Market Morsel: Chinese textiles rebound underpins wool market

Market Morsel

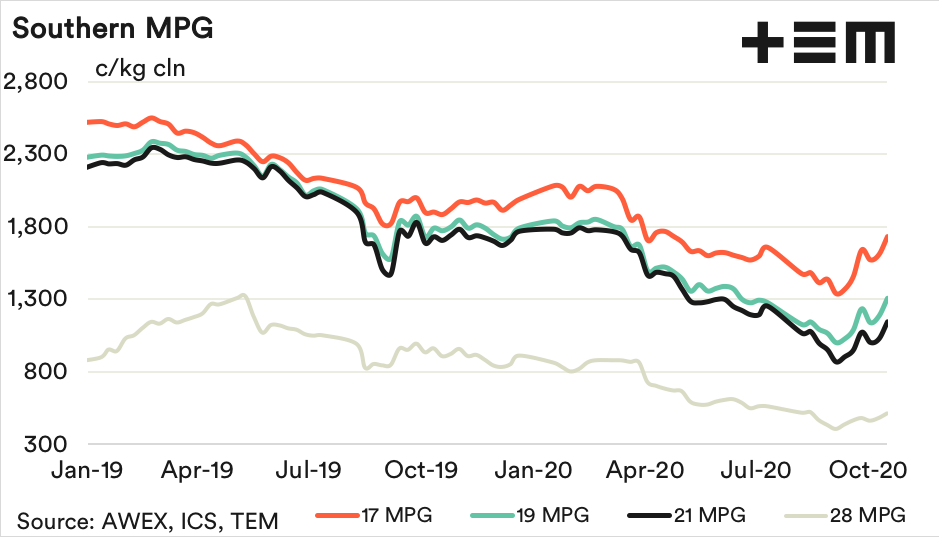

Another week of very strong wool prices surprised many, again. Greasy wool prices were matched by general rises in the textile markets in China during the past week for man-made fibres and cotton as well as yarns, up between 7% and 14%.

Chinese domestic demand is the shining light for apparel markets at present as the USA and Europe continue to struggle with COVID-19. The Chinese demand is spread across fine merino knitwear and some anticipated army uniforms. The fine knitwear demand is soaking up short and low staple strength fine merino wool while the uniform order is more focused on the 19.5 to 21 micron categories.

The pickup in price reflects the supply chain changing tack after letting prices overshot downwards as it battened down the hatches to ride out the COVID-19 induced economic downturn. At this stage, fine merino prices have nearly recovered half of their losses suffered since early 2020, while medium merino and broader have recovered about one quarter. Forward quotes and feedback indicate another week or two of price rises are likely.

17 Micron

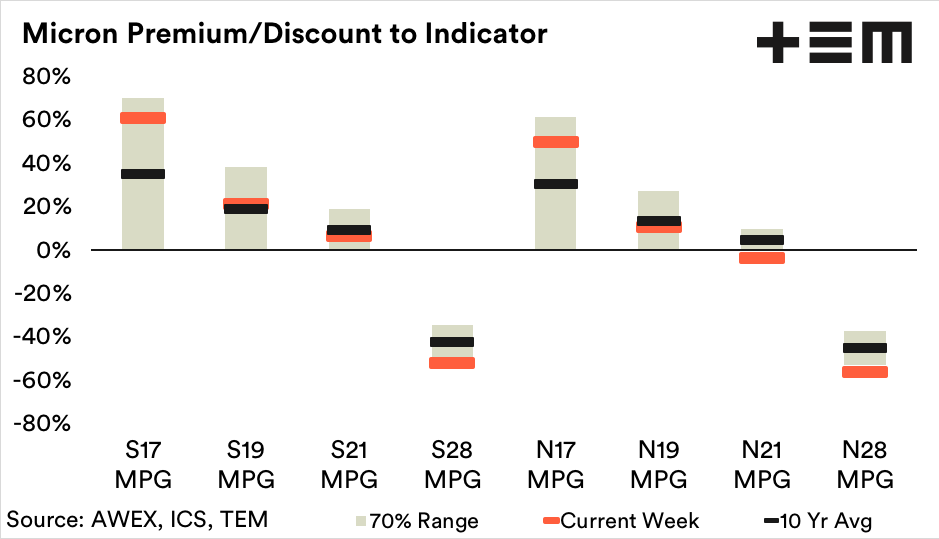

The merino clip continues to broaden in eastern Australia, so supply pressure will persist in widening the gap between fine and broad merino prices (increased micron premiums and discounts). While medium merino prices pick up fine merino prices will pick up as well and then some as the micron premiums widen.

19 Micron

Last weeks conservative view was proved incorrect, with some Chinese Army uniform orders apparently anticipated in November which will pull through 19.5-21 micron through the supply chain. Given this there looks to be more upside yet for the 19 MPG in the next couple of weeks.

21 Micron

While the 21 MPG did ease slightly in relation to fine merino prices this week, the 114 cents lift outweighed the relative decline. A supply chain re-stocking in order to cater for some uniform orders is behind the strength in the broader merino market. Forward bids are above closing quotes so the expectation is that auction prices will lift further.

28 Micron

The 28 MPG continues to trade around 0.45 of the 21 MPG, so any strength in the broad merino market is likely to drag crossbreds higher. Fine crossbreds have benefited the most from the new found life in merino prices.