Market Morsel: New business, higher prices.

Market Morsel

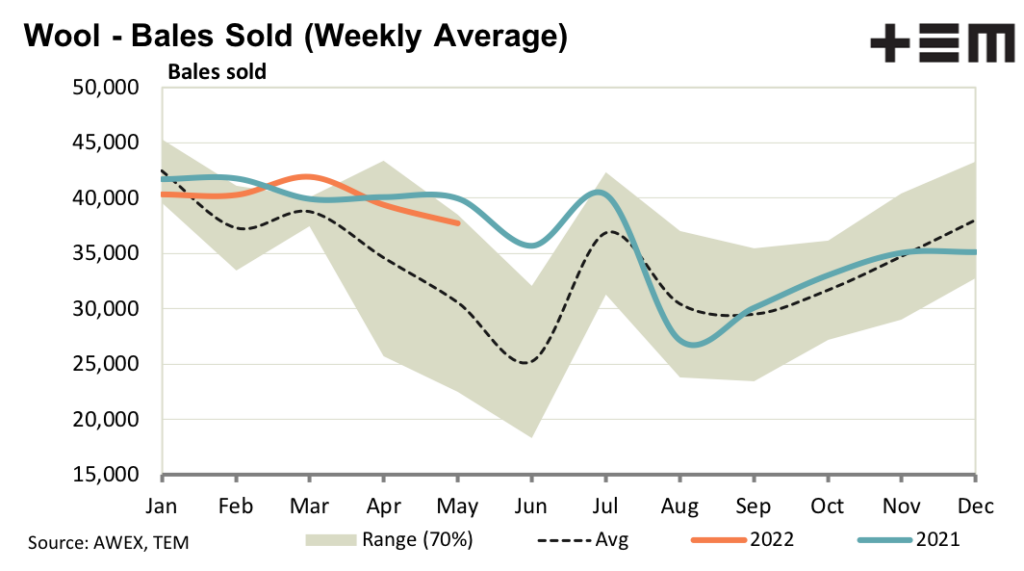

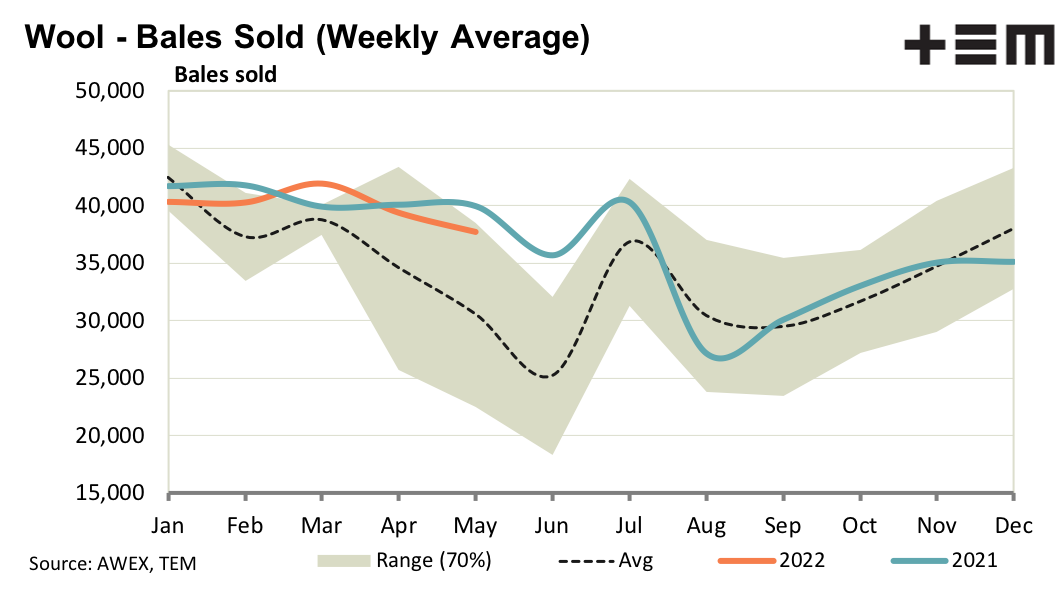

New business reported last week translated into higher prices this week, as offerings follow the normal seasonal pattern of lower volumes. The lower volumes will help exporters deal with financial constraints which have been brought on by slower and less reliable logistics. On the subject of logistics it seems wool may be starting to move through dumps in Australia more easily.

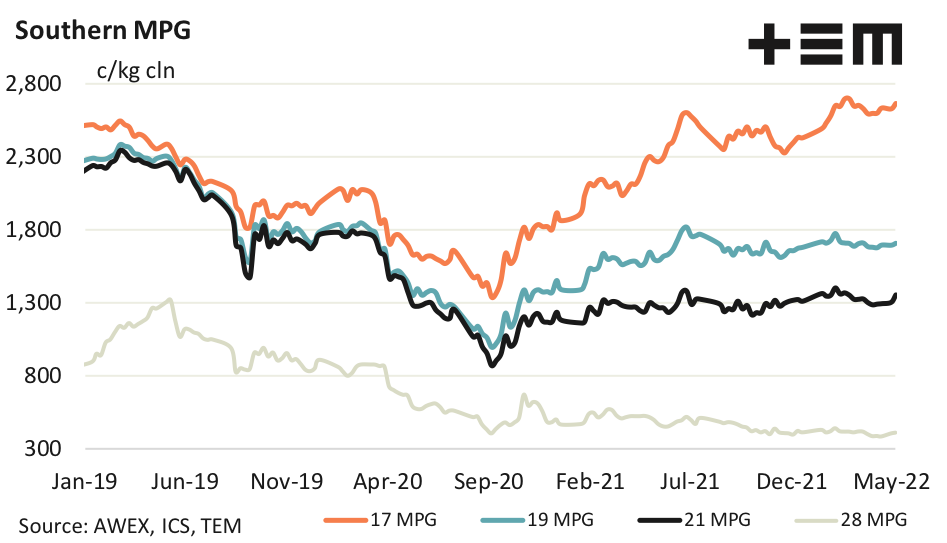

While there is definite economic uncertainty when looking into next season, in the short term apparel fibre prices are generally solid with cotton prices exceptional. The cotton price is up by over 150% on the lows of 2020 and is trading at nominal price levels only seen before in the massive 2011 market. To have the biggest staple fibre market trading at such high levels is a positive for other fibres such as merino wool. Cashmere prices are trading at high levels also, and new business for the 2022-23 season looks to be still focussed on finer 16-18 micron categories which is encouraging given the size of fine micron premiums.

17 Micron

In US dollar and Euro terms the 17 MPG firmed this week after falling since the first week of April. A lower Australian dollar has masked this fall off in price. Supply is variable for fine merino wool, up slightly in the eastern regions and down heavily in Western Australia. Vegetable matter (VM) is a constraint for the finer micron categories in terms of putting consignments together with a VM average of 1%.

19 Micron

South Africa sold wool at auction again this week, although access to Chinese processors has yet to be arranged given the latest outbreak of foot and mouth disease in South Africa. RWS premiums reported by Cape Wools were somewhat reduced, although this may be due to a lack of access to China. Despite all of the issues surrounding supply chains generally, the merino market continues to track along within its preferred price range established early this season.

21 Micron

Full length (100 mm) broader merino fleece wool with lower VM levels sold very well this week, aided by good staple strength levels. Comparable wool with higher VM and RWS accreditation also sold extremely well. In US dollar terms the 21 MPG bounced back this week from its lowest level since last October.

28 Micron

AWTA data shows that crossbred wool production continues to increase year on year (up by 7% in April). This extra volume is being absorbed by the supply chain as wool held by growers in store is underweight in relation to the proportion grown.