Market Morsel: European demand eases

Market Morsel

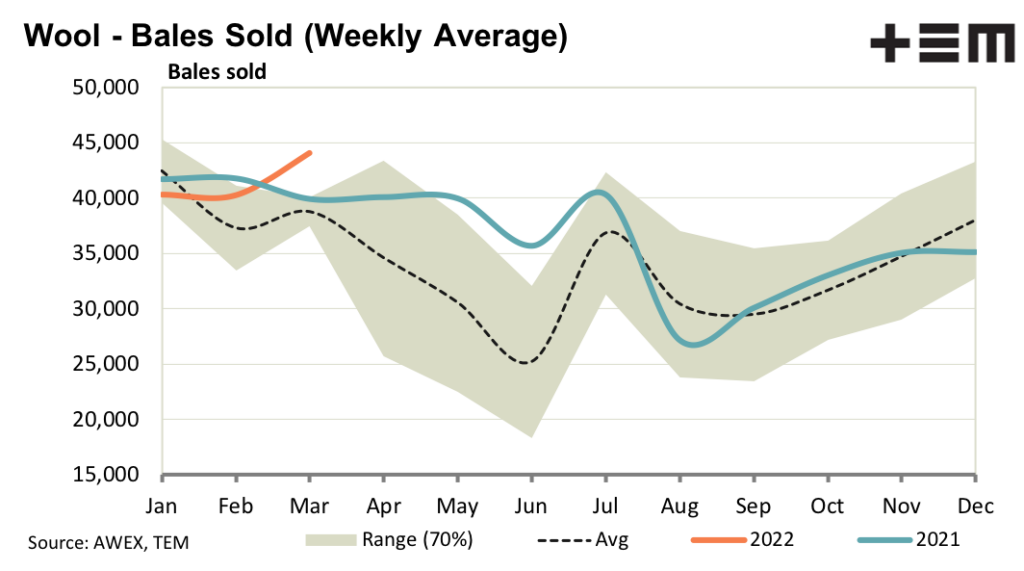

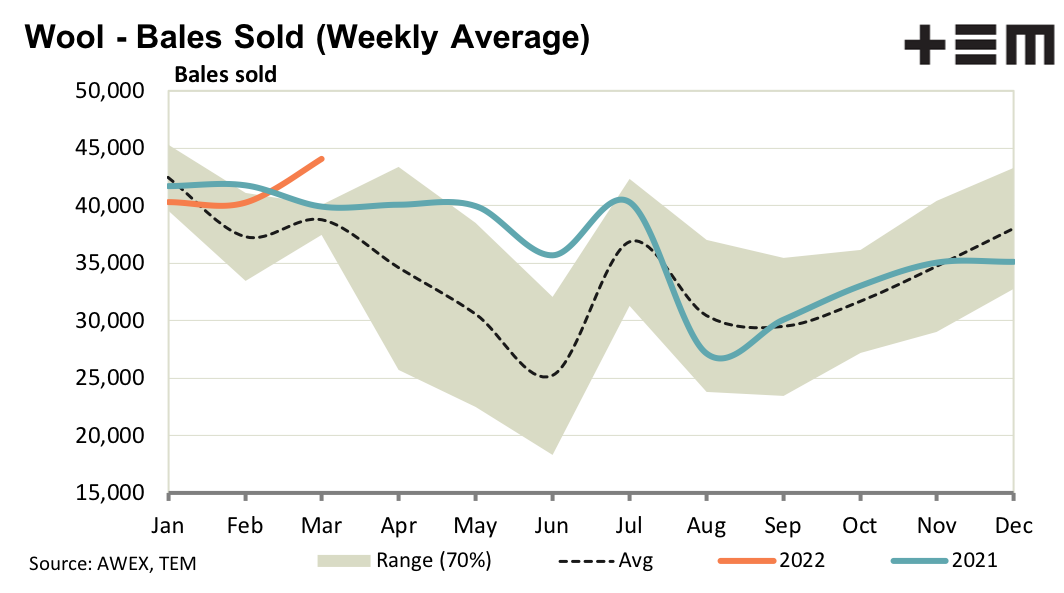

Forward bids for wool remain tentative, with geopolitical risk dampening European demand which is a key ingredient in the forward markets. Wool is not the only apparel fibre impacted by geopolitical risk. Speculation about oil prices, and the potential for them to rise to levels which cause economic growth to fall sharply, is increasing.

In the meantime the greasy wool market is trundling along, with some feedback indicating downstream resistance to high fine wool prices. Crossbred prices remain low but the market is absorbing the increased quantities offered. Bidding in the auction rooms is quietly efficient around the established price levels. In other words the supply chain is happy to buy crossbred wool, but at a very low price. There appear to be enough headwinds in the greasy wool market to rule out significant prices rises in the short to medium terms.

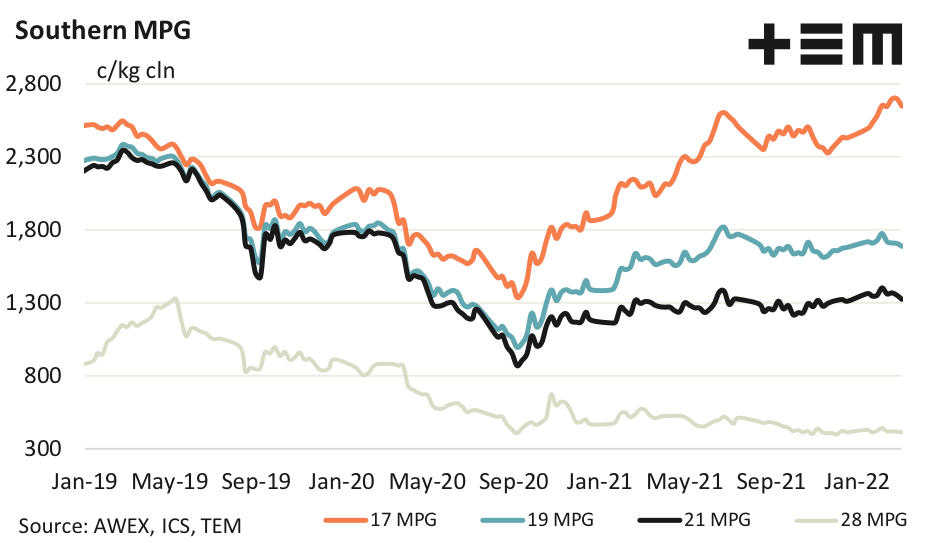

17 Micron

Seasonal processing cycles and stocks along the supply chain mean that it takes some time for higher greasy wool prices to work their way downstream through tops, yarn and into cloth. Some reports of resistance to increased fine merino cloth prices have filtered back upstream indicating downstream demand is unlikely to pay higher prices for fine merino wool.

19 Micron

Geopolitical risk is the risk of the moment, but it is rising interest rates and energy prices (stimulated by geopolitical risk) which are shaping up as the risks for retail demand through 2022 into 2023. The uncertainty around these factors is quite high and they do have the potential to pull apparel fibre prices lower. South Africa reported solid RWS premiums again this week, and in the Australian market premiums were evident on the finer side of 19 micron for good merino fleece.

21 Micron

Broad merino lots with higher vegetable matter levels continue to struggle, with often only one exporter operating on these lots in Melbourne. Prices have eased compared to January February (in other words the discounts for vegetable matter have increased) and the seasonal pattern for vegetable matter suggests the supply with continue to increase through to mid-2022.

28 Micron

As mentioned in the overall outlook, the supply chain seems willing enough to buy crossbred wool but at a very low price which is around US300 cents for 28 micron and US415 cents for 27 micron. On a positive note there were some RWS crossbred lots between 36 and 28 micron which seemed to pick up a premium in the order of 150 cents clean this week.