Market Morsel: Baled up

Market Morsel

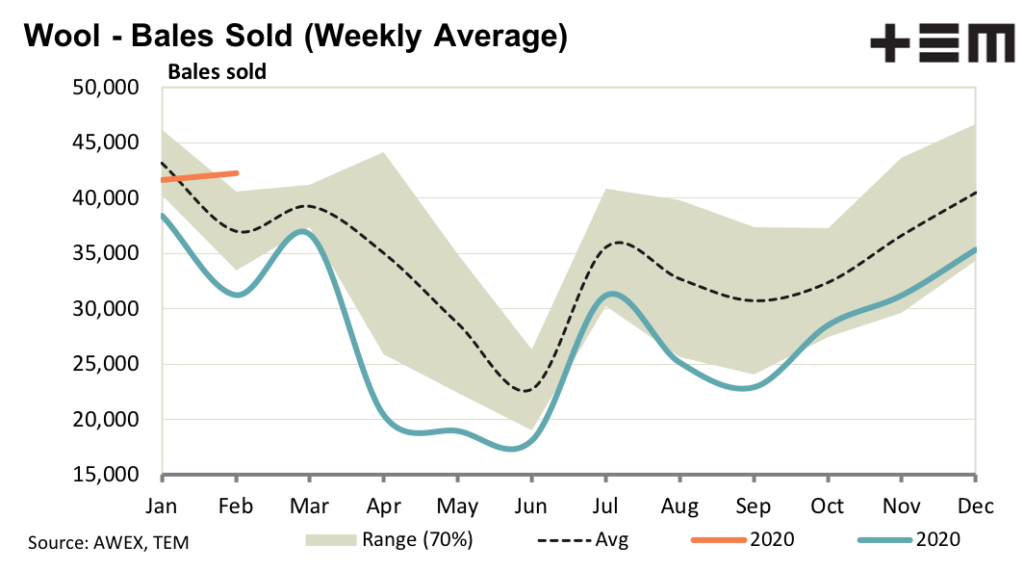

Despite the sizeable offering this week, after a month of sizeable offerings, medium and fine merino prices continued to creep higher. Demand for wool accredited to quality schemes (and non-mulesed) picked up this week with some handy premiums being paid.

Broader merino prices for wool with significant vegetable fault eased, with discounts now at wide levels. This is usually the period of low vegetable fault for the season, with the supply set to increase through to August, so large discounts are not really expected early in the calendar year. Demand for greasy wool remains centred on China, with demand out of other regions generally struggling with the effects of COVID-19.

For the second half of 2021, demand will need to pick up in non-China regions to help support prices. A recovery will happen, but the timing is uncertain. One of the outcomes of the pandemic has been the divergent effect on sales of goods and services. Services have suffered greatly while sales of goods have been relatively healthy, which may help explain the better than hoped for demand fro greasy wool.

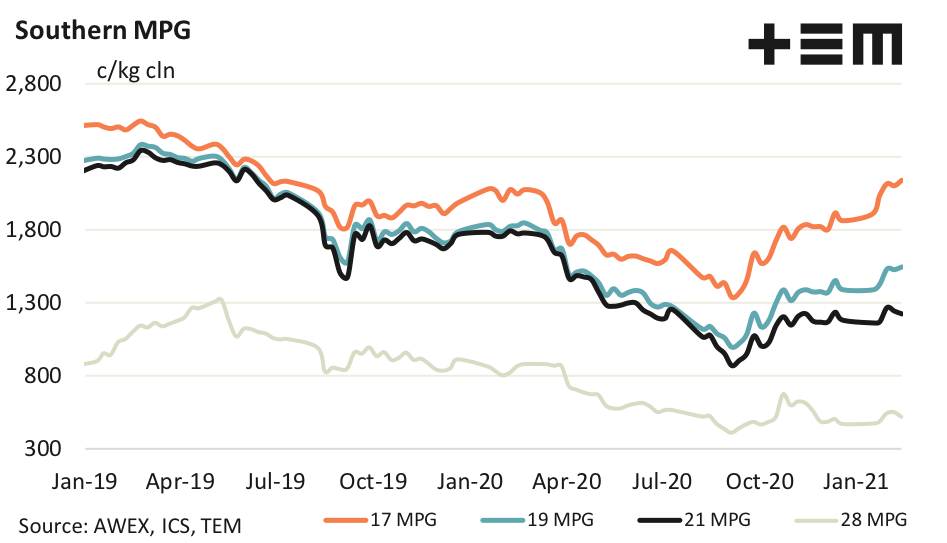

17 Micron

There was a large and varied enough fine wool offering this week to develop price averages down to 13 micron. Despite the plentiful offering discounts for low staple strength and short staple length remain at minimal levels. The 17 MPG continues to trade at July 2019 levels whereas the EMI is trading at April 2020 levels, substantially lower than mid-2019 levels.

19 Micron

It was a really good week for better specified 18-19 micron wool which was non-mulesed and accredited to a quality scheme such as RWS, with some sizeable premiums paid. Whether the premiums extend into next week is uncertain, as they do tend to ebb and flow.

21 Micron

Broad merino wool with 3% plus vegetable fault are being heavily discounted, which is potentially a problem as the supply of higher fault wool is likely to increase through to August, in line with normal seasonal supply trends. On the positive side the discounts are large by historic standards – it is a strange season.

28 Micron

Broad crossbred prices for lots of low quality (especially samples identified as having kemp) are struggling at extremely low levels. Some producer price indices from the BLS in the USA show apparel prices for furnishings to have fallen to low levels during the past two years, implying there is no immediate relief coming for this wool.