Market Morsel: Fleecing the fibres

Market Morsel

No man is an island entire of itself; every man is a piece of the continent, a part of the main. The same can be said of fibres. No fibre is an island; they are part of the whole.

On a regular basis, we compare the fibres, as it provides a quick outlook on the market structure across the major fibre types. Our last update was in October (see here).

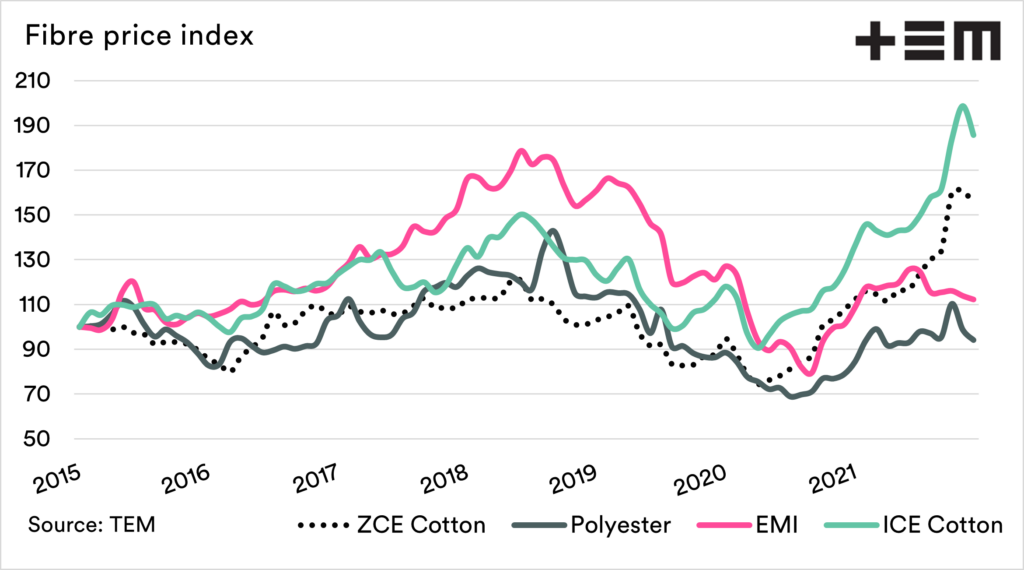

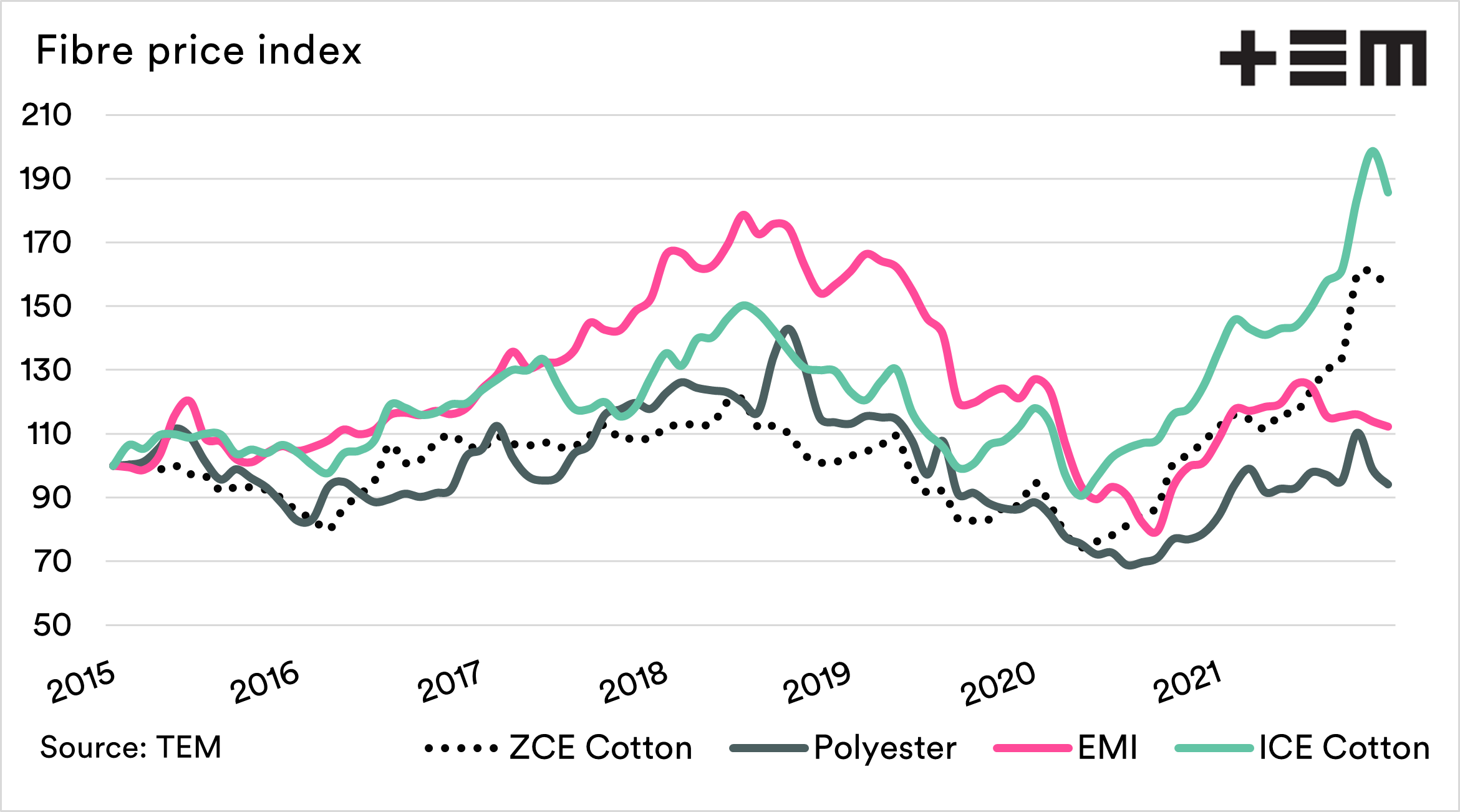

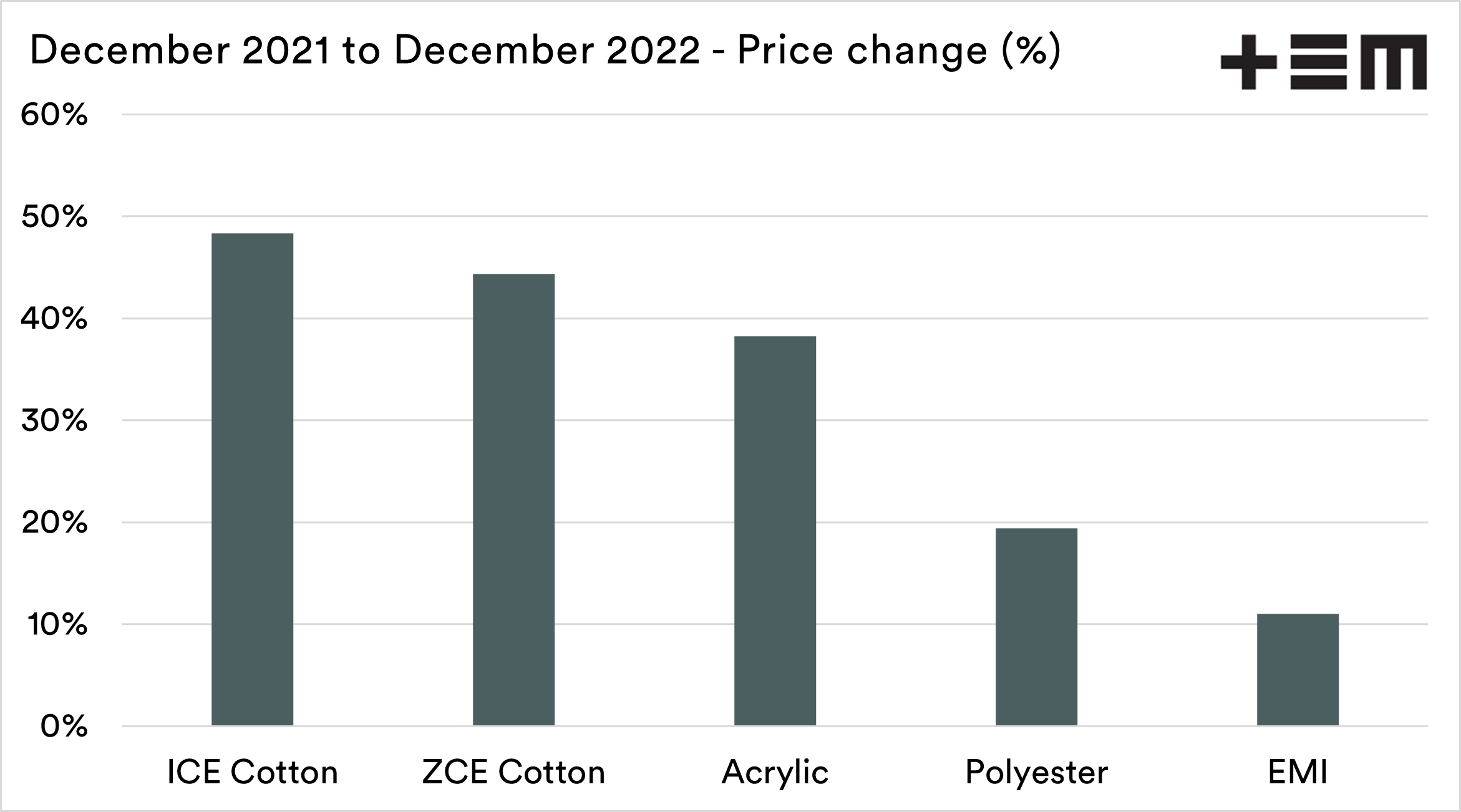

The chart below shows the following fibre types as an index, with 2015 being 100. The index’s value is that it allows the reader to quickly determine the rate of growth easily with pricing at different levels of magnitude.

- Zhengzhou cotton futures

- ICE cotton futures

- Chinese polyester

- Eastern market indicator (wool)

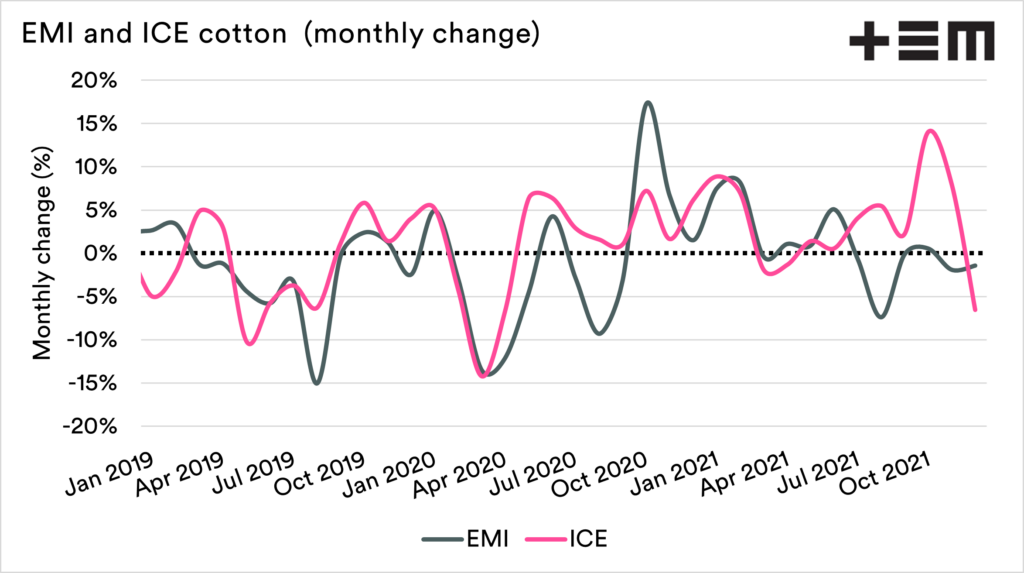

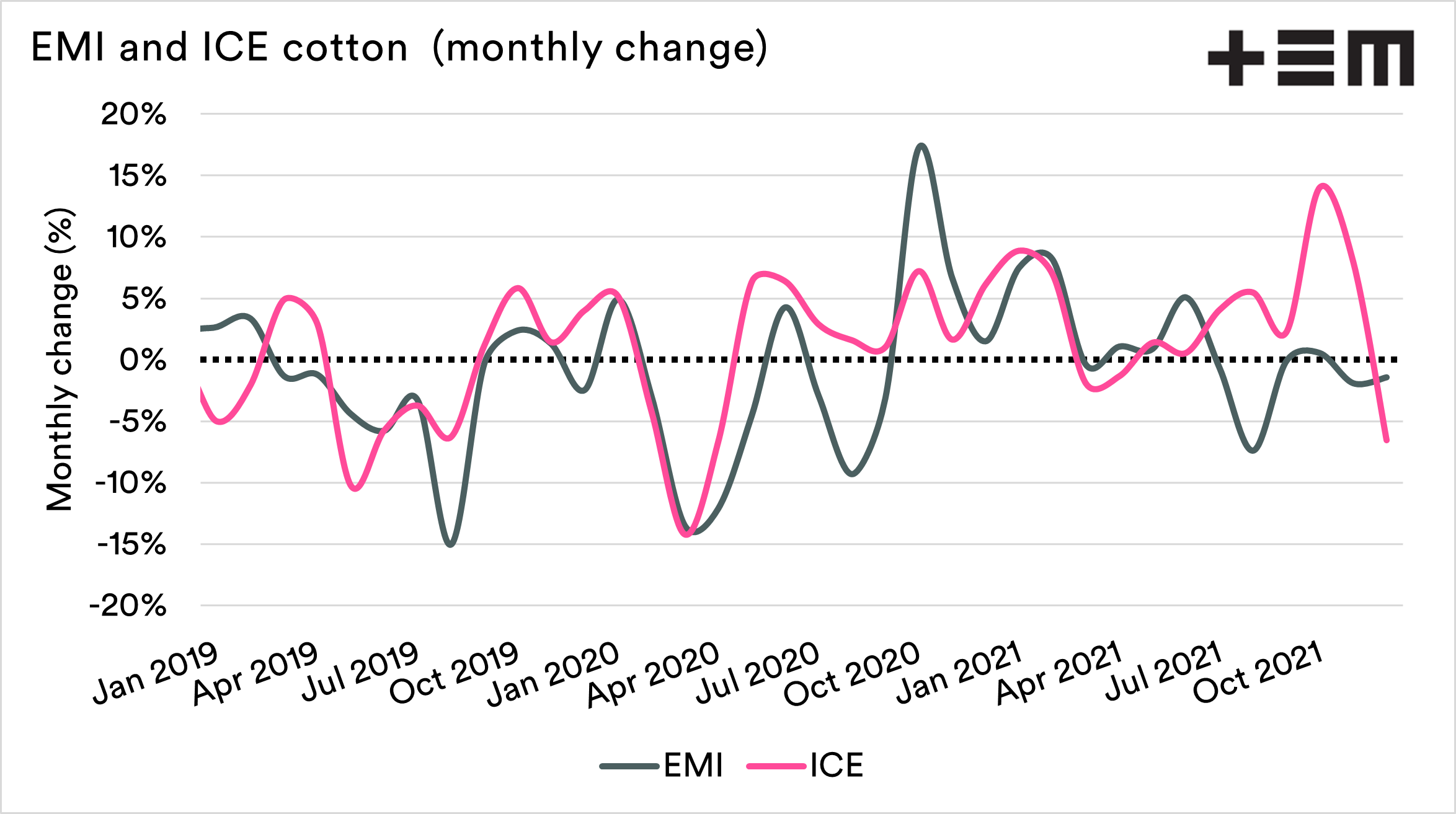

For most of 2021, Cotton has been out performing the EMI, which has resulted in a low wool-cotton ratio. So far in December, Cotton has averaged 7% down, whilst EMI has lost 1%.

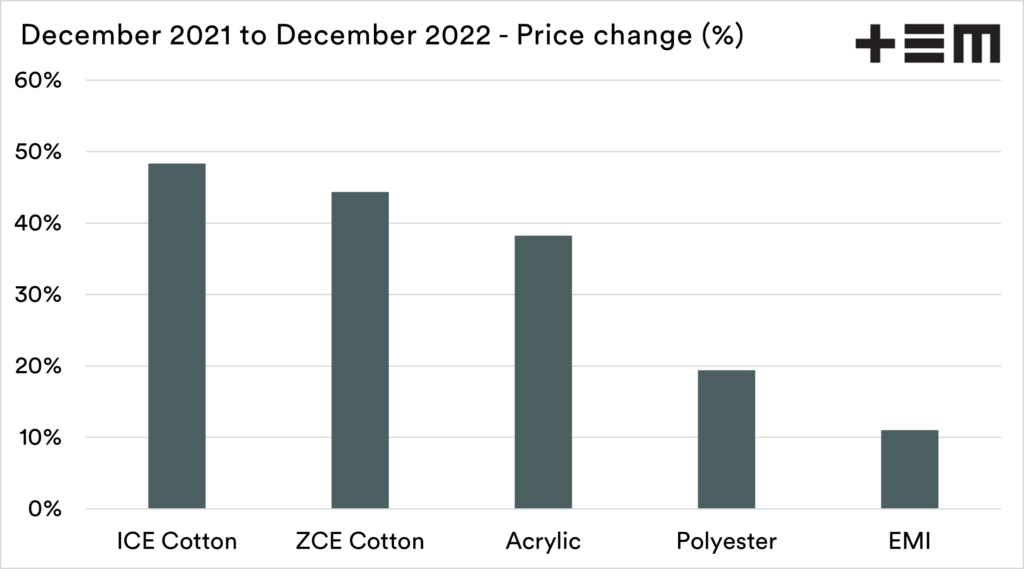

Since last year there have been some big moves in fibre pricing. The biggest gains have been in cotton, with ICE futures showing a rise of 48%, and Chinese futures at 44%.

On the opposite end of the spectrum the EMI has only seen a modest 11% increase in value.