Market Morsel: RWS premiums

Market Morsel

While wool prices are fairly stable in US dollar terms, there are some big premiums being paid for RWS accredited wool both in the merino and crossbred clips. This was certainly evident in sales this week. The supply of RWS wool is not large and, with South Africa not selling this week and the Argentine supply waiting for new season shearing in the spring, there are limited avenues to purchase this wool around the world. Hence the big premiums being paid. Increased shipping times and higher shipping rates continue to add extra strain to the costs of exporters, in the order of 150-200 cents.

That cost is seen by the supply chain, but has to be deducted from prices paid at auction, so the greasy wool market is running some dollars below where prices may have been given pre-covid shipping arrangements. It would be a good time for AWI to commission an update of the Sheep’s Back to Mill publication so these costs become transparent at our end of the supply chain.

17 Micron

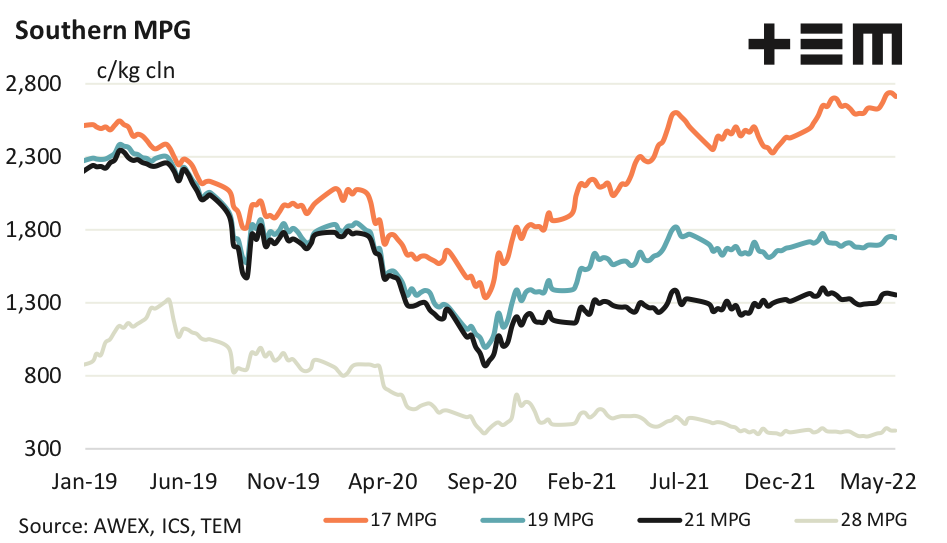

In the absence of a strong price trend, week to week fluctuations in the exchange rate are showing up in the price paid at Australian auctions. The 17 MPG was down slightly this week but when viewed in Euro and US dollar terms it was up again, building on the bounce in price which began early last week.

19 Micron

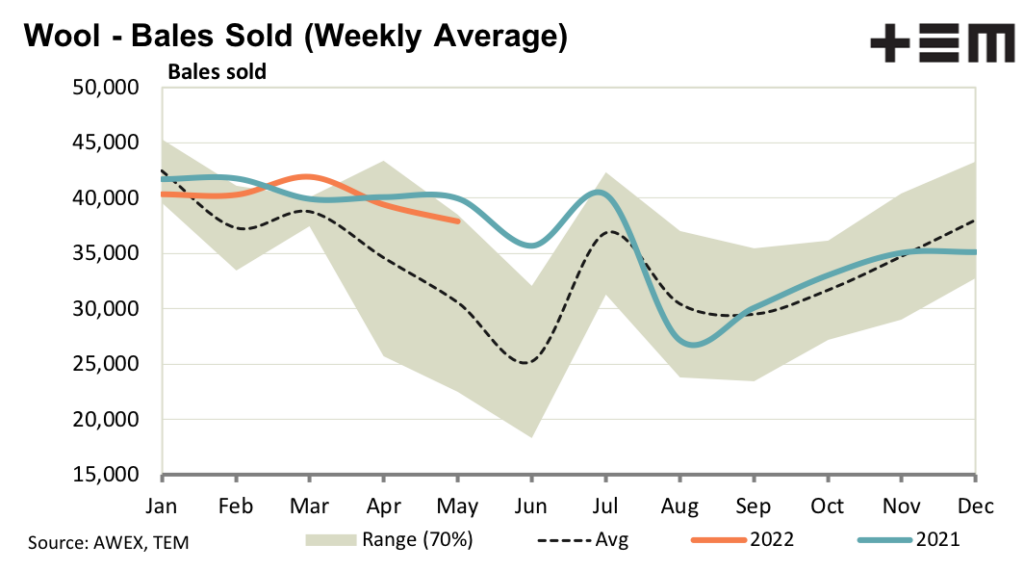

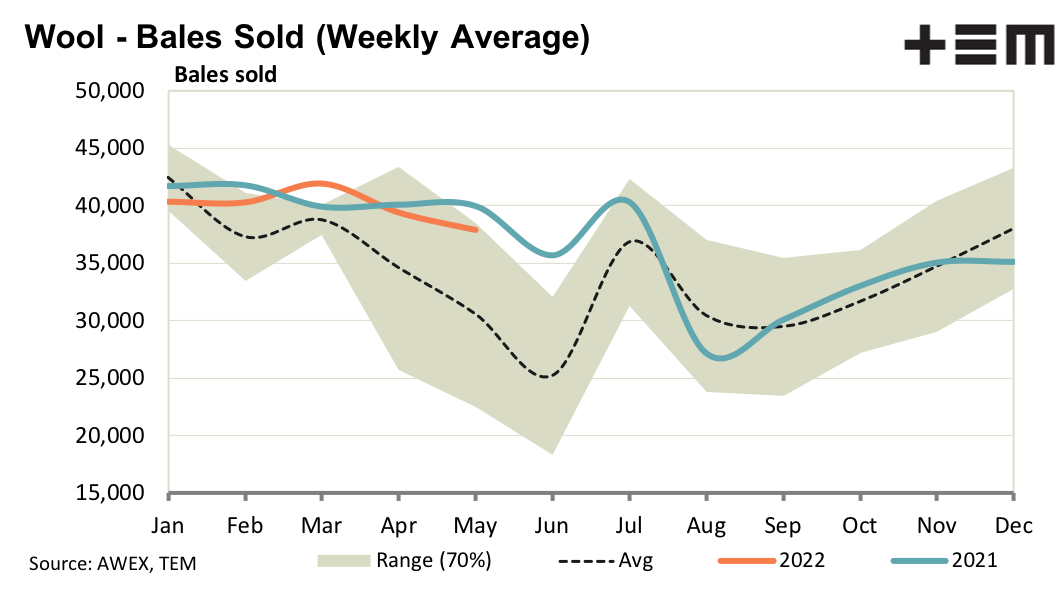

The fibre diameter of the merino clip is close to unchanged (Australia wide) for May, with the Western Australian clip still broader but at a slower rate. Given the run of reasonable seasonal conditions on average, wool volumes will be a function of sheep numbers which will pick up given the low sheep and lamb offtake (slaughter) levels.

21 Micron

The last time the 21 MPG drifted sideways with no real rising trend (up or down) for 18 months, as it has done since early 2021 in US dollar terms, is the 2004-2006 period. The current drift sideways (rising trend in local prices due to a weaker Australian dollar) is therefore unusual.

28 Micron

In looking at crossbred prices the broad end of the crossbred micron range is up some 50% since the lows of mid-2020, which sound good in percentage terms but means 50 cents per kg in US dollar terms and 100 cents per clean kg in AUD terms. “Crossbreds ain’t crossbreds” given the wide micron range, hence end uses, they cover.