Market Morsel: Generally stable

Market Morsel

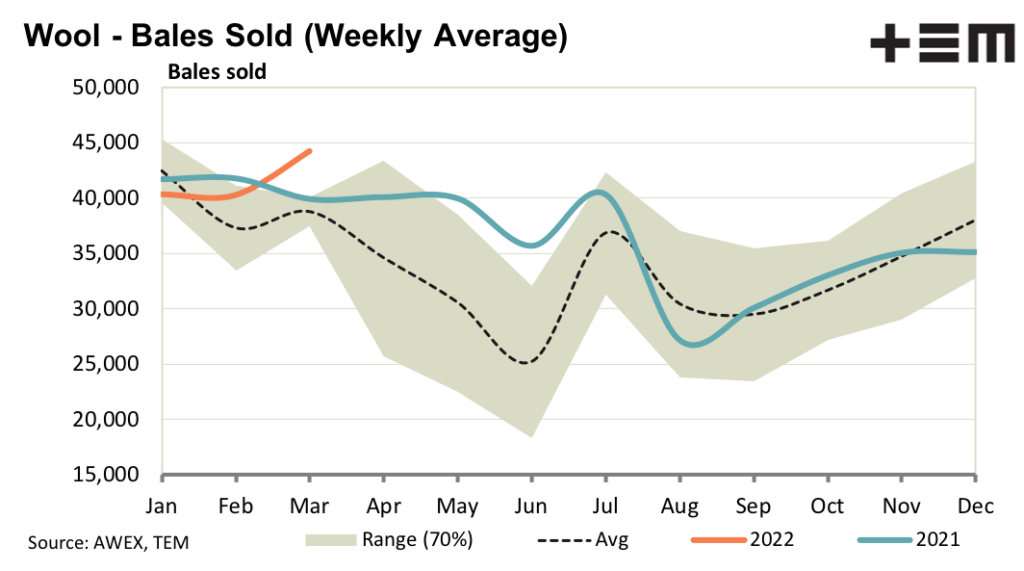

Greasy wool prices were generally steady this week, which in a turbulent world where the nickel price jumped 66% in a day, is quite an achievement. Sales by topmakers to a range of regions have been reported while China continues to absorb a full range of wool types. Enquiry for RWS accredited wool across a range of wool qualities is reported.

On the subject of RWS South Africa sold 5,500 bales of RWS accredited merino wool this week, their largest reported offering to date. The political and economic backdrop to the greasy wool market is “fluid” at present, with a lot of uncertainty. This uncertainty builds on top of the existing problems of logistics. The lead time for shipping newly purchased wool is currently 6 weeks, which effectively increases the stock level held by the supply chain and puts pressure on the cash flow of exporters. For the time being demand seems to be strong enough to hold wool prices at current levels.

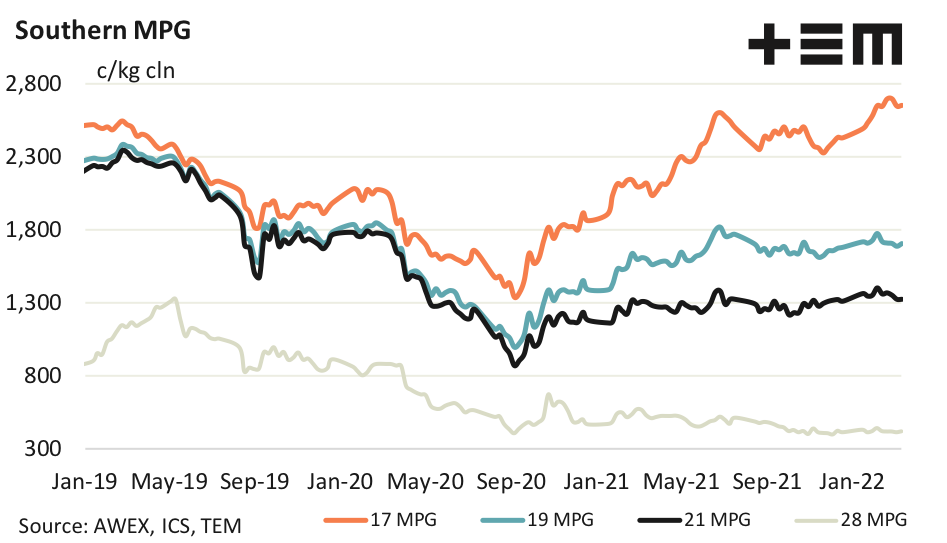

17 Micron

In March (to date) eastern merino clip is running 0.2 micron finer while in the west it is running 0.39 micron broader. Changes in the eastern clip will dominate changes in the finer micron categories so the market will have to accommodate more fine merino wool which should put some downward pressure on fine wool premiums.

19 Micron

Forward markets combine the expectations of buyers and sellers, and in doing so provide a view on the assessed risk to future prices. So, forward prices discounted deeply to the auction market indicate the strong expectations of prices falling. In the current market the forward curve is close to flat indicating that the market is not yet perceiving significant downside risk. Keep in mind that some events (such as the 2020 pandemic) surprise everyone.

21 Micron

There were more exporters bidding on high vegetable fault broader merino wool in Melbourne this week. Exporters and early stage processors are adept at adjusting quickly to changes in supply, so cheap prices tend not to last. The greasy wool auction market is quite efficient despite the naysayers.

28 Micron

Man made fibres tend to have a solid positive correlation to crude oil prices, which are up 44% for the calendar year to date. This is helping lift the likes of polyester staple fibre prices which in turn will help support crossbred prices which are trading at very low ratios in relation to the man made fibres.