Market Morsel: China bans SA wool

Market Morsel

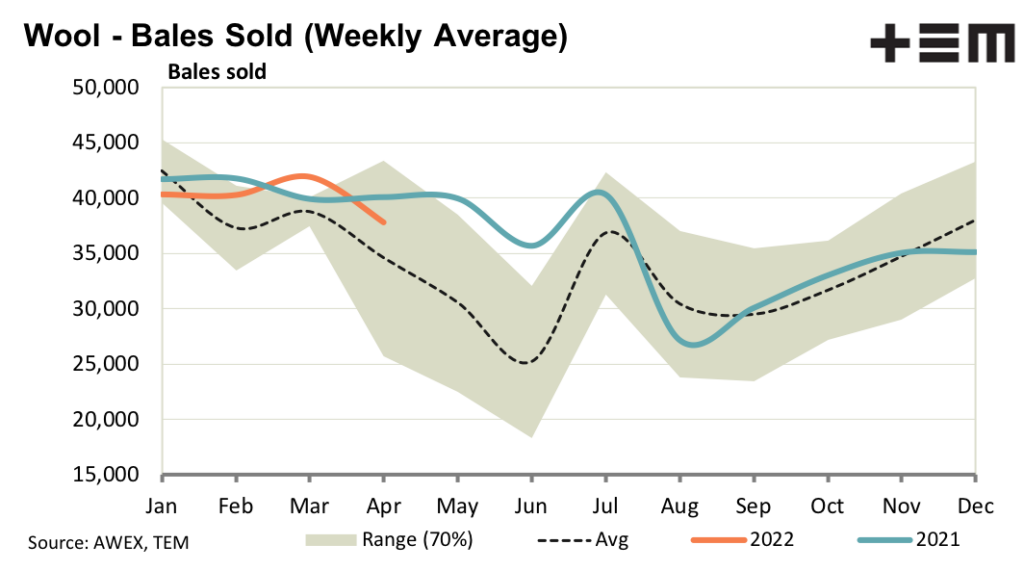

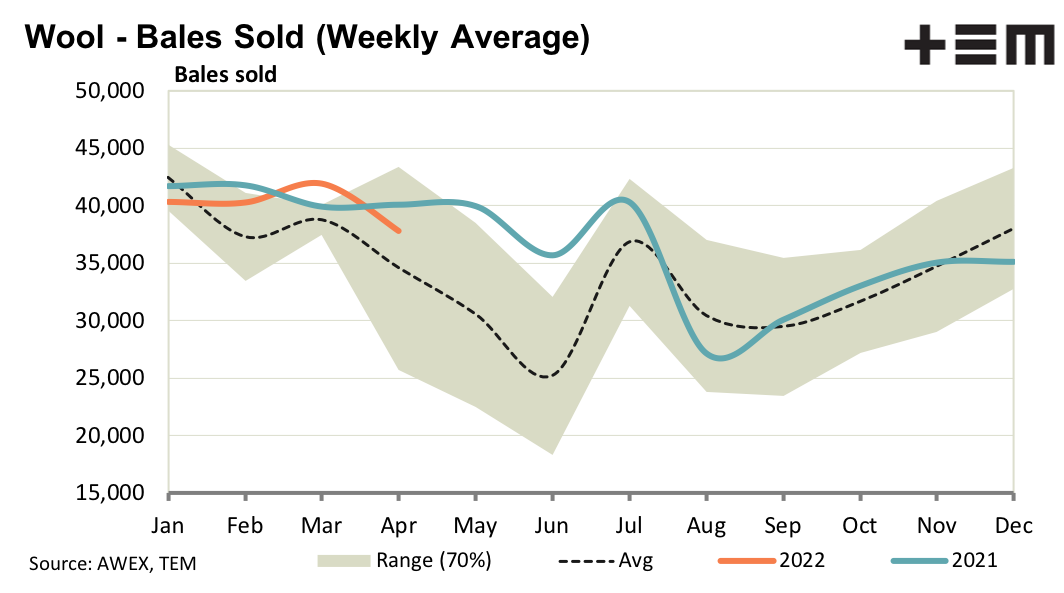

A flare up in foot and mouth in South Africa lead China to ban wool imports from there last week. Auction sales were then suspended in South Africa as some 80% of the South African clip is processed in China. With the experience of 2019 it is very likely appropriate protocols will be put in place by South Africa to enable the resumption of wool exports to China, but this will take a little (undetermined) time.

The most immediate impact of the South African situation is the absence of a major (if not the main) supplier of RWS accredited merino wool. Exporters will have to scour Australia, New Zealand and South America to make up the shortfall. In our domestic market quality remains an issue in terms of vegetable matter levels and the effects of a wet summer (cotts, jowls, colour and water stain). Quality systems are all well and good but fundamentally wool needs to be firstly fit for purpose.

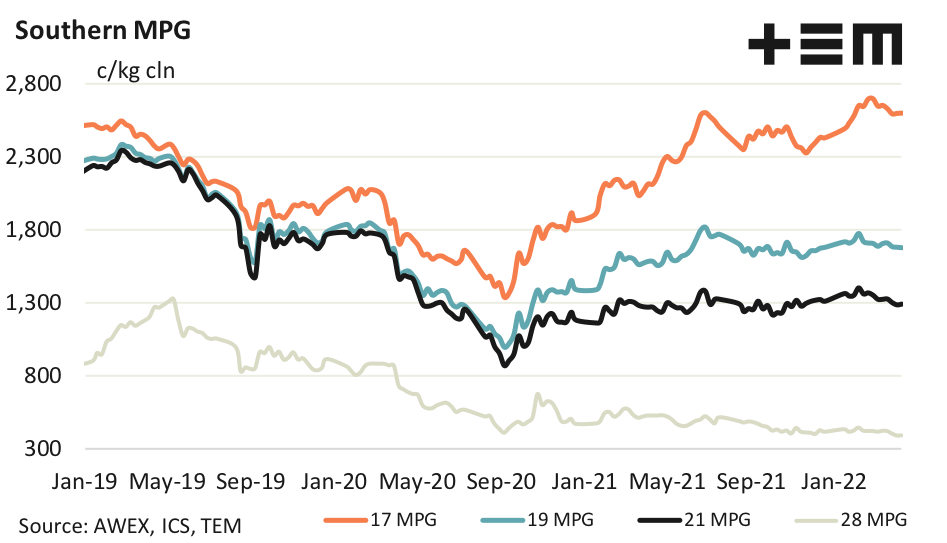

17 Micron

Quarterly sales of 16-18 micron wool were the third highest in volume terms for the March quarter when looking back across the past 22 years. In Gross sales value they were the second highest (third highest in US dollar terms). For the fine merino these are excellent measures.

19 Micron

RWS premiums did seem to firm this week, after appearing to weaken in the previous week. Suspension of auction sales in South Africa knocked out around 70% of the weekly supply of RWS accredited merino wool based on recent sales. This is a big drop in the supply of wool in strong demand, as evidenced by the premiums the market has been paying.

21 Micron

The supply of vegetable matter (VM) is the heaviest in the broader merino micron categories, which fits with these wools coming from the geographical zones which produce most of the vegetable matter in the clip. This means the limits on VM are felt the most for these categories and they have the greater discounts for higher VM. Unfortunately it is only early April and the ample supply of VM will persist until mid-2022 and so will the discounts.

28 Micron

While the supply chain is absorbing all of the crossbred wool offered there are gaps in the market as exporters will only buy lots they have a place for. Trading conditions do not encourage a build up of stocks. This means lots may be neglected in one sale and then achieve valuation in the next sale.