Market Morsel: Resilient fibres

Market Morsel

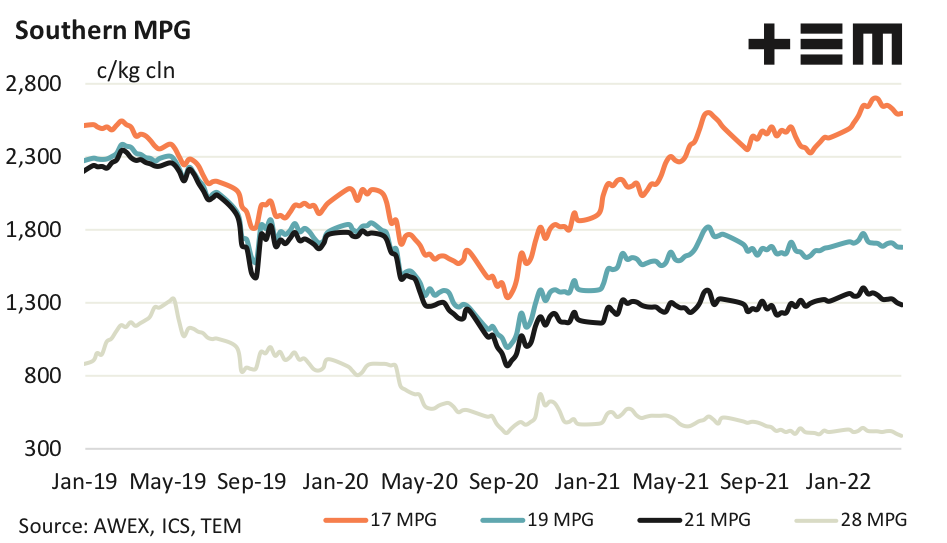

Apparel fibre prices have proved resilient in the face of various recent shocks, with the exception of crossbred wool which has not recovered from the initial COVID shock of mid-2020. Cotton in particular has enjoyed a stellar run. So the apparel fibre price backdrop continues to be a positive one for merino wool. Unfortunately apparel fibre prices do not provide a forward view on merino prices, as they tend to move coincidentally.

For crossbred wool the best that can be said at present is that the supply chain is absorbing increased supplies, at a price. The sales volume of crossbred wool was up by the order of 30% in March, year on year. This is a hefty increase when there is no lack of supply of crossbred wool (albeit of varying quality but then so is the Australian crossbred clip) around the world. Vegetable matter (VM) continues to be an issue especially for 19 micron and finer wool reflecting that a lot of this wool comes from regions which have higher VM in the wool. It is a constraint on exporters building consignments with an average VM of 1%.

17 Micron

RWS premiums were more selectively applied this week, with some resistance reported from exporters. It seems some exporters are sitting on RWS stock and might be having trouble selling it with full premiums. While the 17 MPG looks to be trending lower from February highs, in US dollar terms and from a European perspective prices have been relatively stable during the past six weeks.

19 Micron

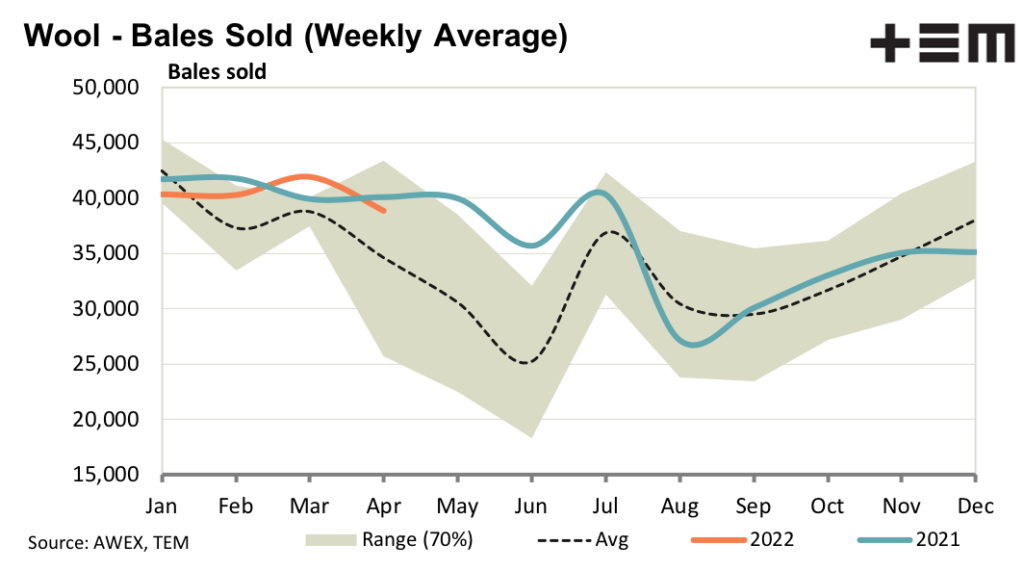

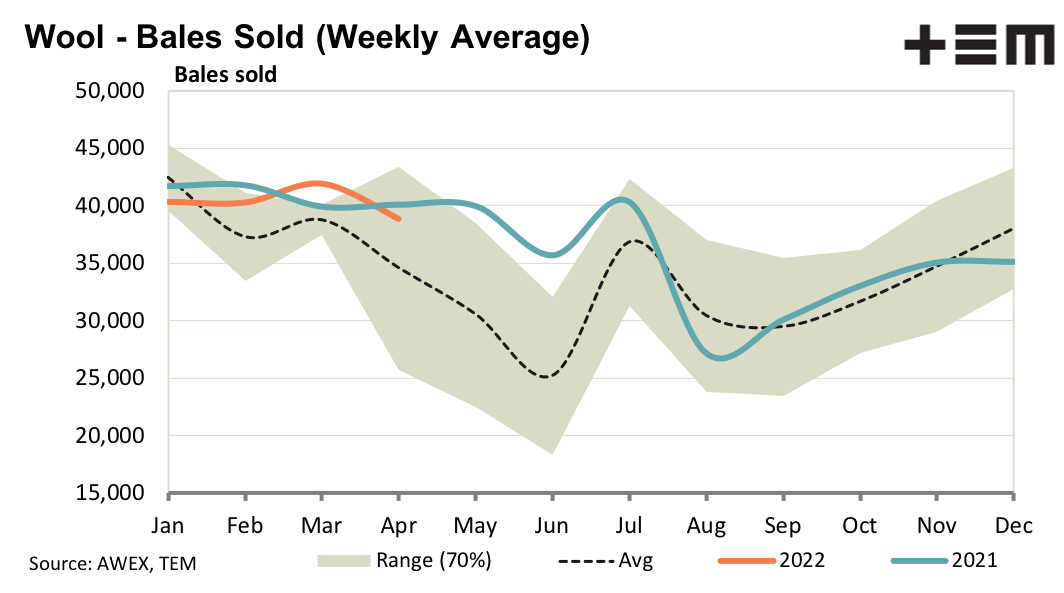

The merino greasy wool market continues to trend sideways, with little change except that induced by changes in the exchange rate. The weekly offering should pull back after Easter, which is a normal seasonal pattern. This will be required as the supply chain will go into its quiet period in the middle of the calendar year (the northern hemisphere summer). Further substantial upside in prices from current levels appears unlikely for the merino market in 2022 in a world working its way through a number of economic shocks.

21 Micron

In eastern Australia AWTA 21 micron volumes were down 24.5% in March (down 23.5% for the three months to March) which is a big fall. The overall Australian supply of 21 micron wool has been bolstered by big increases in Western Australia but the influence of the western clip will ease in the coming months along seasonal lines, so the national supply of 21 micron wool is likely to fall year on year. This will help firm the 21 MPG in relation to the finer micron categories.

28 Micron

Auction data shows that sales of crossbred wool were up by 30% in March, compared to March 2021. AWTA volume data for March shows a continued rise in crossbred wool supply both in the east and in Western Australia (off a much smaller base). The market is absorbing this increased supply at rock bottom prices.