Market Morsel: Spring comes unsprung

Market Morsel

In general wool prices eased this week, as the weakening economic backdrop to the market became more tangible through less new business. Unfortunately the economic weakness has some time to run, so demand is likely to continue weakening through the spring. Bidders in the forward wool market are limiting their interest to the near months due to economic uncertainty.

A lower Australian dollar will help cushion the effect at Australian markets and the finer merino categories are currently trading at high price levels. Premiums for RWS accredited wool, with at least reasonable specifications, are also receiving sizeable premiums, across the merino micron range.

The backlog of wool in South Africa which was mentioned last week has caused the sale next week to be delayed, in order to allow some wool to be shipped. From an RWS perspective this means access to supply is being limited, which should help interest in Australian RWS wool offered for sale.

Looking across to other fibres, cotton production is being impacted by both drought and floods. In China power rationing is helping limit the production of man made fibres. So, not all the uncertainty in the world is bad for wool prices, but it is certainly a complex commercial environment.

17 Micron

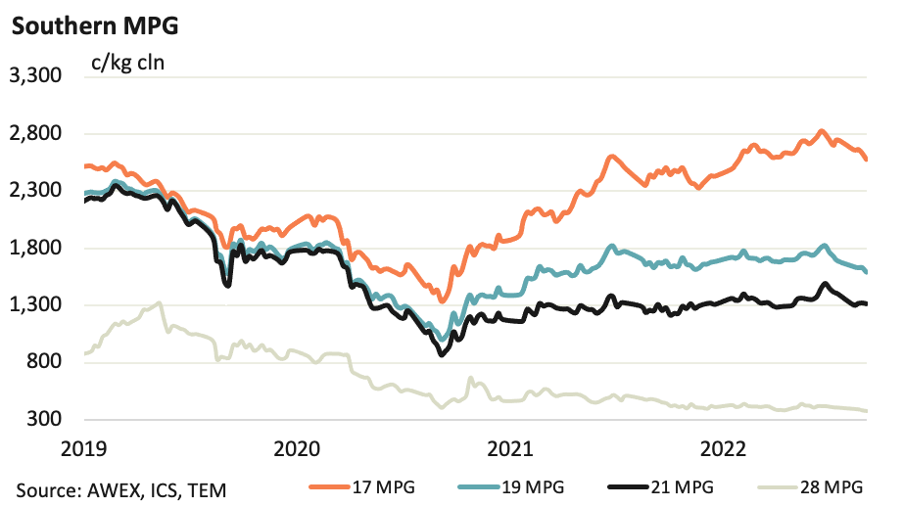

The 17 MPG remains at twice the price level of the 21 MPG, reflecting the still extremely strong premiums and discounts for micron operating in the wool market. Fibre diameter remains little changed, year on year, so there are no big swings in fine wool production likely this season. Change in volume is therefore not going to be a big factor in driving changes in micron premiums and discounts.

19 Micron

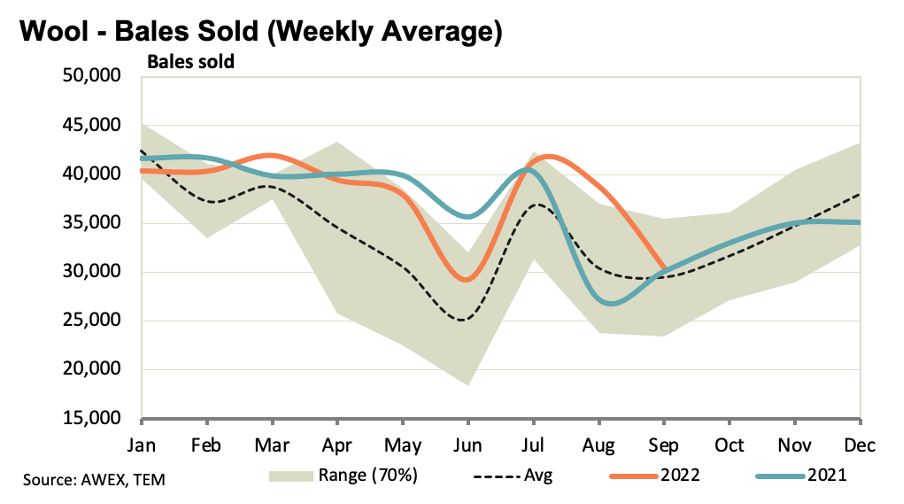

AWTA core test volumes were well up in eastern Australia during August, and well down in Western Australia. A look at the BOM August rainfall map for Western Australia explains why volumes were down there – it was very wet. In the east there looked to be some catch up the volume data, with an underlying increase in the flock continuing as revealed by the continued low slaughter levels.

21 Micron

In a change from early 2022, demand at auction for broader merinos is solid. Vegetable matter levels have eased slightly but it is the interest out of China for uniform orders which is the main driver of improvement for this sector of the market.

28 Micron

At the risk of sounding like a stuck record there is little good news out and about for crossbred wool. The poor domestic economy in China, and from that the domestic demand for wool apparel, is certainly not helping the situation crossbred categories are in.