Market Morsel: Softer A$ masks greasy weakness

Market Morsel

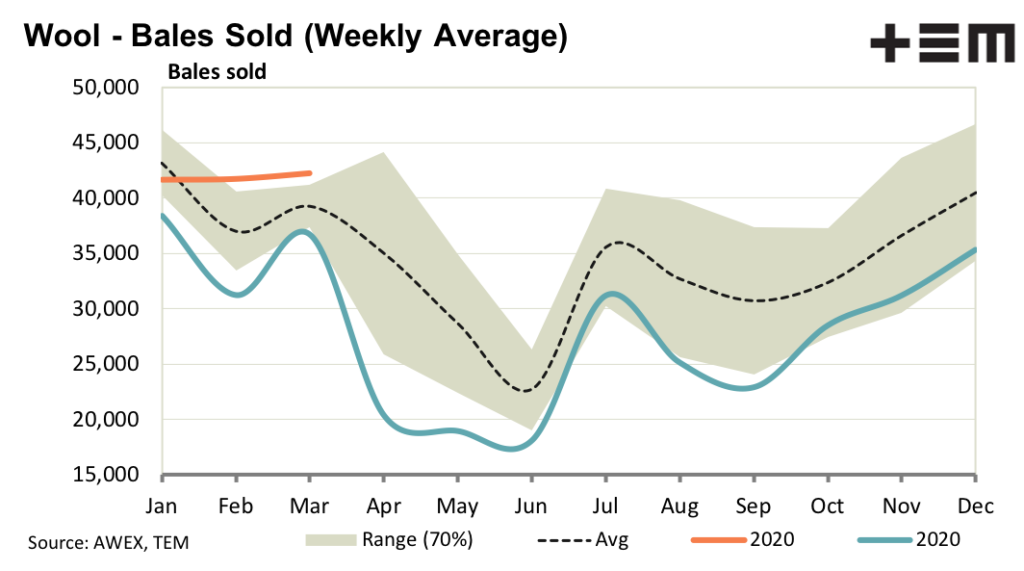

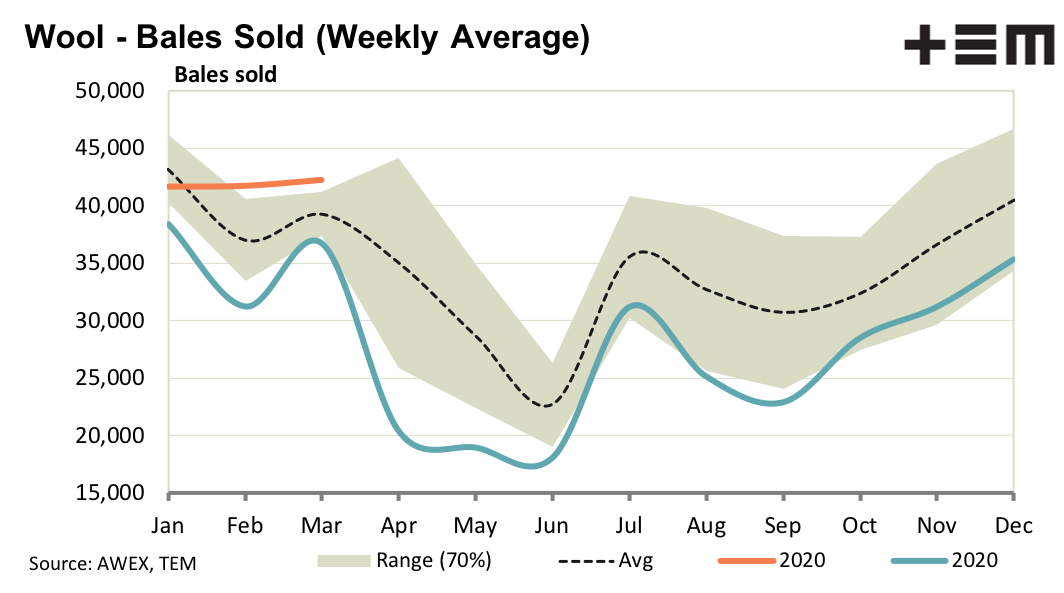

This week it was a case of a weaker exchange rate (down two cents against the US dollar) which masked weakness in the greasy wool from the perspective of the supply chain. Slow logistics continue to stretch trading capital available to exporters by tying up the capital in greasy wool which is slow to be shipped.

Despite the weaker performance in US dollar terms, it was a solid market for most wool types with the exception of low grade crossbreds, low yield cardings and merino wool with higher vegetable fault. Demand for fine cardings remains strong, which is reflected in the relatively high prices for this category in relation to other wool categories and fibres.

Demand out of Europe continues to be reported as extremely quiet. The Chinese economy is expected to slow in late 2021, so an improvement in European and US demand is required as 2021 progresses in order to stop greasy wool prices easing in the coming spring. This will hinge on the effectiveness of vaccination programmes currently under way.

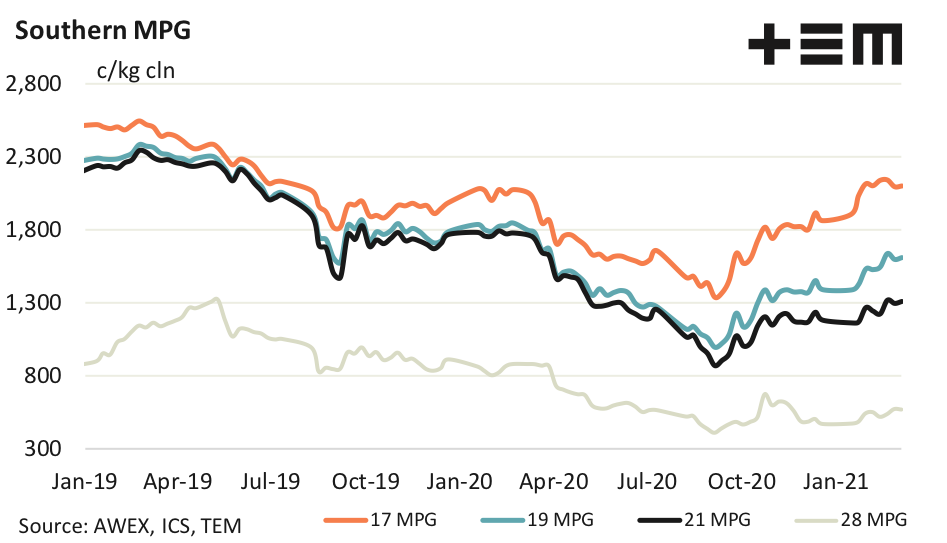

17 Micron

The best performing fine merino categories (compared to history and other fibres) are the cardings. Reports indicate that demand remains very strong for these types of wool, even though the Merino Cardings indicator has been trending lower since January. Prices for sub-16 micron wool remain strong, with very limited supply as the AWTA data shows.

19 Micron

Prices did steady this week, although a weaker exchange rate helpd the local prices. AWTA core test data showed there was little change in 19 micron volumes during the past three months. In price terms the 19 MPG is a shade lower than in late March 2020, having recovered its loses due to COVID-19.

21 Micron

AWTA core test volumes showed a continued increase in 20-22 micron wool in February (aided by an extraordinary rise in NSW volumes of 42%). The NSW increase in volumes seems to be driven mainly by wool from a combination of on farm stocks and delayed shearings. It will certainly have the supply chain scratching their heads as to what is going on with supply in Australia.

28 Micron

The 28 MPG held around 0.43-0.44 of the 21 MPG this week. More encouragingly the New Zealand coarse crossbred market (centred on 38-39 micron) has been rising in the past month (from extraordinarily low prices) which will help to shore up prices on the coarser side of 28 micron.