Market Morsel: Covid-19 re-emergence dampens prices

Market Morsel

The reaction to recent prices rises which began last week took hold on Tuesday, re-setting prices are a lower level. On Wednesday prices steadied enough at the new lower levels for forward bids to re-appear again late in the day at premiums to the auction market. This seems to be flagging a base in the greasy wool market for the time being.

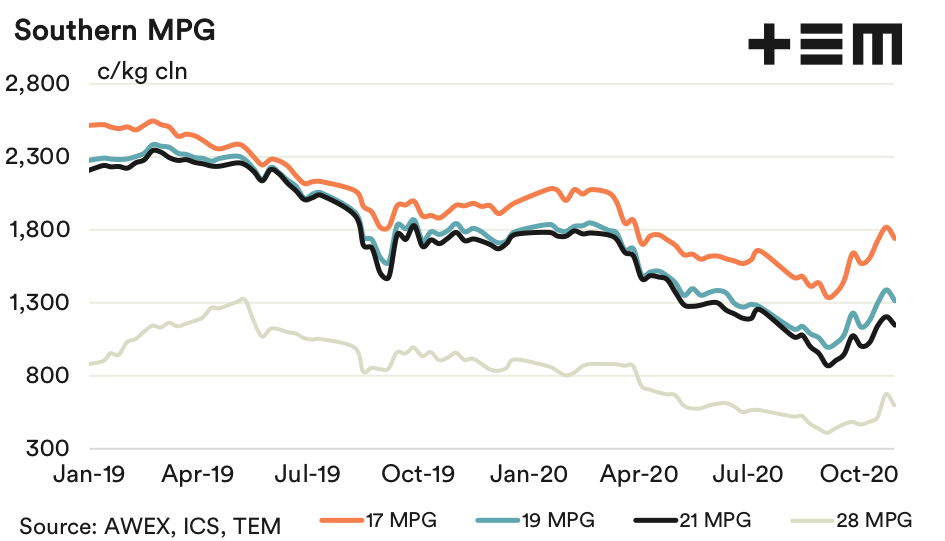

A year ago, in the spring of 2019 the greasy wool market carved out a trading range of 150 cents after rebounding from early September lows which persisted until February/March 2020. It appears we are seeing a repeat performance in 2020. The 19.5 MPG is down 130 cents from its recent high, with support flagged by strong forward bids extending out to mid-2021.

The situation with COVID-19 in Northern America and Europe continues to deteriorate, which is not good news for worsted wool demand. As the WTO stated COVID-19 is likely to extend and enhance a sluggish economic recovery, which translates into a sluggish recovery for greasy wool prices.

17 Micron

The strong forward bids in the market point to prices firming next week which means the 17 MPG will find support at the levels it fell to in April. At this stage the bottom of a trading range for 17 micron is shaping up around 1750 cents. Micron premiums should continue to widen through to next autumn.

19 Micron

Assuming a trading range of 150 cents (as happened in late 2019), the lower side for the 19 MPG is set to be around 1300 cents and the high side around 1450 cents. From late 2020 onwards the wool supply chain will need demand in Europe and North America to kick in and help the domestic Chinese demand. At what level this will happen is most uncertain at the moment given the resurgence of COVID-19 in these regions.

21 Micron

The forward bids were correct again last week, calling a weaker market for this week. Let us hope they are correct again, as they are calling a stronger market next week. Quality has improved dramatically for merino wool, including broad merino wool.

28 Micron

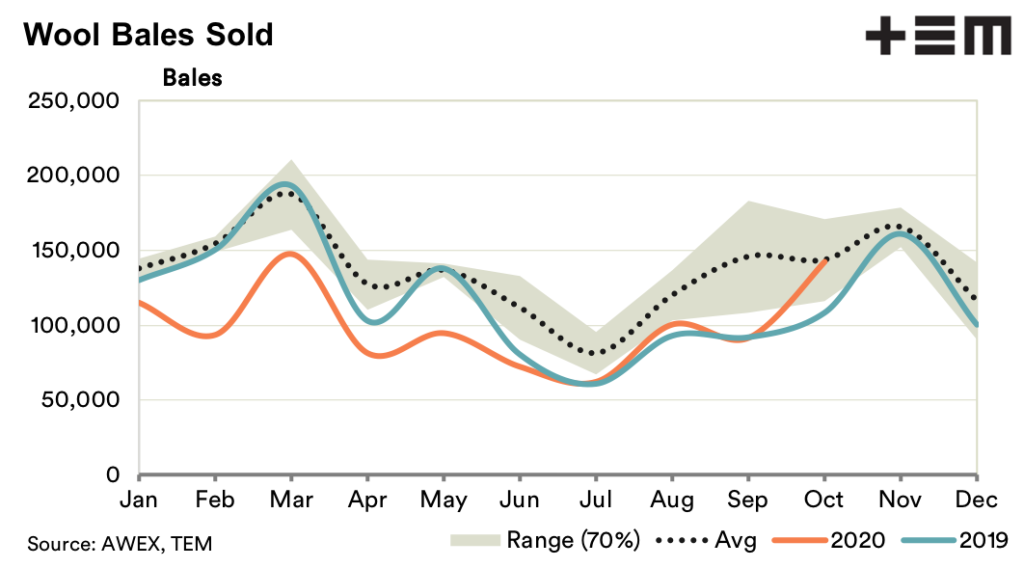

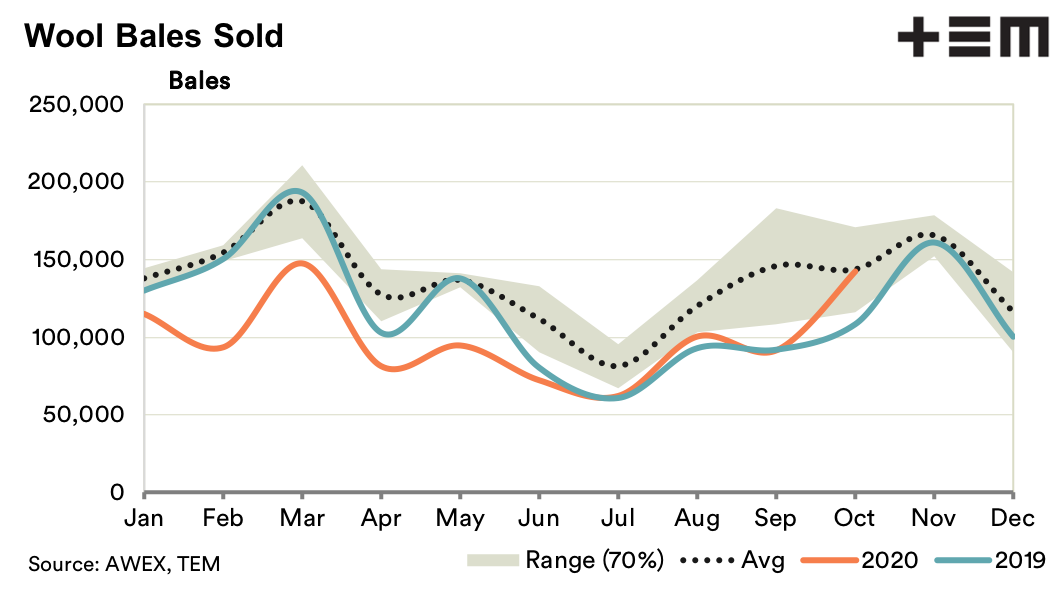

Crossbreds joined the throng in falling this week, but forward bids have appeared at current auction levels. The proportion of crossbred wool generally rises from September to January, were at peaks around 25% of wool sales. This will put some pressure on crossbred prices in relation to merino prices.