Market Morsel: Caution warranted in wool market

Market Morsel

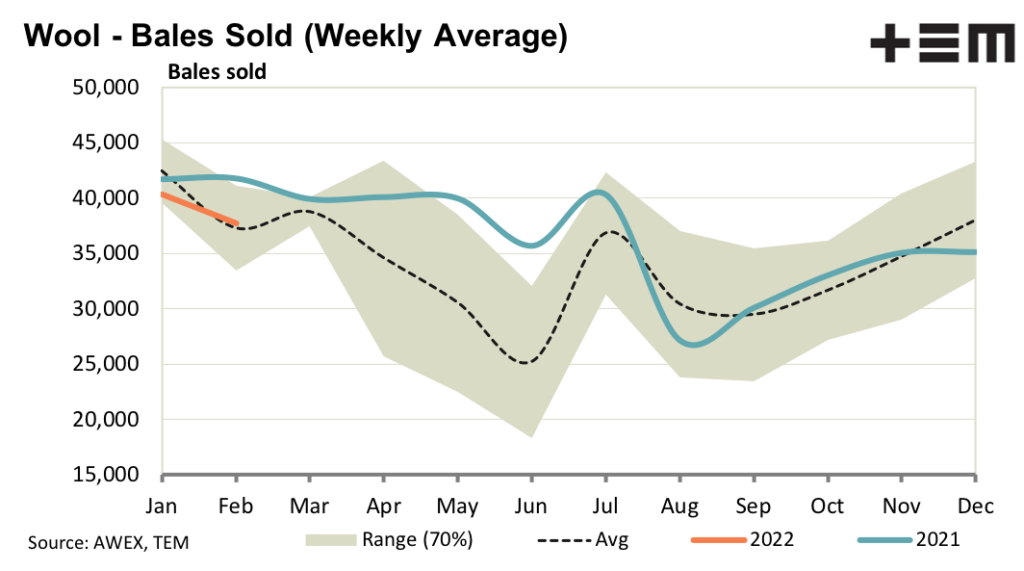

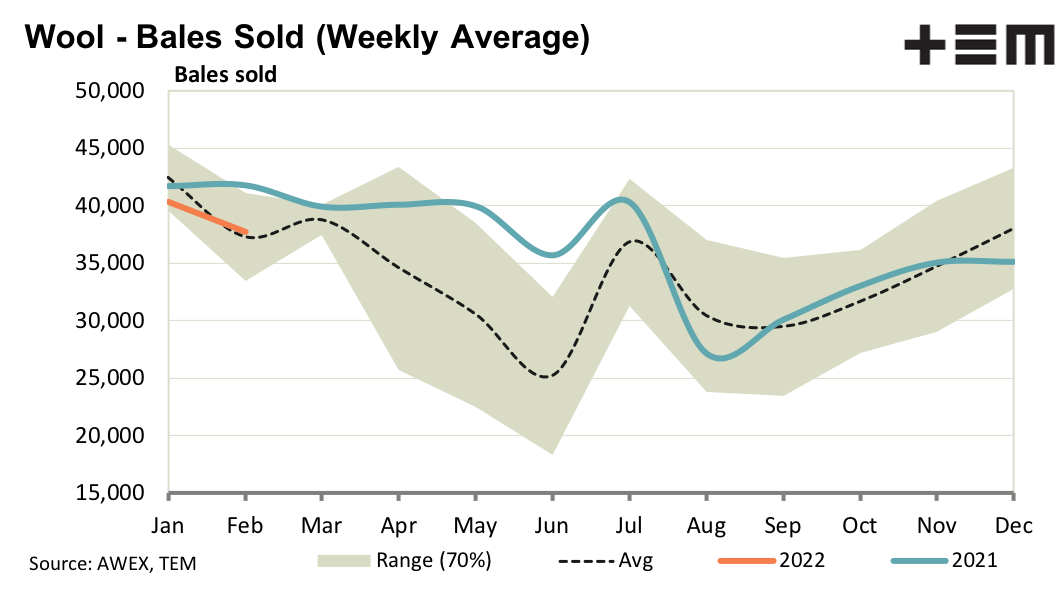

Short term demand remains quite robust for merino wool, with logistical problems leading to slower payments along the supply chain the issue with potential to derail prices. Fremantle prices faltered on Thursday with some western MPGs down. How this plays out in the coming weeks will depend on part in the size of wool offerings.

Higher prices have started to draw greasy wool out of storage as farmers take advantage of the best prices since mid-2021. Extra offerings from held wool have the potential to exceed the trading capital available to exporters. For the season to date auction sales have been 79% of AWTA core test volumes, which is the average level for the July to January period for the past 15 years.

The supply chain has absorbed Australia production this season so far, with good prices albeit helped by the exchange rate. Looking further ahead there are enough economic (interest rates, Chinese economic growth) and political (Ukraine) issues in the world to warrant caution in the outlook for apparel markets such as greasy wool.

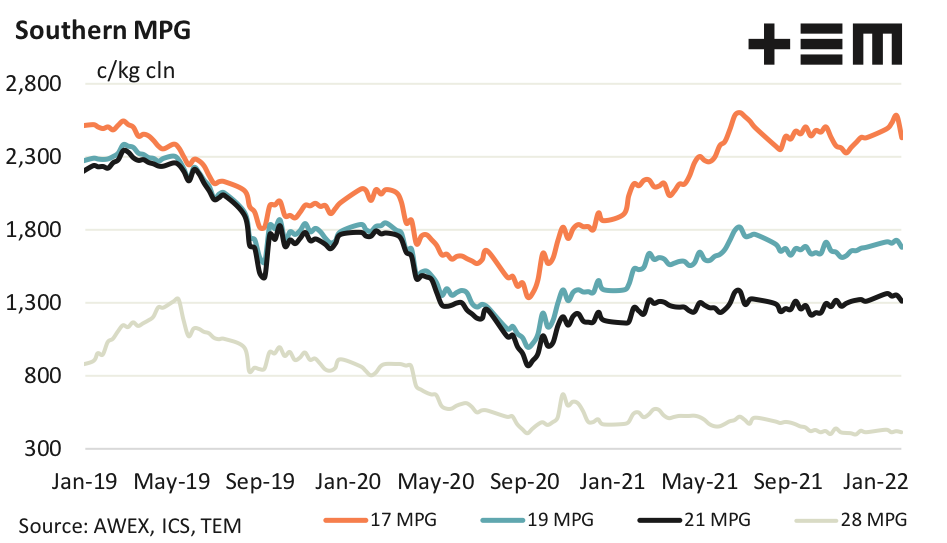

17 Micron

The finer MPGs rose again this week, and there appears to be some prospects of further rises in the short term although European demand (which has helped drive these premiums) is approaching the time of year (in the Australian autumn) when demand for greasy wool eases.

19 Micron

The strength in the merino market is focussed on the finer micron categories. While there might be some further upside for the 19 MPG it seems likely slow logistics hence payments will be enough to limit any price rises. On a brighter note RWS premiums were on show again this week in the order of 200-250 cents for medium merino fleece.

21 Micron

In US dollar terms the 21 MPG is within US50 cents of the upper bound of its trading range which it has been in since early 2021. This implies that only limited rises are possible for the broader merino categories in the short term, with higher vegetable fault and lower yields impacting on price.

28 Micron

Crossbred prices were highly variable this week, even for full length fleece. While the bulk of crossbred prices are cheap any way they are analysed, the timing of a recovery in prices remains an unknown.