Market Morsel: Always back that horse called self-interest.

Market Morsel

There were news reports this morning of China disrupting the cotton trade with the potential implementation of a tariff (40%) on Australian cotton. (see article here).

This is a big hit to an industry recovering from recent droughts. I thought it was worthwhile taking a deeper look into cotton as a sequel to this weeks ‘And the cotton is high’, with a specific look at China.

Generally, nations do not make trade decisions which will be contrary to their self-interest, as the old saying goes ‘Always back the horse called self-interest’.

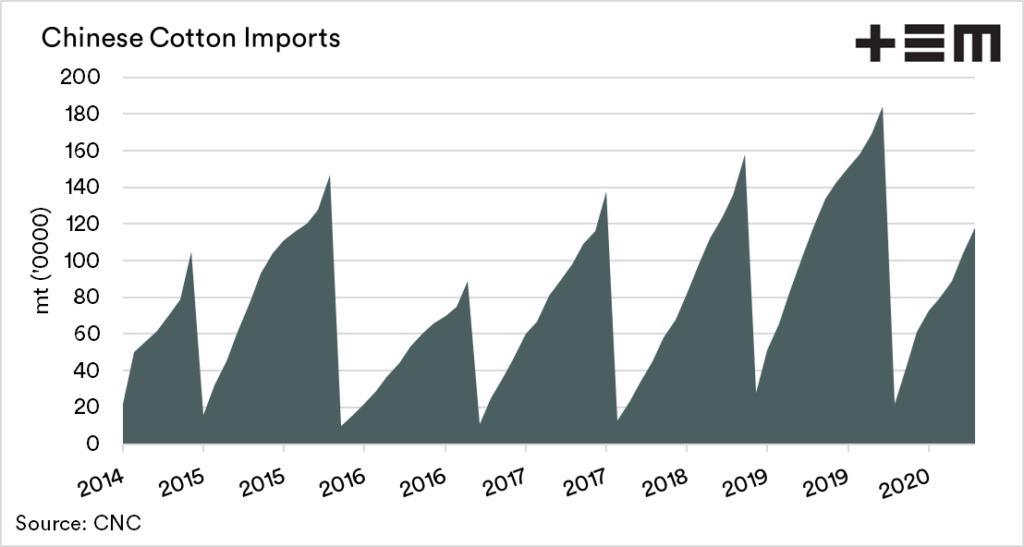

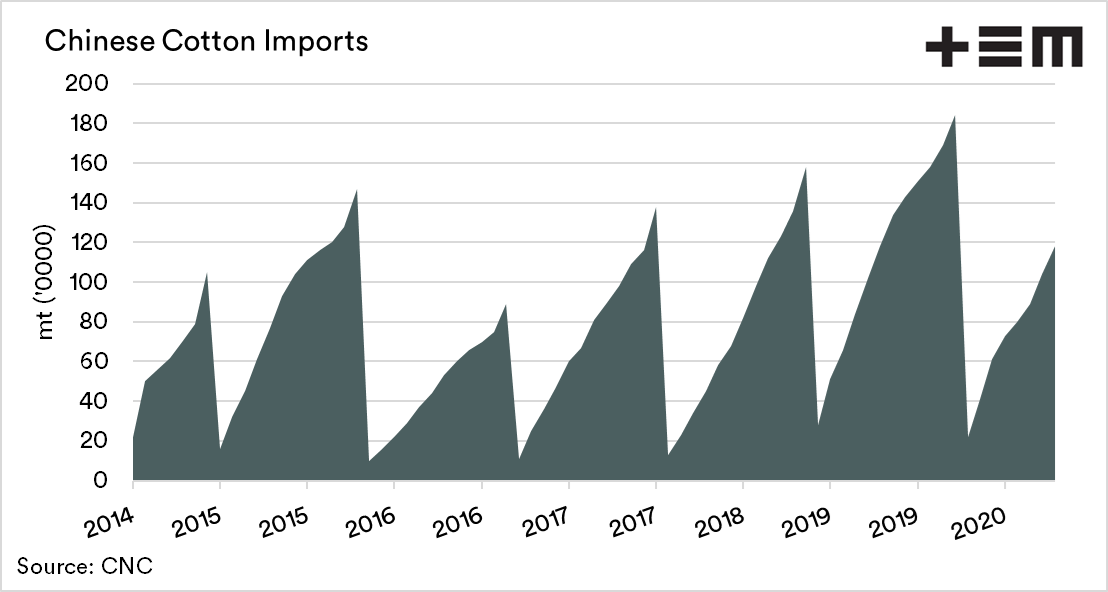

Up until August, China had imported 17% less cotton than the same time last year. This is in contrast to other agricultural commodities (ex Barley) which are all firmly up. The export number is a sign of reduced demand for imports, in part due to CV-19 reducing apparel requirements.

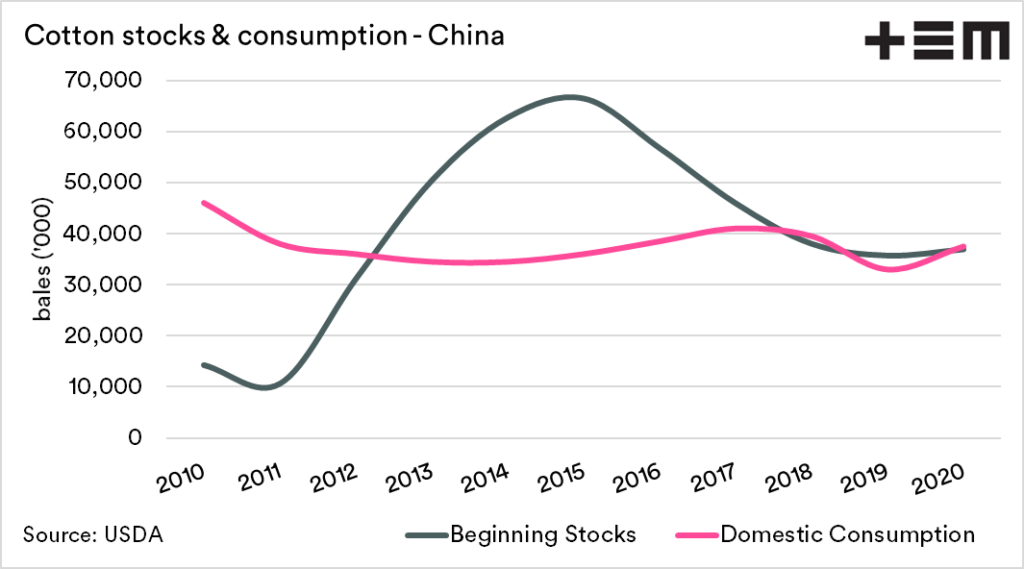

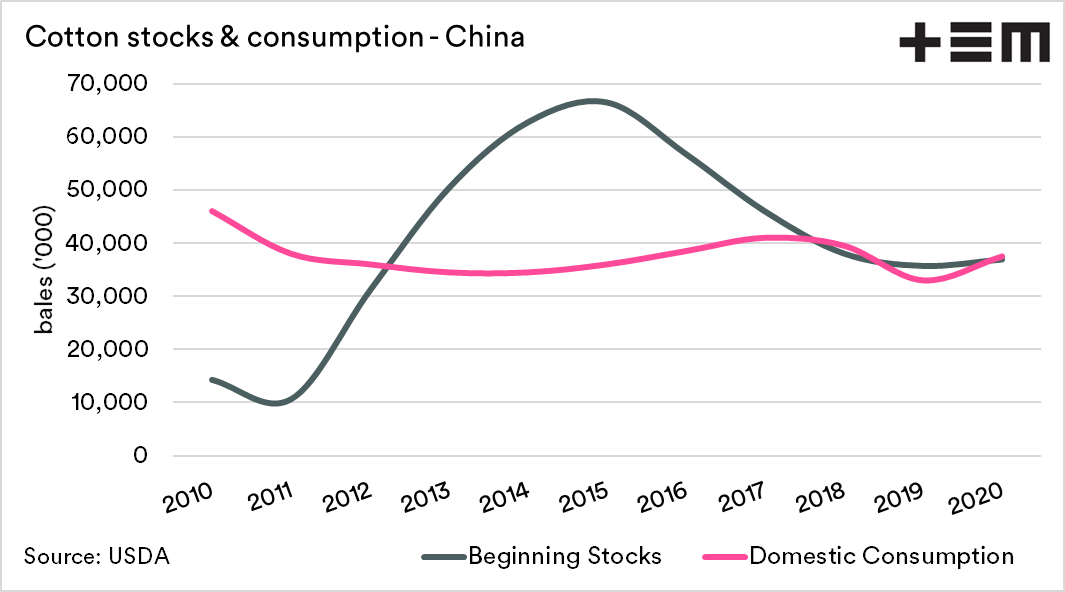

You will hear this a lot from us, but the numbers tell the real story. At the start of this season, China had stocks which equated to 98% of a years domestic demand. This is a huge stockpile, which when domestic production is added to the equation is pointing towards reduced import requirements.

The supply and demand picture (if USDA data is correct) points towards a scenario where China is well stocked for cotton. This would make cotton an easy target to attach a target for two reasons. Firstly as political manoeuvring with the recent tensions, and secondly to assist the prices provided to local farmers.

We have seen the second reason in recent times with pulse tariffs into India. The reality though is that China can apply a tariff, and not materially impact upon their own industries.

If this was going to hurt China, they wouldn’t target this commodity. It is political, but it is more than a political gesture. The government should be looking at all export produce to determine which ones that China can get by without.

Let’s hope that cooler heads can prevail and that the two governments can get to the negotiating table.