Market Morsel: Potholes can’t stop a solid finish

Market Morsel

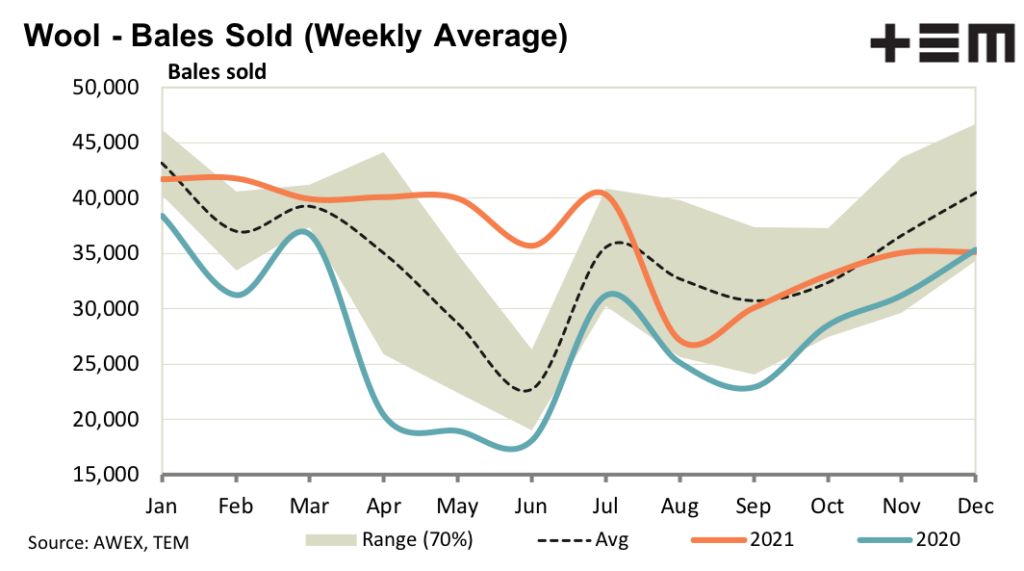

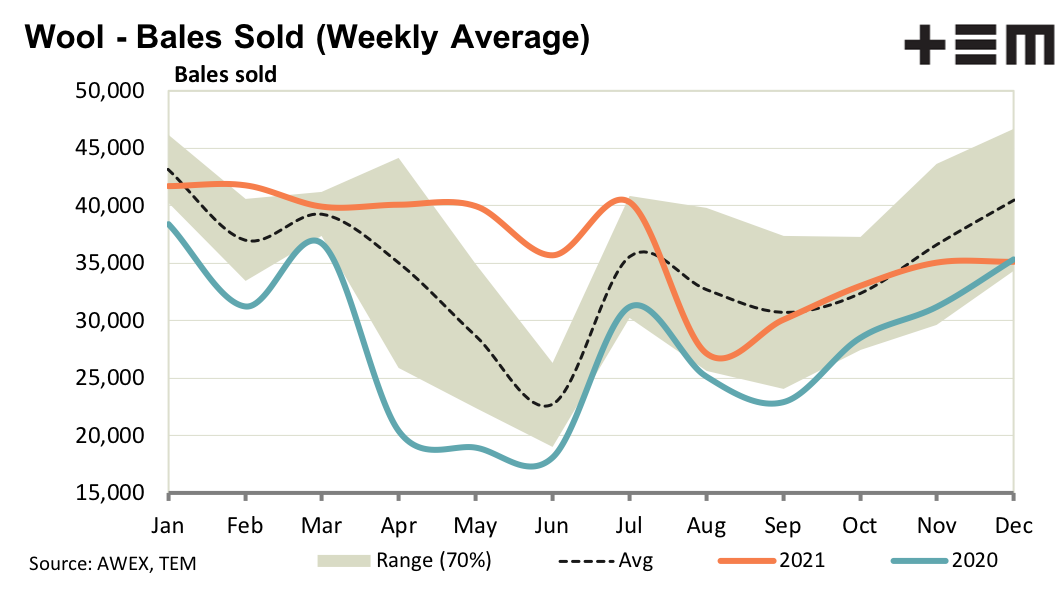

While there were the usual potholes for a market prior to a long recess this week, on the whole it was a solid finish. Prices have been drifting along with little change for the past six weeks, despite some weakness in other fibres as the impact of high energy prices in China abated. Interest in RWS accredited lots continued this week, although the buying was slightly more discerning in terms of wool quality.

Reports indicate that slow shipping, one of the big issues for 2021, is tying up exporters capital and restricting their ability to buy wool. It is expected this factor will persist in the market for some months yet. The view forward into 2022 remains murky, with the latest variant of COVID-19 causing uncertainty. At this stage export orders for mills in China are at healthy levels, uniform orders for the Chinese government are helping support capacity utilisation for the mills (volume of throughput) and Chinese domestic demand is tepid.

The next report will be published on Friday January 14, upon the recommencement of auction sales.

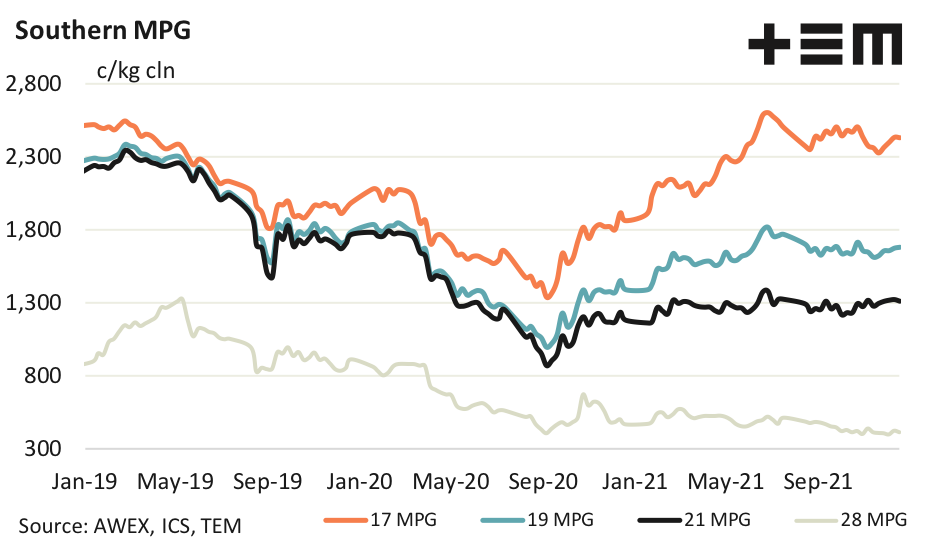

17 Micron

Demand was variable for the sub 18 micron categories this week. This was probably due to a three week recess coming up and exporters working hard to manage their trading capital. However the eastern merino clip continues to fine up so the supply of finer wool will pick up in 2022 and put some pressure on price.

19 Micron

The bulk of the merino clip continues to trade at pre-pandemic levels, which (it was thought at the time) were the bottom of the downward cycle which began in 2018, ending in late 2019. From a cyclical perspective the market has regained half of the fall suffered from 2018 through to mid-2020, but seems stuck at this level.

21 Micron

Some of the broader merino lots struggled on Thursday, as buying was selective – avoiding lower staple strength, lower yield and higher vegetable matter. As a rule prices for better, broader merino lots were flat from 20.3 micron and broader. If anything prices picked up for the broader lots.

28 Micron

The 28 MPG continues to trade around 400 cents, which was the low for the market in 2005-2010 and in 2020. Hopefully this old chart pattern will continue to be a support level, which seems to be what 28 micron forwards are also assuming.