Market Morsel: A hesitant supply chain

Market Morsel

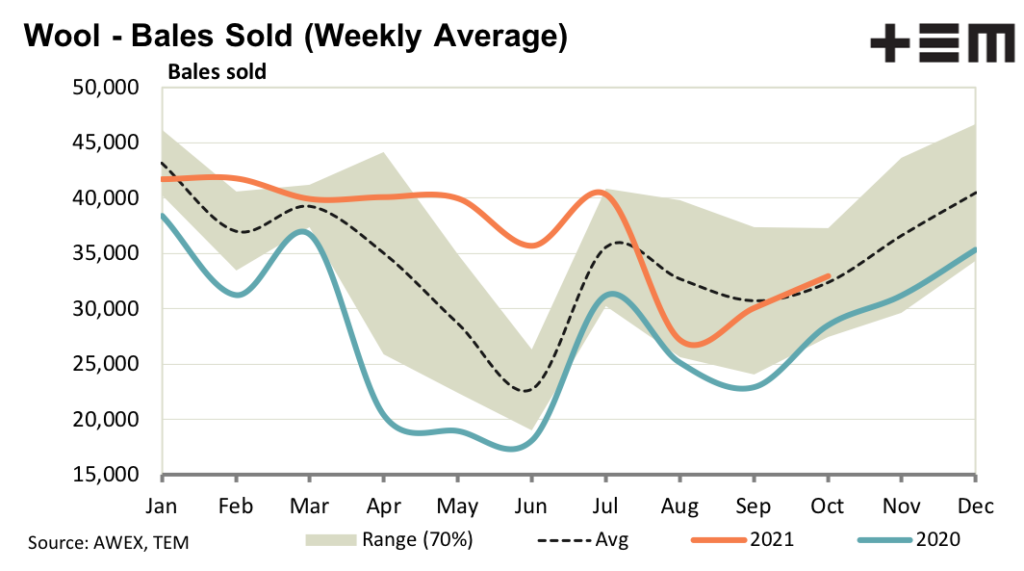

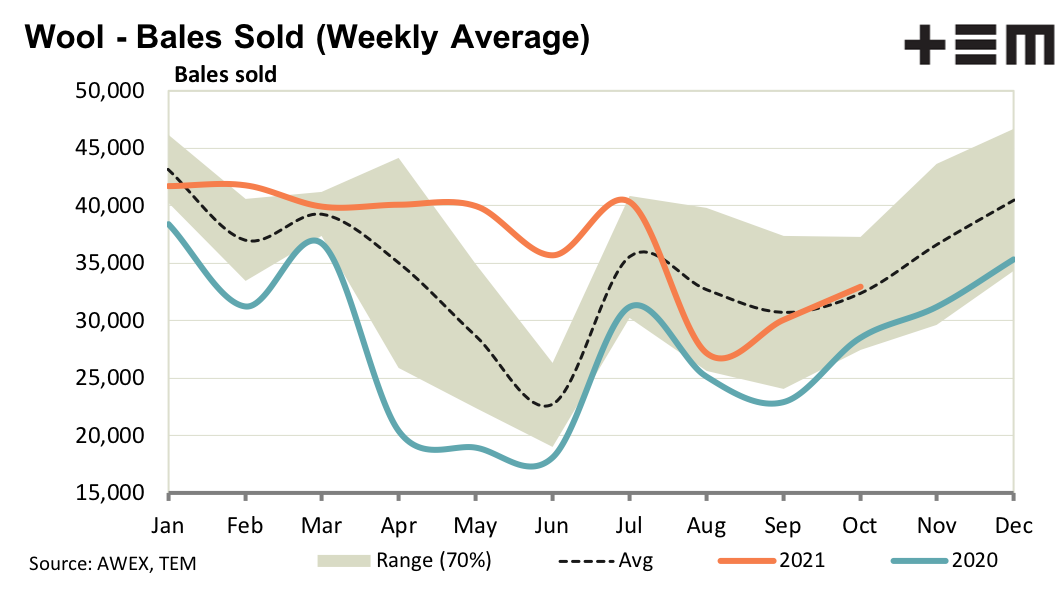

The new business from late last week translated into substantial price rises at wool auctions this week for merino wool, boosted in US dollar terms by a higher Australian dollar. As a result of the combined effect of higher wool prices and Australian dollar the supply chain is hesitant to write new business, so prices look likely to ease slightly in the coming week.

Some of the bigger apparel fibres in China are seeing prices ease, as the worst of the electricity shortages passes. Wool processors are generally working four day weeks, which is allowing wool to flow. Premiums for RWS accreditation cropped up for a composite clip this week.

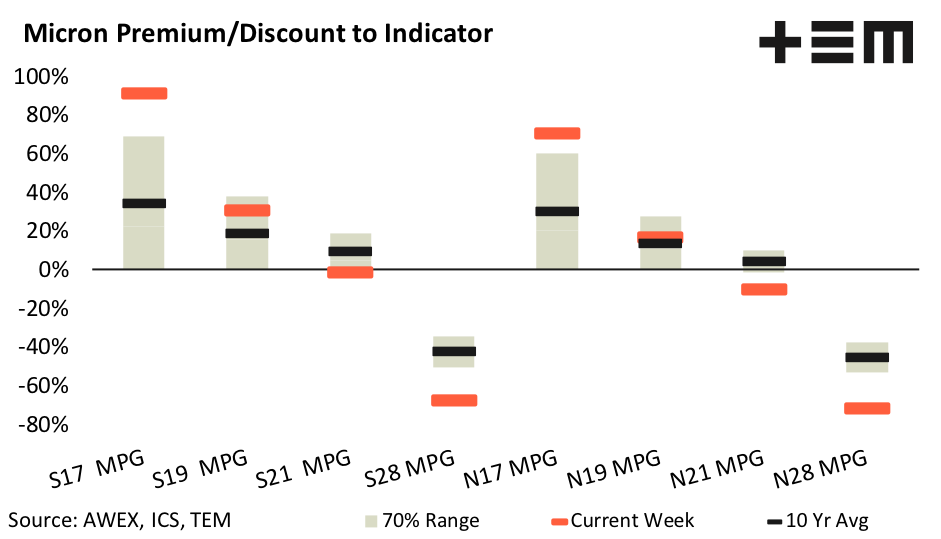

Exporter feedback indicates there is interest for RWS accredited wool in these categories, an area of wool production not usually linked to premiums. It is a changing world. Micron premiums and discounts for merino wool remains large in cents per kg terms. However the merino clip looks to have finished its post drought broadening cycle, and this will reduce some of the stimulus for wide micron premiums and discounts.

17 Micron

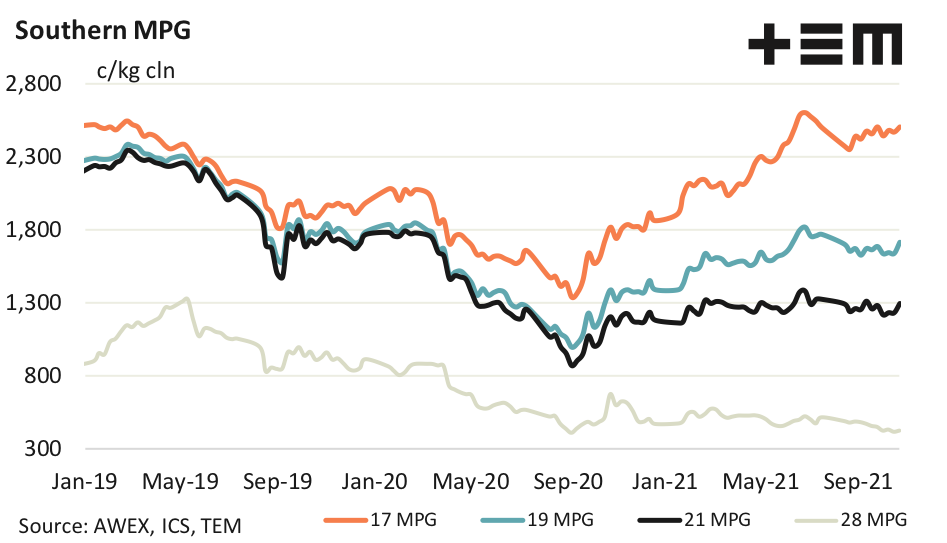

RWS wool hit 5.4% of merino fleece sales this week (about half was New Zealand wool) so the volume is growing. Premiums continued to be paid for well specified merino wool. Fine micron premiums continue to hold up well, with the gap between 17 and 21 micron still around 1200 cents.

19 Micron

Merino prices picked up strongly this week on the back of new business down late last week, in line with the much stronger apparel fibre markets generally in China in October. The energy situation in China (mainly in the form of coal supplies) is being brought under control, so apparel fibre prices are unlikely to continue surging upwards.

21 Micron

There are some rumours about uniform orders in China (when aren’t there?) which are likely to favour 19 to 21 micron wool as the finer micron categories will be ruled out due to relative cost. In addition the merino clip has stopped broadening, which is good news for 20-23 micron prices as it will reduce the supply pressure on them.

28 Micron

Crossbred prices picked up slightly this week, better when viewed in US dollar terms. The interesting thing in the crossbred market this week was an RWS accredited composite clip receiving premiums. It is early days but is a definite positive for crossbred wool.