Market Morsel: Gliding into Xmas

Market Morsel

After a tumultuous 2020 wool prices are gliding into the Christmas recess, with two weeks of sales to go. This is much to the relief of the supply chain. From a buy side perspective domestic Chinese demand for greasy wool continues to wind down, which is normal.

Top makers are still buying greasy wool to maintain their desired levels of production, but will be looking to export markets to absorb their tops. At this stage the export markets remain extremely quiet although there is some expectation they will start to fire up again after the Christmas recess, with the need to re-stock supply chains. If this proves to be the case it will allow the greasy market to continue limping along until retail demand starts to pick up again, sucking wool through the system.

In the meantime grower stocks of greasy wool are building but at a slower rate than was feared in mid2020. In the bigger picture these grower stocks will be an asset to the supply chain, as fresh shorn wool production continues to feel the delayed effect of drought.

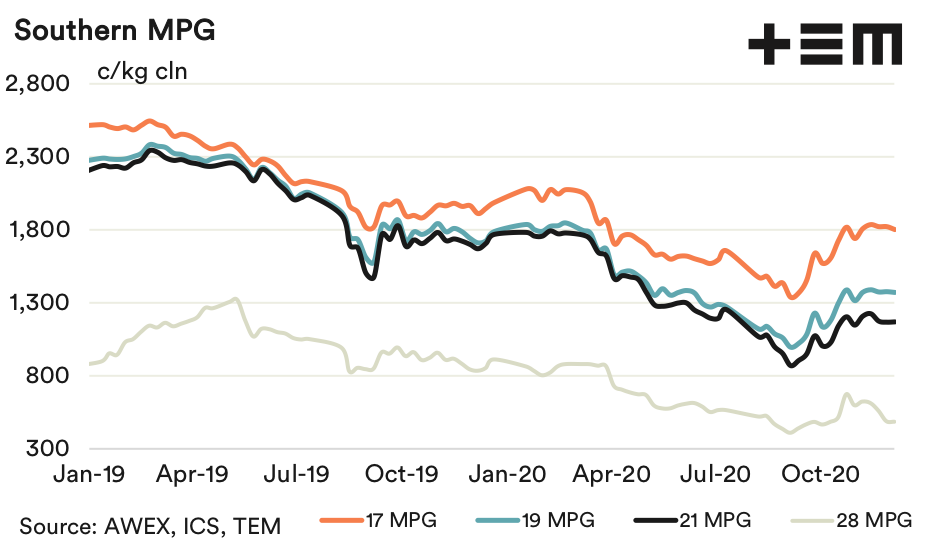

17 Micron

AWTA core test volumes showed a continued fall in 18 micron and finer volumes in November. This is as expected. Discounts for fine merino wool generally remain at minimal levels. The 17 MPG is some 500 cents above the early season lows, and 100-150 cents below the price range traded in a year ago.Falling supply will remain supportive of the finer merino categories for the balance of this season.

19 Micron

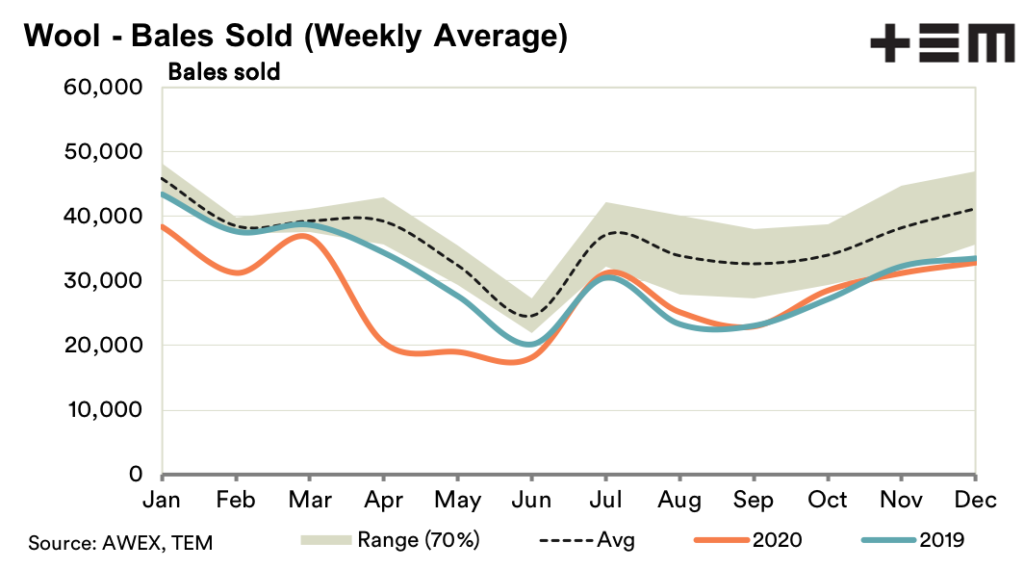

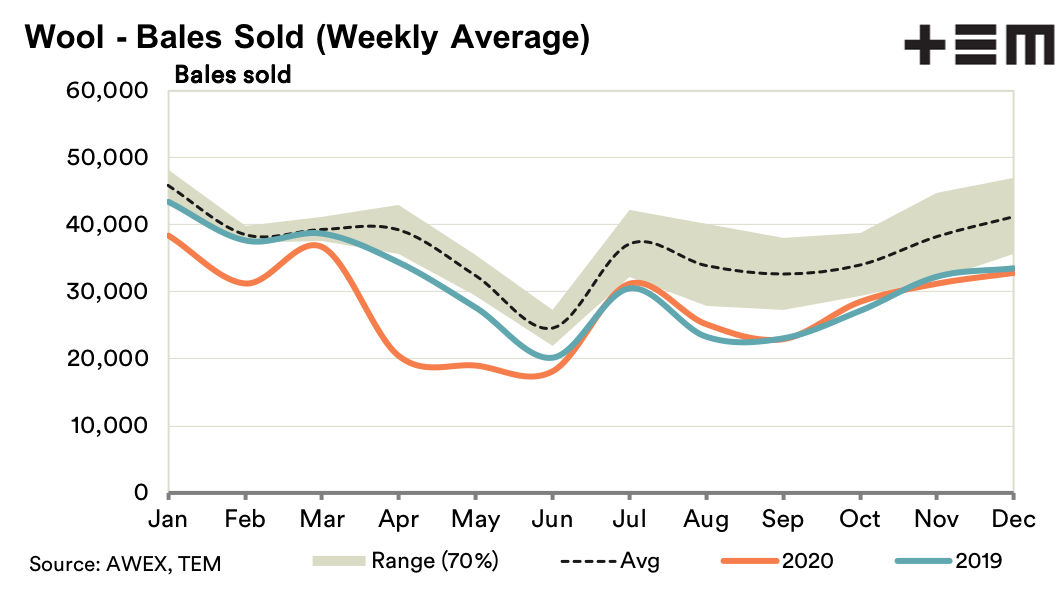

At this stage the wool trade would be happy to see the 19 MPG stay unchanged through to the Christmas recess. Early January sales historically have tended to be larger, as wool banks up during the recess and some wool has been held over for these sales.

21 Micron

This season, however, sales of 55,000 bales per week are likely to push the buy side price expectations lower. Discounts for vegetable fault (VM) are widening for the broader merino category. This will be a function of supply, increased for broad merinos (+40% in November) and for higher VM in the broader merinos.

28 Micron

Crossbreds are relatively cheap in relation to merino prices and the supply of 28 micron and finer is down year on year, two factors which will help stabilise crossbred prices. Demand, though, continues to be reported as very weak.