Market Morsel: Concerns over China

Market Morsel

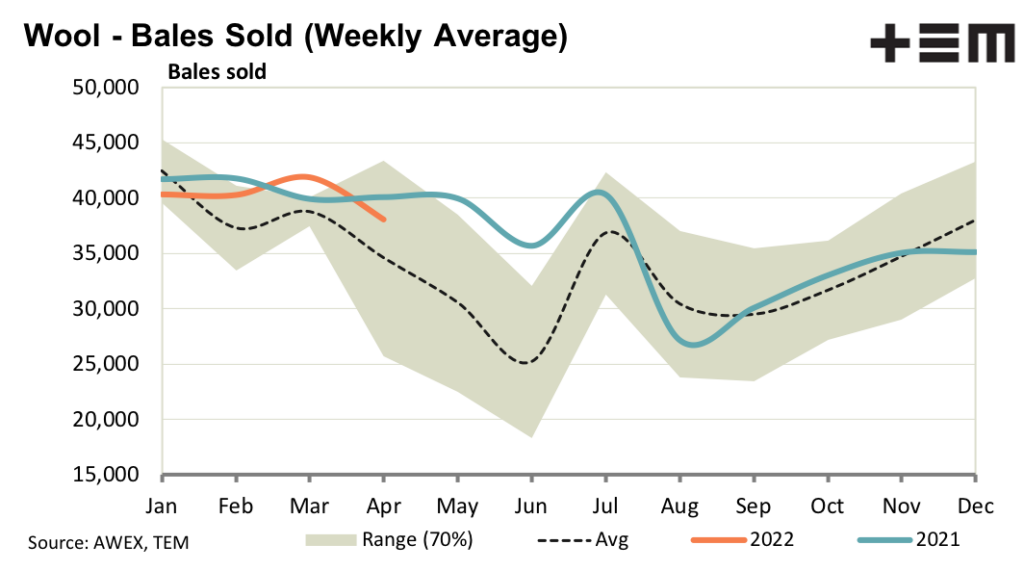

Despite continued issues with lockdowns due to Covid in China new business was reported late this week, which is needed to help keep the wool market ticking over near current levels. Logistic constraints on international shipping remain a concern and are now being compounded by internal constraints within China due to the lockdowns.

A 1% fall in the Australian dollar helped hold prices up in local terms this week, with exporters chasing low vegetable fault wool as its proportion in the wool offered falls in line with seasonal patterns. Australia offered 2300 bales of RWS accredited merino wool this week, the largest weekly offering yet, which was enthusiastically bid upon by the supply chain with handy premiums paid as were for non-mulesed SustainaWool accredited lots. It would be good news if SustainaWool and Authentico can start to help supplement the demand for RWS as it increases the supply and also injects some competitive pressure into the supply of quality scheme services.

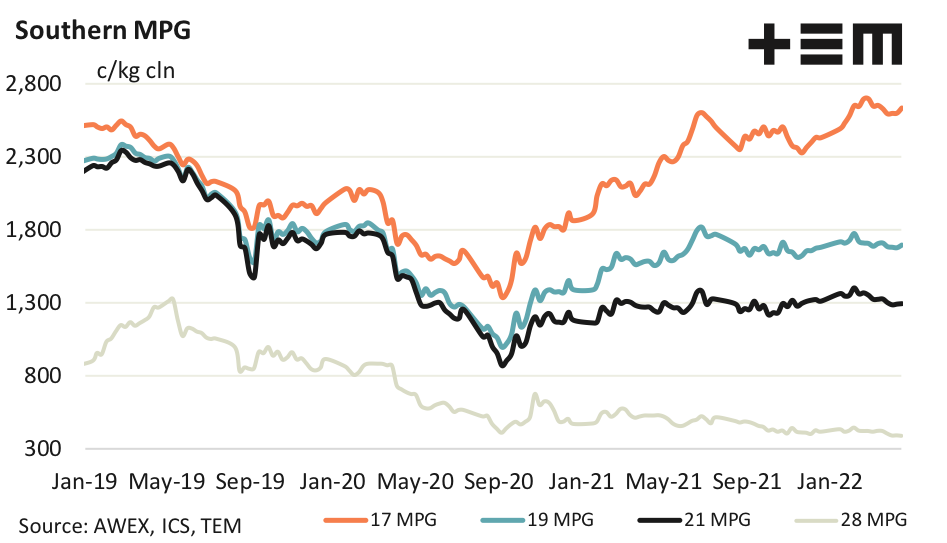

17 Micron

In US dollar terms the fine AWEX MPGS look to be finding resistance at recent price levels, which were on par with mid2021 peak levels. Fine micron premiums are high as are fine micron prices. The premiums have been high for over a year now, which is old in micron premium cycle terms so it would not be a surprise to see them start to ease in the new season.

19 Micron

RWS premiums were on show again this week, when 2300 bales of RWS accredited merino wool were sold. This is the largest weekly volume sold yet. Interestingly SustainaWool (non-mulesed) seemed to pick up some handy premiums as well. Hopefully this continues as a trend. “Seemed” was used with regards to SustainaWool as it is difficult in this market to apportion values to different wool characteristics – it is a very tough market to value in.

21 Micron

The market went after fleece wool with a vegetable fault under 1% this week. It seems many Chinese mills buy from traders who organise the greasy wool purchasing and finance. These traders are conservative in their buying habits, sticking to traditional (and accepted) consignment specifications which include a 1% vegetable fault average.

28 Micron

Where an order is in play crossbred wool sells well. Where there is a lack of an order (it may be the end of the week) gaps in the market open up as exporters do not have the capacity or confidence to buy cheap crossbred stock. This means some lots have to be offered a couple of times to get fair value.