Market Morsel: Energy rationing hits wool

Market Morsel

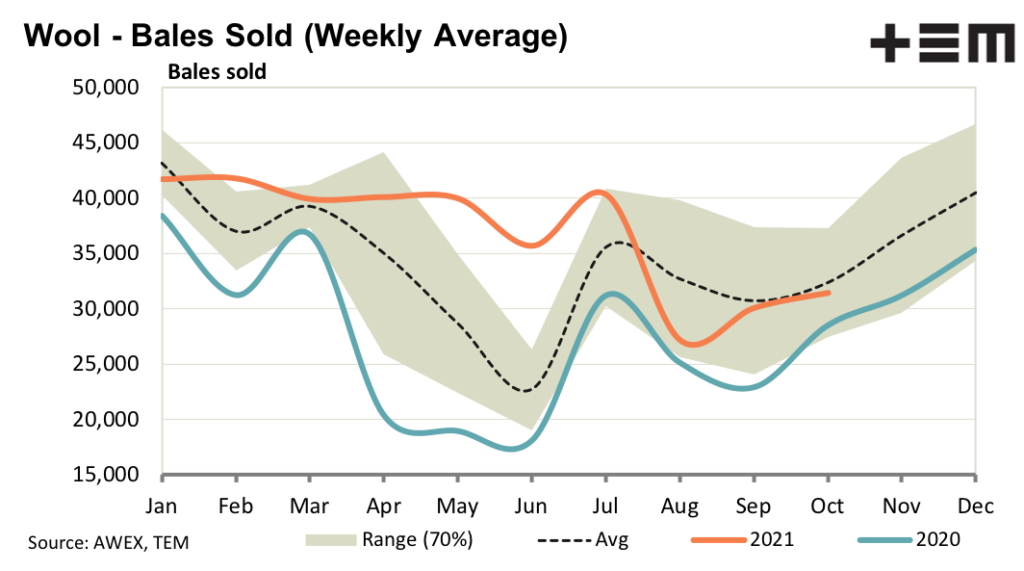

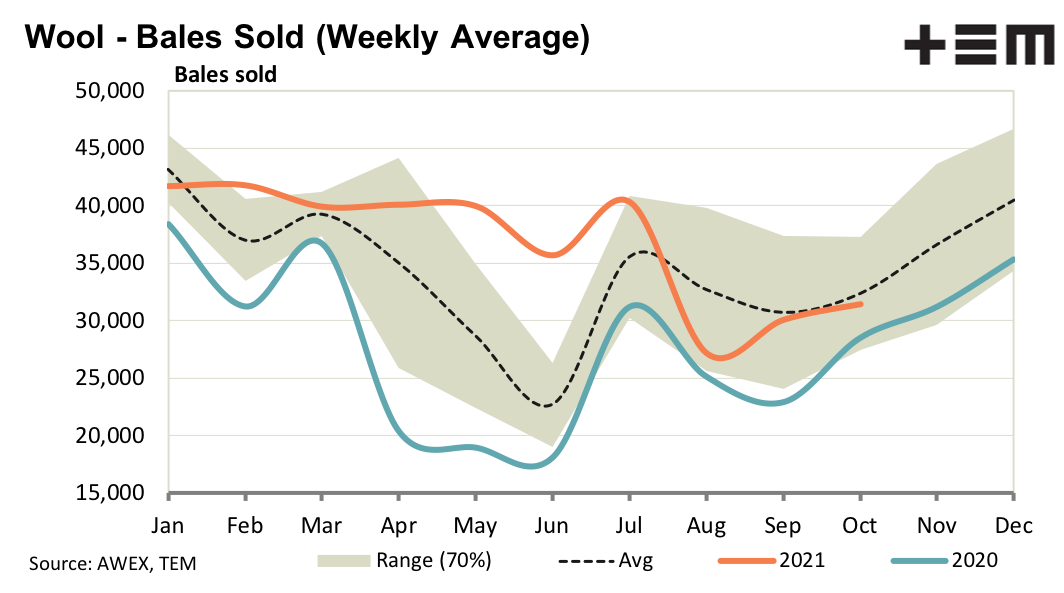

Electricity rationing, in Chinese provinces where textile mills are located along with other industry, turned up as a factor this week in the greasy wool market. Prices eased as a result, but the picture from a wider apparel fibre perspective is not so clear.

Cotton prices continue a rising trend which began in March 2020. Some reports expect polyester prices to lift on lower production. For greasy wool this is good news as it rules out any major downturns in apparel fibre prices.

The issues emanating from China look to be short term, which explains why forward wool prices are solid for 2022 but scarce for the next few months. Weakness in wool prices was not evenly felt this week, with higher vegetable fault wools relatively neglected while demand for well specified lots with RWS accreditation was strong. Contrary to the general concerns, there was some mention of new business done late this week, which is usually a pointer towards a firm market in the following week.

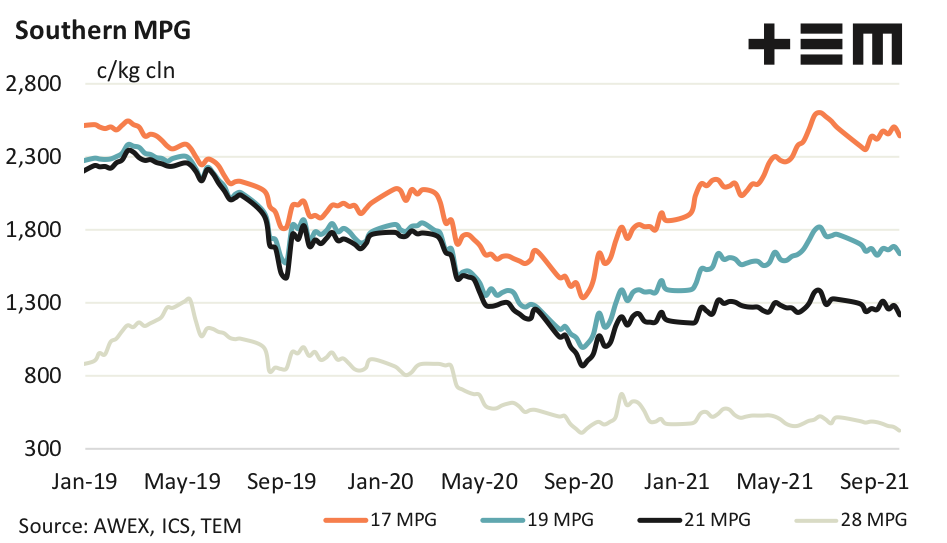

17 Micron

Pricing in the fine wool market remains quite varied, according to the combination of qualities a lot has. For example high staple strength is a gateway to receiving a higher price for RWS accreditation, so long as the vegetable fault level is not too high. Staple strength premiums on average eased as a result, as they are not uniformly applied across all lots.

19 Micron

The medium and broad merino categories face a test in the next few weeks from uncertainty introduced to the supply chain by electricity rationing in China. This will be added to the issues of increased container shipping costs and the normal uncertainty at this time of the season as the supply chain waits to see how the retail sales begin for the northern Autumn/Winter season.

21 Micron

Discounts for higher vegetable fault jumped again this week as demand eased in response to uncertainty out of China. Seasonal patterns in supply still favour a shrinkage in these discounts in the coming months. The spread in price between the 21 and 19 MPG has peaked around 400-450 cents (for the third time in 20 years). It is likely to work its way lower in the coming year.

28 Micron

The weaker demand this week, which saw a lower merino market, pushed crossbred prices lower, with exporters being very selective where wool quality is an issue (for example where a lot has medullated fibres).