Market Morsel: June peak

Market Morsel

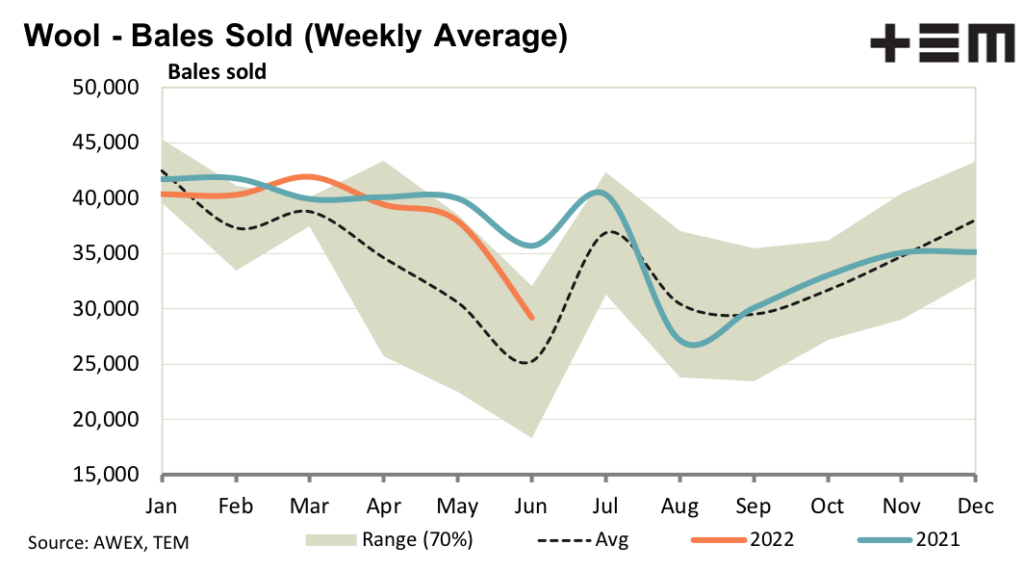

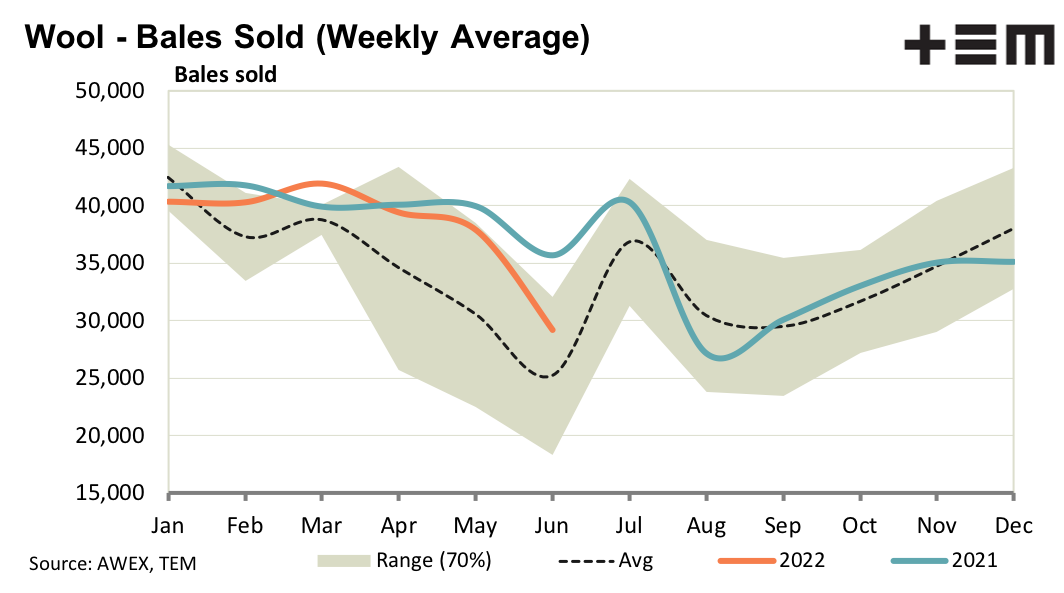

June has again turned out to be a time of peak prices, as it was last year, with prices easing as the market faces a relatively large offering next week which is the first sale week of the new season 2022-23. A fire at a large Chinese early stage processor, which knocked out some exporter capacity for the week, simply added to the seasonal pattern of weaker prices.

The auction market has two more weeks of sales before a three week mid-year recess. Logistics remain slower than in previous years (and more expensive) so this will play a role in mills planning their requirements for later in 2022, as wool required before November will have to be purchased before the recess.

For the full season AWTA volumes were up by 5.5% (farm bales) although in clean terms the rise is closer to 6.3%. Slaughter numbers remain at levels consistent with a continued build up in the flock size for the 2022-23 season, although this will be subject to the outcome of spring seasonal conditions.

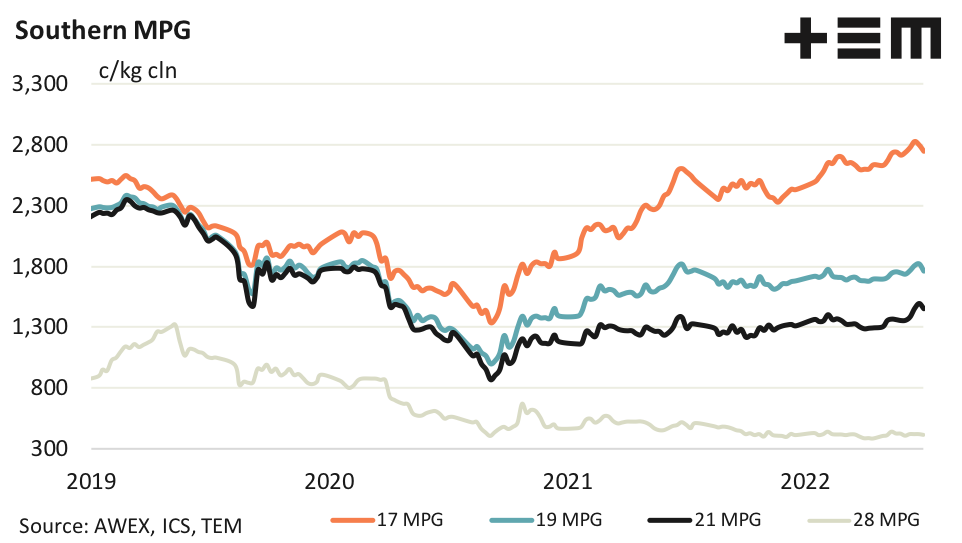

17 Micron

The 17 MPG weakened further this week in US dollar terms. Fine merino premiums have spent 18 months at high to extreme levels, so a shrinkage in premiums this season would not be a surprise.

19 Micron

Prices did ease as expected this week, perhaps by more than expected. In recent weeks prices for cotton and polyester staple had also eased so wool is in good company. The jump in offer volumes for the first week of the season has caused some consternation on the buy side, but the lift and volumes and subsequent reaction from the buy side are the same as in most years.

21 Micron

Premiums for RWS accredited broad merino wool are consistent in cents per kg terms with medium merino and probably higher than for fine merino wool (where the base prices is currently much higher). This week the market chased non-mulsed quality wool, across a range of quality systems.

28 Micron

Reports indicate that producers of 27-30 micron wool in Uruguay (Corriedales) are switching out of their sheep enterprises into beef cattle in response to the extended period of low wool prices.