Market Morsel: New business, prices solid

Market Morsel

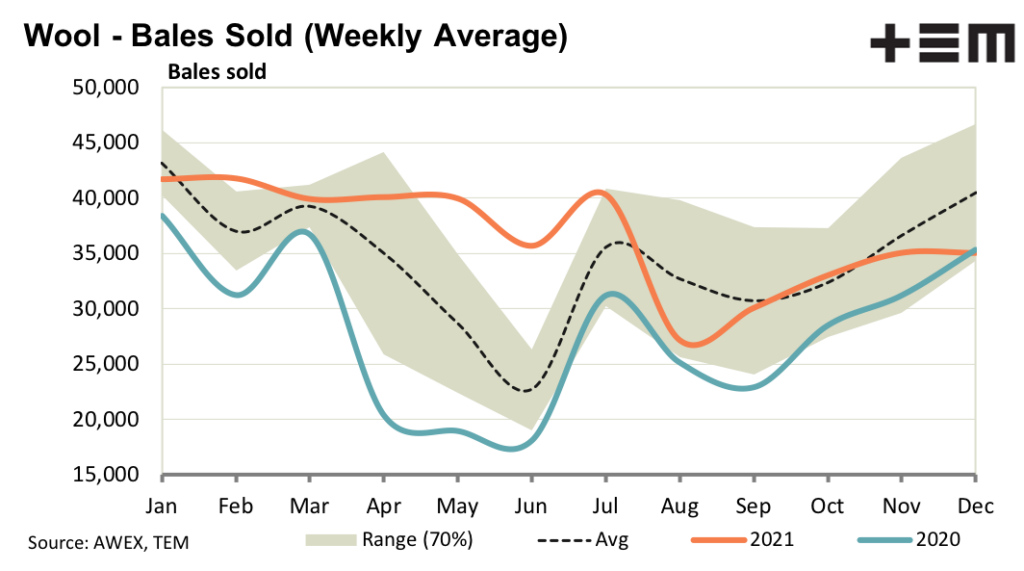

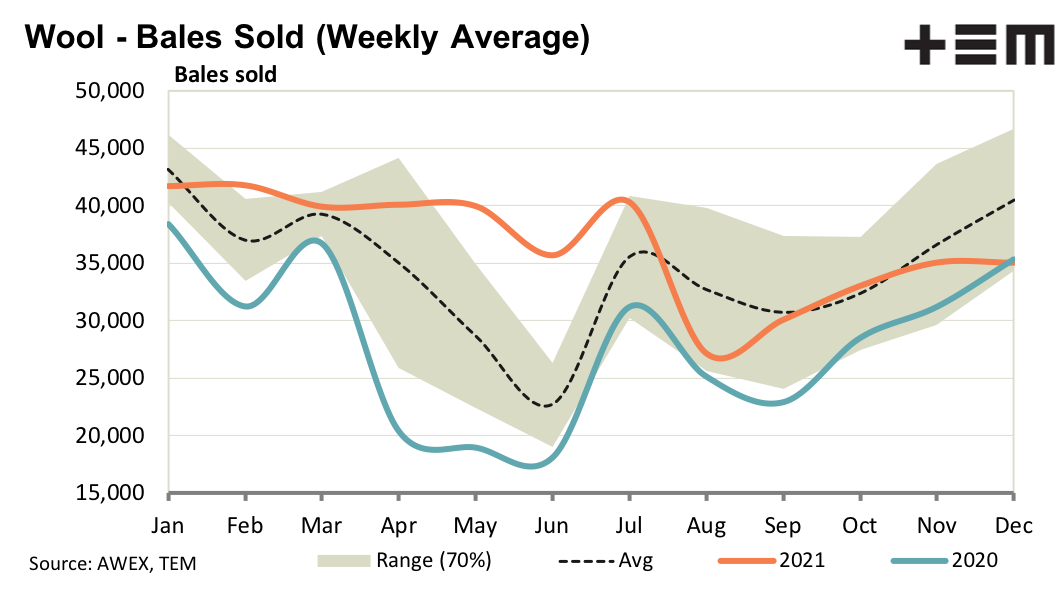

With new business reported to have been written early in the week, in contrast to the normal late week period for fresh business after the sales of the week have been conducted, prices were solid across must categories. Some re-offered lots picked up nicely in both eastern and Fremantle selling centres.

RWS accredited wool was again sought after, helped by the South African market already in recess for the Christmas period. While vegetable matter levels have been falling in recent months, in line with normal seasonal supply patterns, the underlying level remains high for this time of year. Recent rainfall in the northern and pastoral regions (where most of the vegetable matter comes from) points to a plentiful supply in 2022 with presumably rising discounts as the supply picks up.

The merino clip in the eastern regions continues to fine up, in contrast to Western Australia where it continues to broaden. These supply trends will drive change in the price structure of the greasy wool market in 2022.

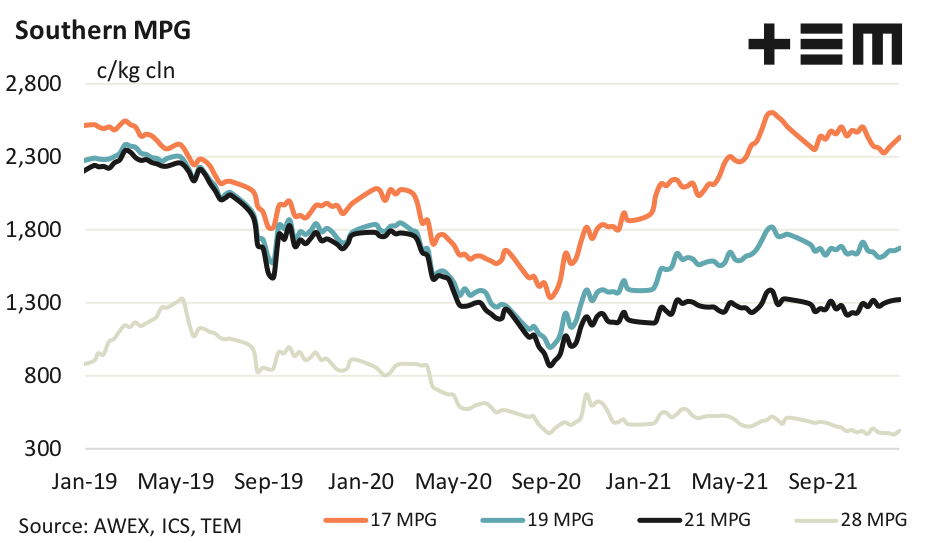

17 Micron

Fine merino prices remain at relatively high levels, especially for the finer categories. The effect of wet weather is starting to show up in the finer NSW wool with more water stain and unscourable colour, as well as some low staple strength. The increased volume of faulty wool will test the market.

19 Micron

RWS wool achieved some big premiums again this week, even where some lots had characteristics which would normally put them in a low grade of wool such as being over long, very low staple strength or high vegetable fault.

21 Micron

Broad merino prices are near 10 year median levels, not low and not high. In contrast cotton prices are close to decade highs with acrylic prices also very strong. Reports are that uniform orders in China are helping pull volume through the supply chain, so broad merino is reasonably priced at a time when there is some good base demand.

28 Micron

A solid merino market, with an easing supply of 21-22 micron wool and extremely low crossbred wool prices points to limited downside for the crossbred wool market. This seems to be the conclusion the forward market has reached.