Market Morsel: A correction in prices

Market Morsel

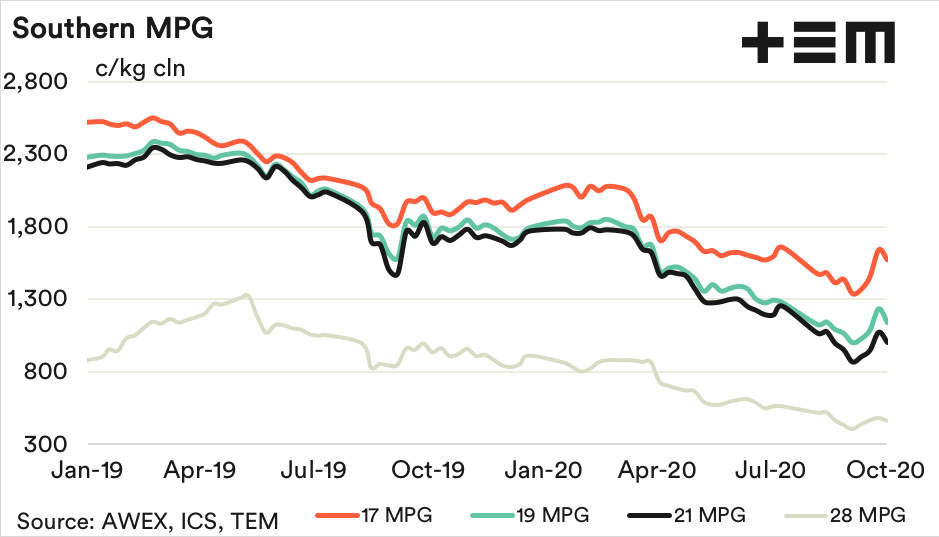

A correction in prices, after three weeks of price rises, appeared this week in the greasy wool market. The market has given up about one-third of the gains made in September, with an expectation that prices will ease again next week.

Given the strength of the down cycle and the time of the season, it would be reasonable to expect prices to give up half of their recent rises which works out to be another 40 cents. With the improved seasonal conditions the supply of over-length wool is increasing as is the proportion of lots with a position of break in the middle of the staple.

Discounts for these characteristics are likely to widen as a consequence. Parts of the supply chain are concerned about grower held greasy wool stocks. These stocks are held by a range of farmers with different price ideas as they have been accumulated across a wide range of price levels in the market.

As such this wool is likely to flow back onto the market at varying times, not as a flood. Given the high lamb to wool price ratio, the stocks may prove to be a valuable resource for the supply chain in the coming years.

17 Micron

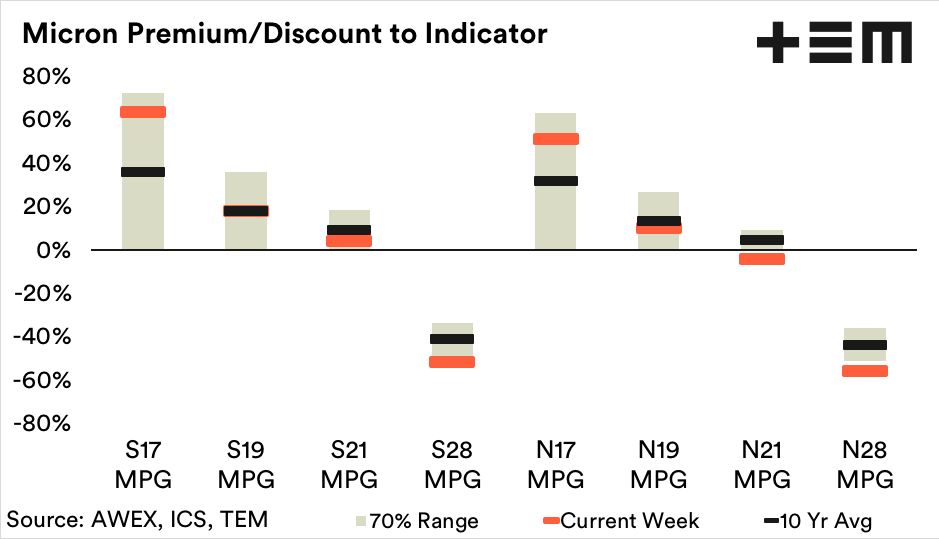

The 17 MPG did not fall as much as the medium/broad merino MPGs, as the micron premiums widened slightly helping to support the 17 MPG. This process should continue through to late in this season. At this stage discounts for low tensile strength remain minimal, but the supply is rising as is the supply of over length wool which will test these small discounts.

19 Micron

The 19 MPG has traded across a 200 cents range in the past month (996 to 1220 cents). The current correction seems likely to take the price back to the halfway point of this range, around 1100 cents. It will be a good result if it finds support there.

21 Micron

21-23 micron volumes as measured by AWTA core test volumes were up by 50% in September compared to year earlier levels. This will test the price differentials between the 21-23 micron categories and the 18-20 micron categories.

28 Micron

The increase in broad merino supplies implies than an additional source of downward pressure on crossbred prices will come into the market. Analysis of grower stocks show them to be fairly evenly spread across the micron categories, even though crossbred prices probably have a longer timeframe for recovery than fine/medium merino prices.