Market Morsel: Misguided fear

Market Morsel

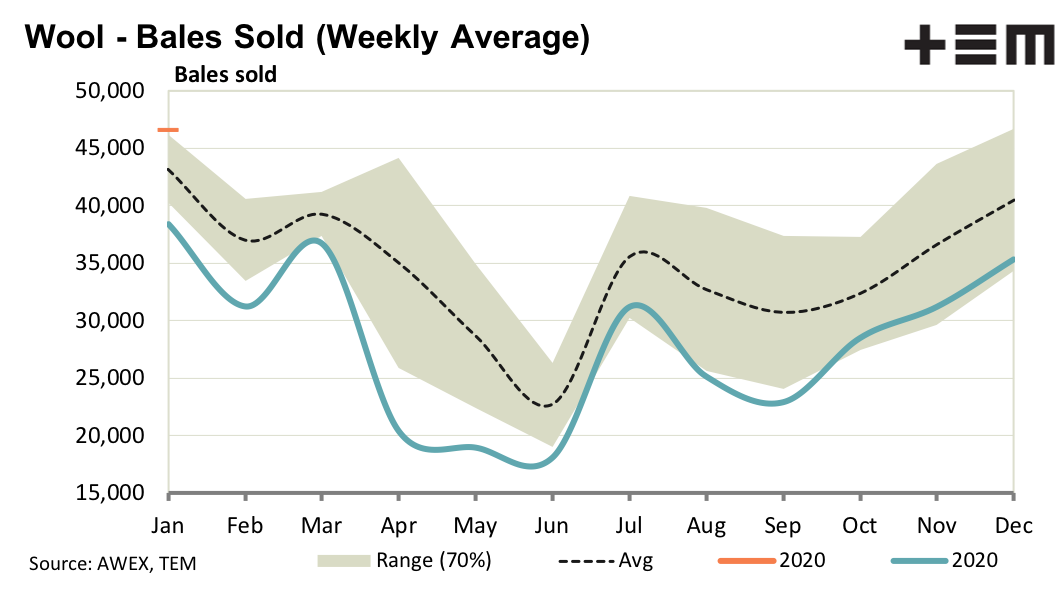

The feared effect of auction volumes in the first two weeks of the new calendar year returning to normal 50,000 plus bales proved misguided this week. Despite a two cents rise in the Australian dollar during the recess, prices lifted for the sub-19 micron categories and held for the broader merino categories.

For crossbreds the week was more of a mixed bag, which means the same as in 2020. Commodities generally are performing well and the apparel fibre markets have in the main lifted in recent months. This means the immediate wider apparel and commodity backdrop to greasy wool is very positive.

There looks to be more room for fine merino premiums to increase, as supply continues to fall while interest from the supply chain is strong. Discounts for short staple length and low staple strength remain minimal so the solid prices for fine merino wool are widespread, not focussed on a small sliver of spinner styles. Discounts for cott and heavy colour are likely to increase, as the supply of these faults increases in response to the improved rainfall.

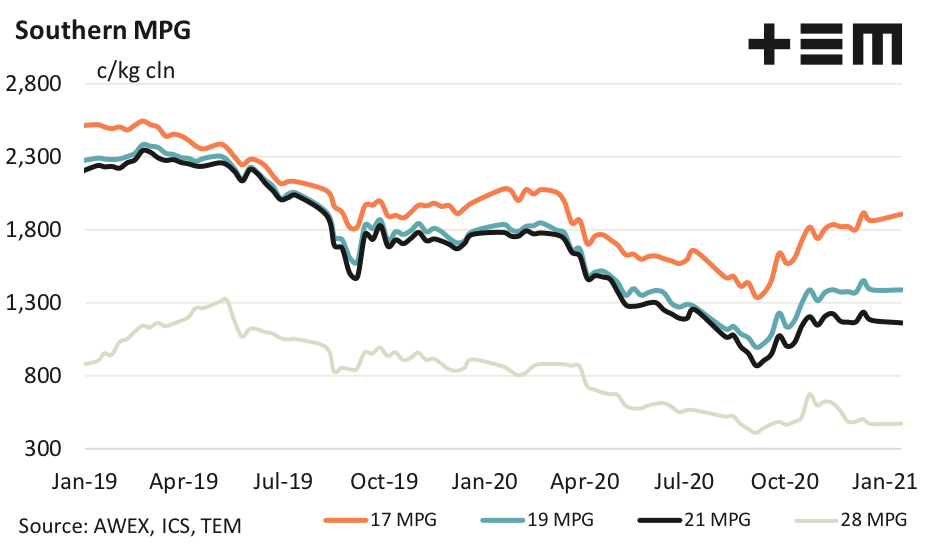

17 Micron

Fine merino premiums continue to widen. The December AWTA volume data showed the supply of 17 micron falling by 17%, 16 micron by 27% and finer than 16 micron by 42%. These falls in supply will help push the premiums higher.

19 Micron

19 micron is the average merino micron, and as such its volume (as measured by AWTA core test volumes) was unchanged in December. The general push fro higher commodity prices looks likely to push the 19 MPG higher (possibly offset somewhat by a higher Australian dollar).

21 Micron

In past years a lack of broad merino wool from Australia has encouraged some wild blending, which had quality consequences.While the supply of broad merino wool is up year on year it remains low by the standards of the past decade. The pushback on quality may help support the broader merino market by discouraging some of this ‘wild blending’.

28 Micron

The 28 MPG lifted slightly this week, with its price ratio to the 21 MPG trading around a lowly 0.4. There does not appear to be much downside for the 28 MPG while broad merino prices stay solid, but weak demand also points to limited upside as well.