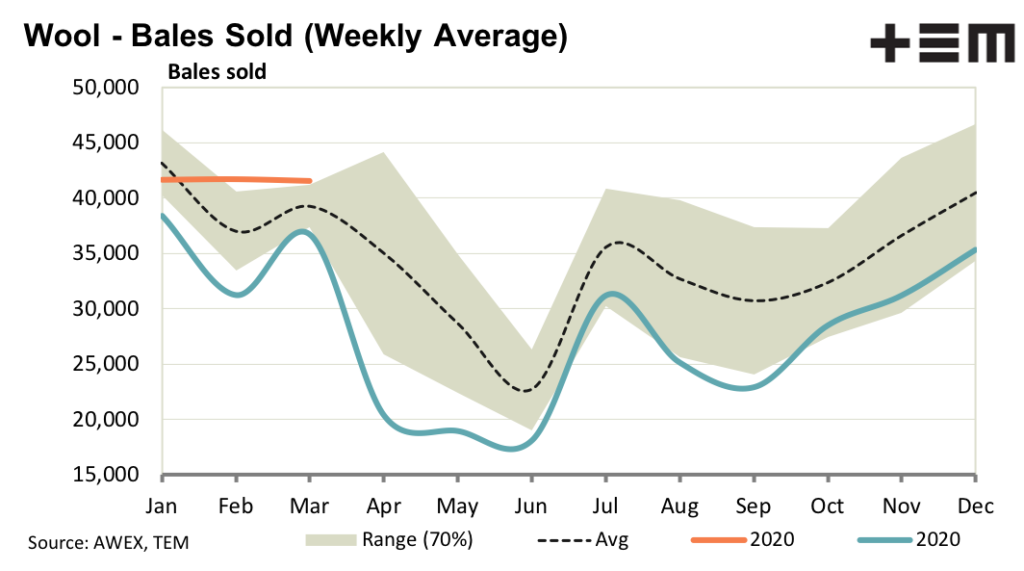

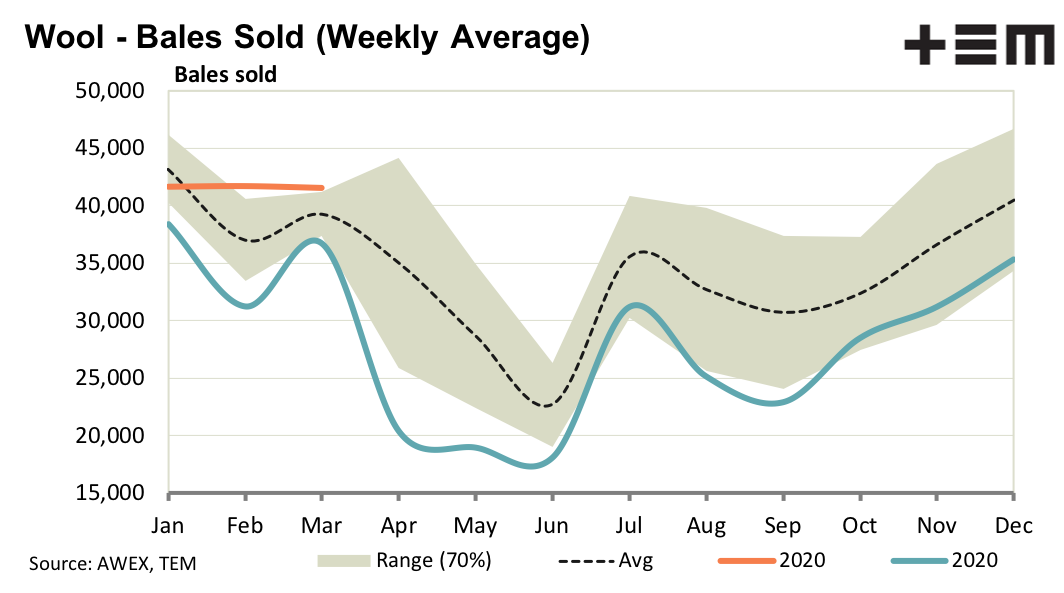

Logistics issues continue to show up in different ways with reports that wool dumps are running out of space due to slow shipping of containers. In general greasy wool prices continued to ease this week for the third week in a row in US dollar terms.

The price weakness is not being “talked down” by the supply chain as most sections now have some stock, so they would like to the see the value of this stock maintained. The supply chain has been building some stock, from low levels, so when some new business eventually shows up they can meet the requirements quickly and not lose the order.

In the USA the economic outlook continues to improve, with a strong re-bound likely in the second half of 2021. Exporter feedback indicates European demand for greasy wool remains moribund, so it remains to be seen if the stronger economic growth in the USA in late 2021 is enough to help lift demand for wool apparel.

At this stage it appears restocking of the supply chain along with domestic Chinese demand has been underpinning greasy wool (and other apparel fibre prices). In the longer run greasy wool needs the other colder, richer economies to fire up.

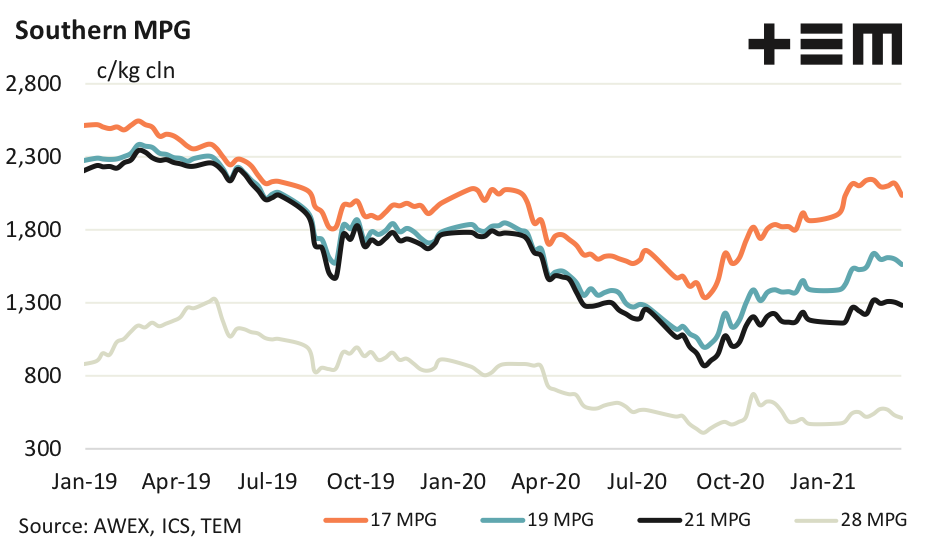

17 Micron

While the merino clip continues to broaden compared to year ago levels, as it is still doing, fine merino premiums should hold most of their value. Discounts for various fault remain generally low although higher vegetable fault is being priced at low levels.

19 Micron

The greasy wool market is in the grip of a mild correction (best seen in US dollar terms) so there is likely to be more price weakness yet. Charting patterns continue to give hope that an old fashioned post-Easter rally is quite possible. Beyond this season the prospects are for a slowing economy in China and a booming economy in the USA with uncertainty about Europe.

21 Micron

The northern half of NSW is enjoying some good rainfall, which will help boost the supply of broader merino wool and vegetable matter supply through 2021. Australia produces about half of the world 21 micron merino supply, so changes in the supply of these regions will be impacting on the market. La Nina weather events are not good for agricultural production in South America.

28 Micron

The increase in crossbred volumes seen in the February AWTA volumes is a likely reason for the slippage in the 28 MPG price ratio to the 21 MPG (larger discount). Despite this the 26-27 MPGs look to be shaping up for a rally in charting terms.