Market Morsel: Headwinds for the wool market

Market Morsel

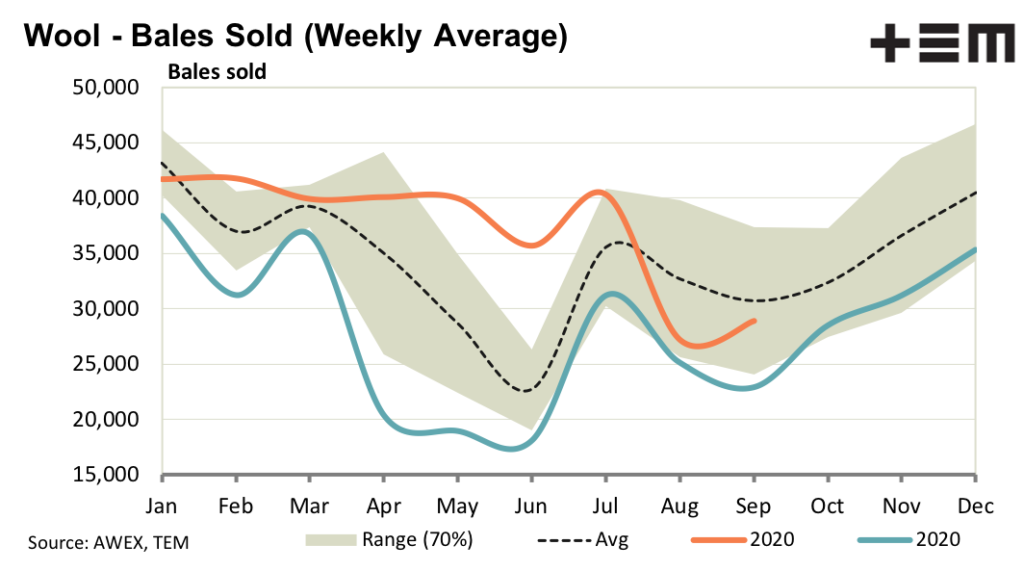

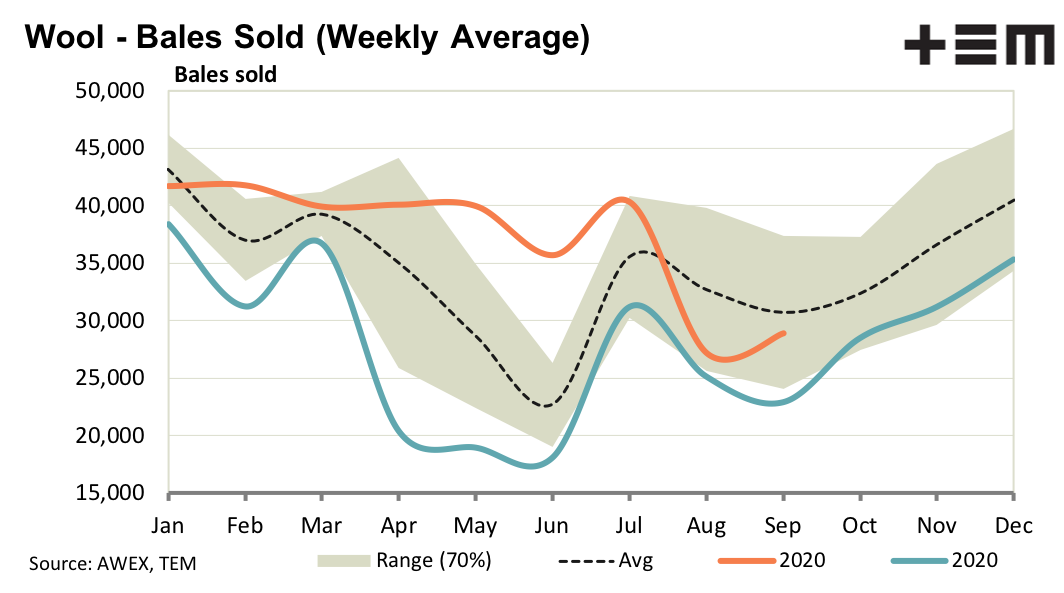

As the greasy wool market works its way through the quiet time of the season, in processing terms, the macro economic outlook appears to be weakening in the short term for both China and the USA. Wool prices do not slavishly follow the macro economic trends but in market jargon these are at least “headwinds” for the greasy wool market. As such substantial and sustained price rises in the next few months for merino wool looks very unlikely.

On the positive side, reduced clearances when prices ease means that supply is fluctuating enough to match demand and also introduces some supply risk for the buy side of the market. On farm cash flows remain strong, which is enabling wool growers to comfortably hold wool. However it will pay to be moderate in terms of price expectations for wool held into late 2021. Vegetable fault discounts are likely to ease as the supply of vegetable fault follows its seasonal path lower from now through to Christmas.

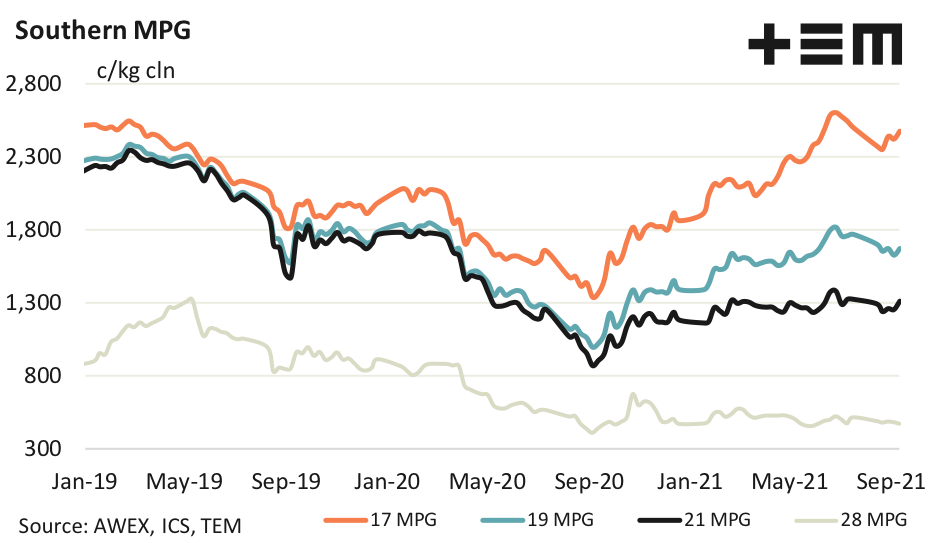

17 Micron

The average merino micron for September to date (only 3 selling days) is unchanged on the September 2020 level, a reminder the increase in fibre diameter will come to a halt quickly. RWS wool, when allied with good specifications, is keenly sought in the market. If allied with poor specifications there is little if any premium being paid.

19 Micron

Prices continue to drift along, both in Australian (excepting the June rally) and US dollar terms. Supply looks set to continue increasing with the sheep and lamb turnoff at low levels indicating the flock is expanding. Prices for fleece wool with 2% or more vegetable fault are quite volatile, with on average very big discounts being applied to these lots. These discounts should shrink during the December quarter.

21 Micron

The big increase in 20-23 micron merino wool is mainly coming from the non-pastoral zones in eastern Australia (the wheat-sheep and high rainfall zones) with some increase in Western Australia. Over the past three decades, as the supply of broad merino wool has fallen the price of broad merino has increased markedly in relation to the other apparel fibres such as cotton and acrylics.

28 Micron

Positive news about crossbred wool demand out of China continues to be scarce, so the price continues to trade along at large discounts to merino wool. The peak Australian supply of crossbred wool tends to arrive in the March quarter, early in the calendar year. Keep this in mind if holding stocks in store.