Market Morsel: Solid footing

Market Morsel

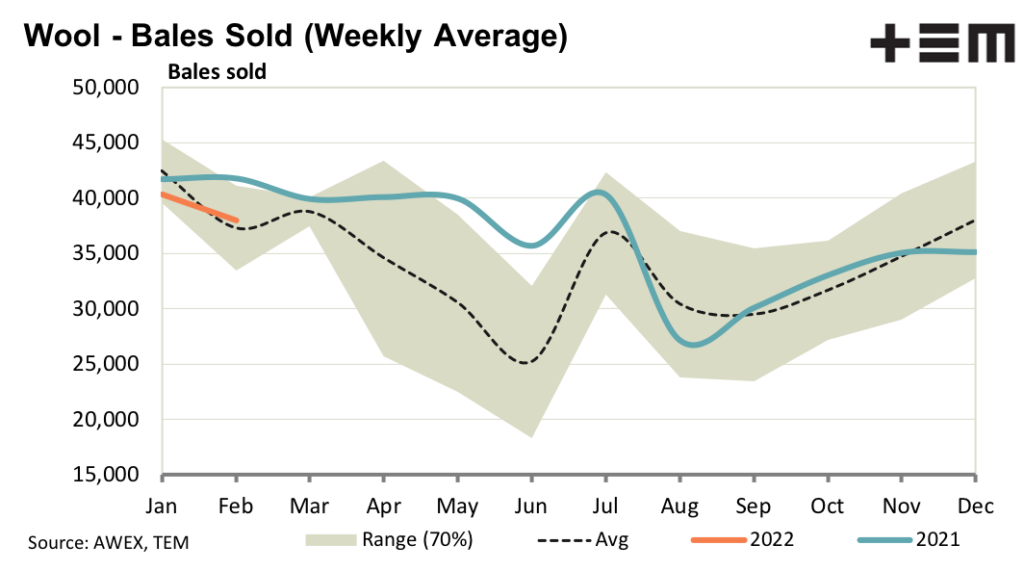

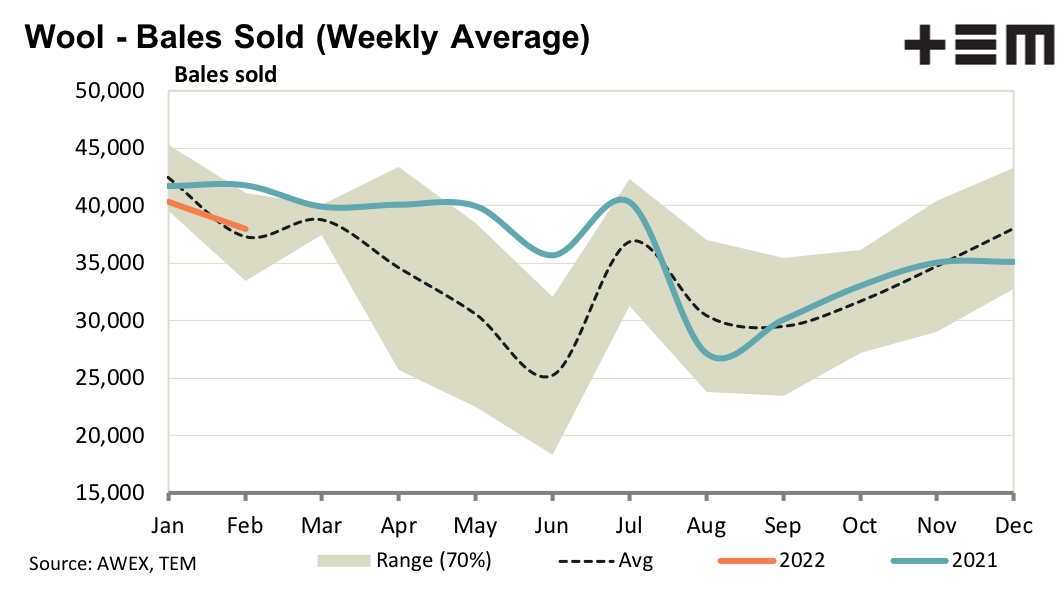

After starting shakily in response to a large rostering of over 50,000 farm bales the Australian market finished the week on a solid footing, after South Africa cancelled their sale for the week on Tuesday night thereby taking 7-8,000 bales of merino wool off the market. South Africa took this drastic step because there is the equivalent of 3-4 weeks of shipping (for Chinese ports) in the dumps awaiting ships. This has tied up storage space and trading capital to such an extent it was judged necessary to stop sales, in order to allow this part of the supply chain to clear.

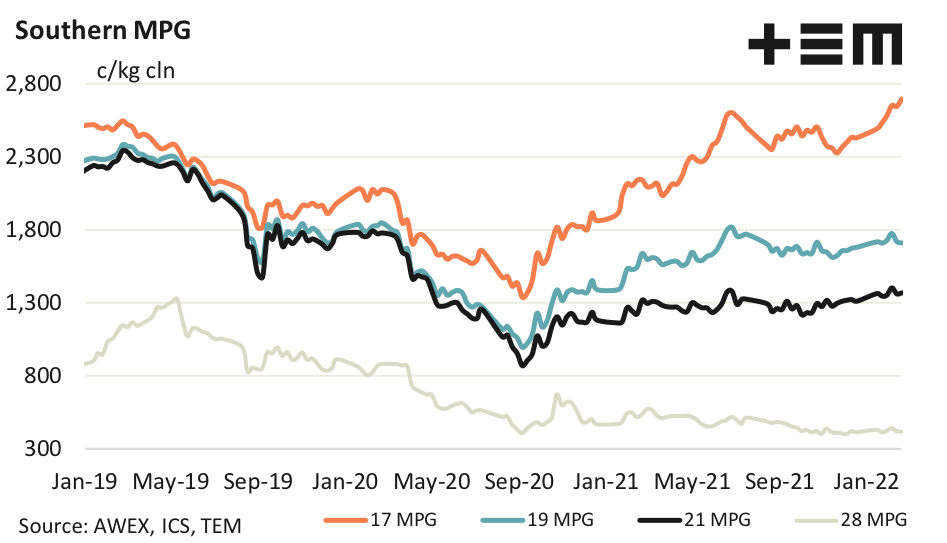

Finer merino prices picked up, with fine merino premiums widening back to levels seen in mid-2021 in US dollar terms. This means they most likely are nearing their upper limits. In contrast the medium and broad merino prices are trundling along without any great trend upwards or downwards, with some confidence in their prices levels coming from the supply chain. In the short term it is logistic issues which pose the biggest risk to wool prices.

17 Micron

The 17 MPG lifted strongly this week, with the 17 to 21 MPG premium rising to its highest level in cents per kg terms since 2001. However in US dollar terms the premium is close to its recent peak level reached in mid-2021, and there are reports of some shifting of orders out of 17.5 into 19.5 micron.

19 Micron

The absence of South African auctions reduced the offering of merino bales in the combined Australian/South African centres by around 15% for the week. It is not clear yet if South African will sell again next week, as they have to physically ship wool to clear some space in the dumps and allow exporters to roll over their trading capital. In the meantime the 19 MPG is likely to drift along near current levels.

21 Micron

The broader merino indicators held their value this week, with some solid RWS premiums paid. These have been averaging, as a rule, in the range of 200-300 cents in February. Feedback out of the supply chain indicates no great issue with the current price levels. In the short term it seems that logistic interruptions are the biggest risk to the market.

28 Micron

Crossbred indicators finished marginally lower this week. In US dollar terms these indicators are tracking along at extremely low levels, with enough demand around at present to hold them at these prices (around US300 for the 28 MPG and around US400 for 27 micron).