Market Morsel: Fibre optics

Market Morsel

Commodity markets do not operate in a bubble; they trade in subsets of commodities. These are generally interchangeable commodities.

Take barley and wheat as an example. The two products can be substituted for one another when feeding animals. Whilst there are quality differences, it comes down to a calculation of discounts to accommodate the difference. If wheat becomes too expensive, we see a bigger move to feeding barley.

The same occurs with the fibre markets; no fibre is an island. They are generally purposed for apparel wear and are ultimately substitutable.

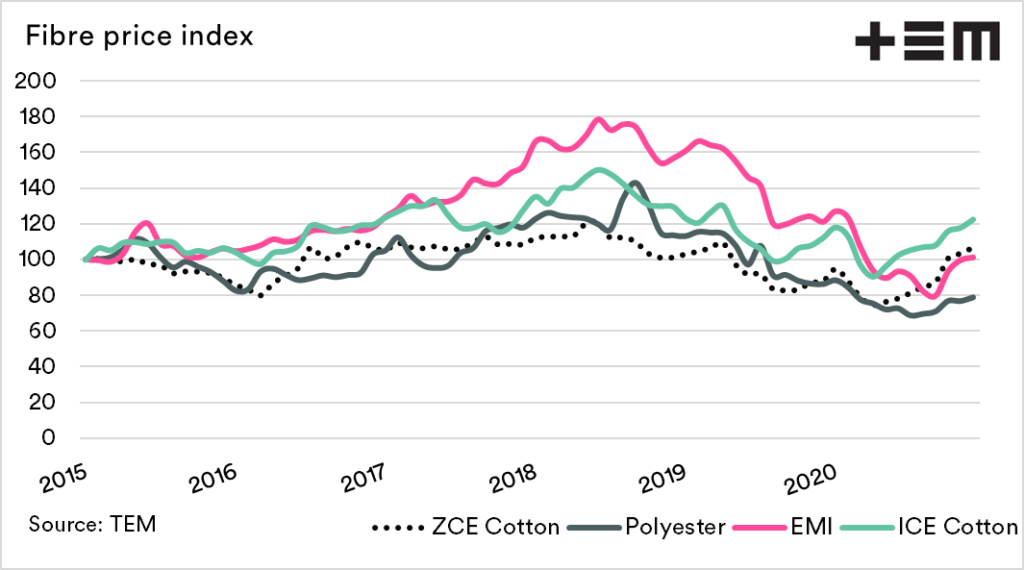

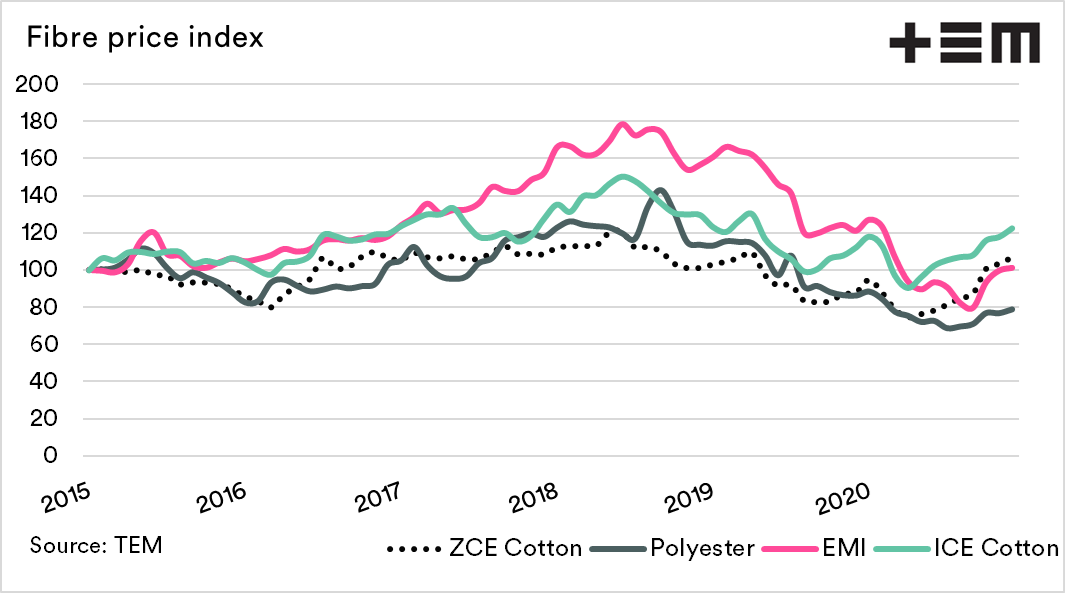

The chart below displays four major fibre pricing points:

- Zhengzhou cotton futures

- ICE cotton futures

- Chinese polyester staple fibre

- Eastern market indicator (wool)

These four pricing points have been converted into US dollars and converted into an index with January 2015 representing 100. The value of the index is that it allows the reader to quickly determine the rate of growth easily with pricing at different levels of magnitude.

The apparel market peaked during 2018 but has been on a downward trajectory since. Since mid-year, the fibre market has recovered.

This is primarily due to economic stimulus around the developed world. The question remains how long this will be maintained, and whether the recovery is a ‘dead cat bounce’.