Market Morsel: Good moral fibre

Market Morsel

Commodity markets do not operate in a bubble; they trade in subsets of commodities. These are generally interchangeable commodities.

This is seen in many commodities, soybeans with canola, barley with wheat and ethanol with crude oil.

This same pattern of fungibility is shared in the fibre industry. The same occurs with the fibre markets; no fibre is an island. They are generally purposed for apparel wear and are ultimately substitutable.

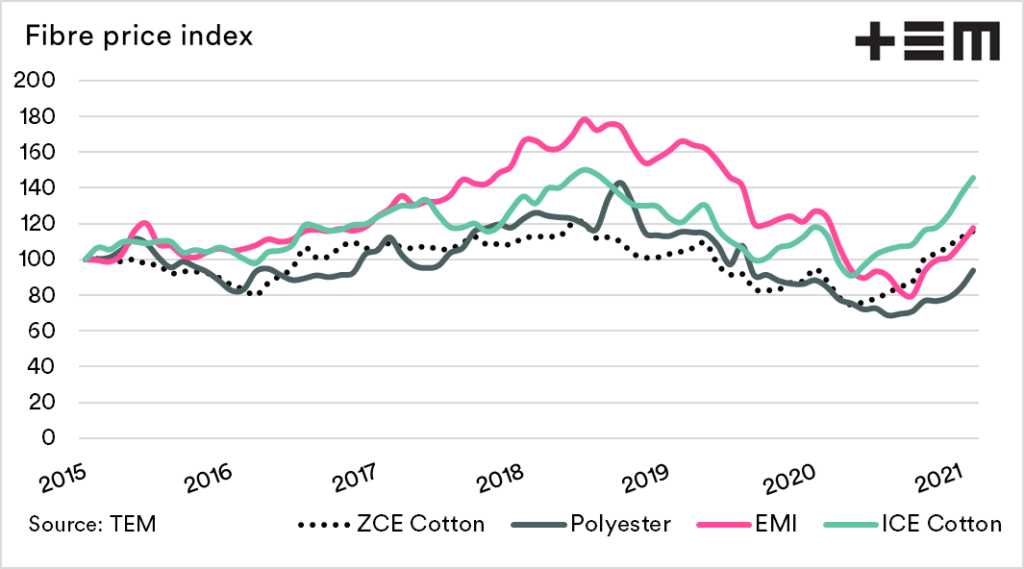

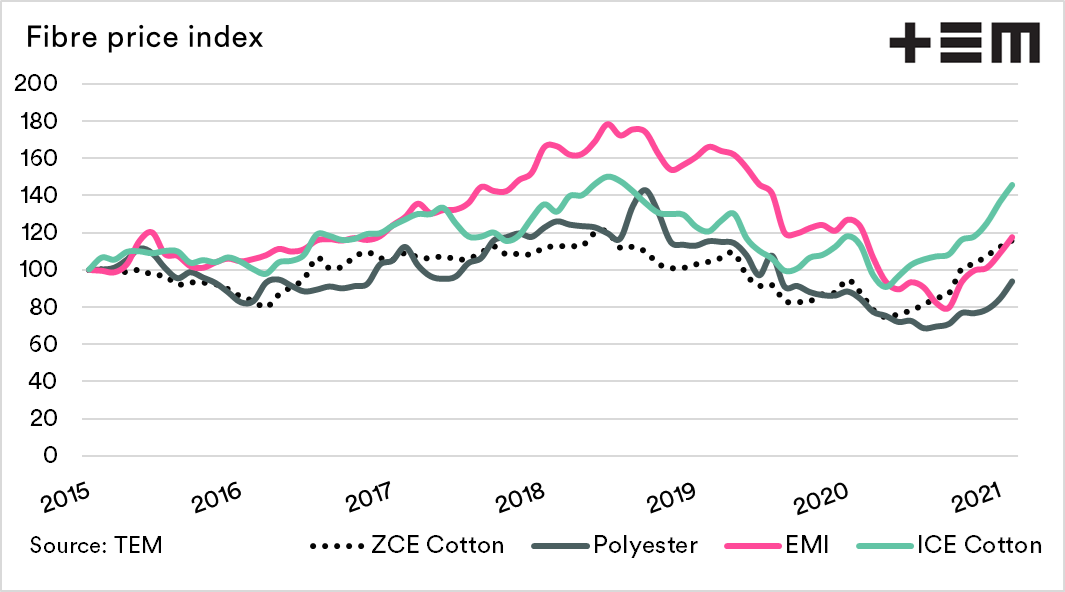

The chart below displays four major fibre pricing points as an index:

- Zhengzhou cotton futures

- ICE cotton futures

- Chinese polyester staple fibre

- Eastern market indicator (wool)

These four pricing points have been converted into US dollars and converted into an index, with January 2015 representing 100. The index’s value is that it allows the reader to quickly determine the rate of growth easily with pricing at different levels of magnitude.

After fibre markets peaked during 2018, there has been a general downtrend with the low coinciding with the COVID-19 lockdowns worldwide. The second half of 2020 has seen a resurgence in pricing, which has flowed through into 2021.