Market Morsel: Unchanged

Market Morsel

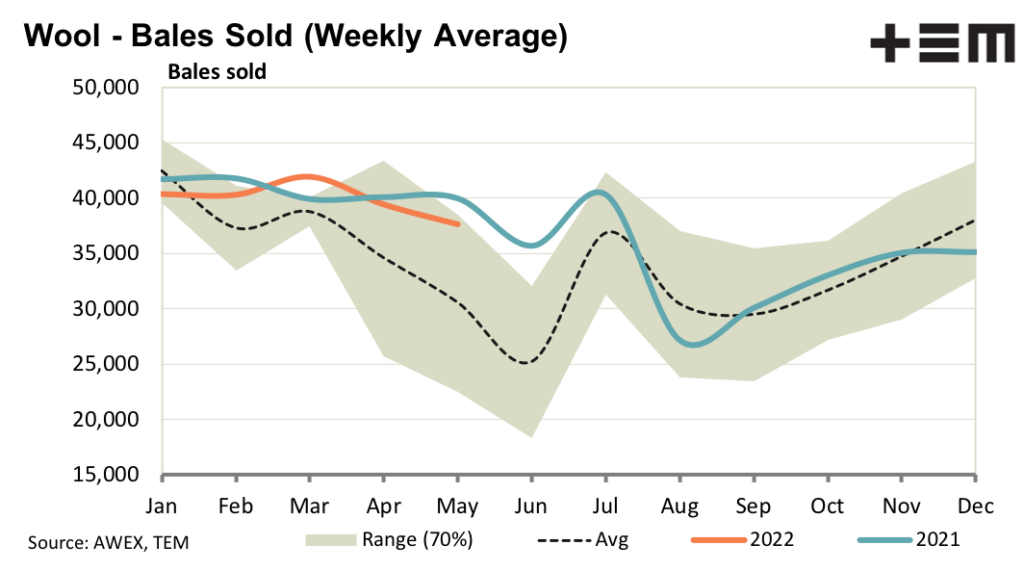

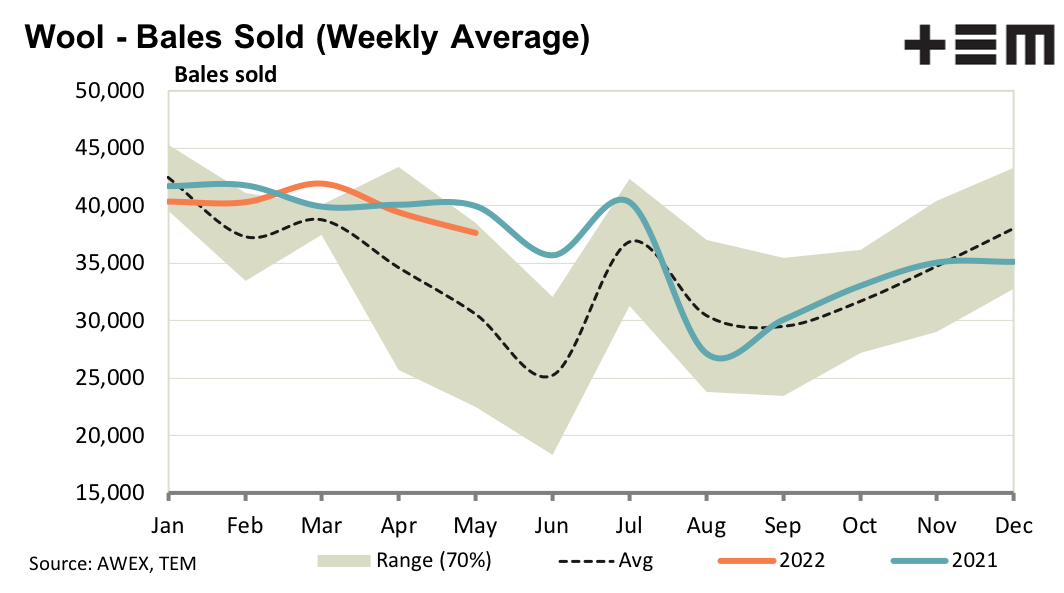

It was another week of an unchanged greasy wool market in US dollar and Euro terms with a small increase in Australian dollar terms. The market did finish on a solid note with Fremantle prices for fleece above eastern closing levels. Apparel fibre prices also firmed this week (cotton and polyester staple fibre) so the fibre backdrop to the greasy wool market remains supportive.

As mentioned in previous reports, the domestic Chinese market looks set to weaken through the rest of 2022 with this scenario starting to be well acknowledged along the supply chain. Despite the problems in the world, some apparel fibres (cotton, cashmere and fine merino) continue to have a stellar run. Consumer expenditure continues to be skewed towards goods rather than services, an outcome of the pandemic and internet shopping, which is offsetting what negatives there are in the world.

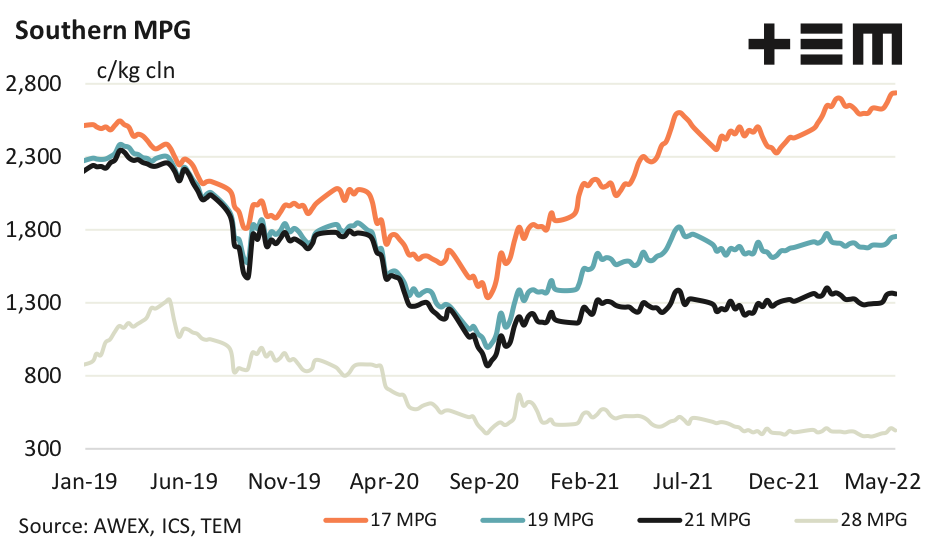

17 Micron

The Australian dollar continues to support the 17 MPG in local prices, pushing the 17 MPG to levels not seen since October 2018. In US dollar and Euro terms it is little changed since late April. Vegetable matter levels have become an issue for fine merino with 15 micron VM levels reaching their highest in four years this week.

19 Micron

RWS premiums on the finer side of 19 micron appear to be appreciably smaller (due to a higher base price) than on the broader side in cents per kg terms. It is hard to use South Africa as a benchmark at present as they are struggling with the Chinese moratorium on South African wool due to the outbreak of foot and mouth disease.

21 Micron

Some reports of a reaction to the high cotton prices (replacing some cotton with polyester staple fibre) suggests the rampant cotton market is starting to run into resistance. Regardless the 21 to cotton price ratio is so low, the downside risk for broad merino looks to be modest at best.

28 Micron

Another look at crossbred prices in the past decade suggests prices were dragged higher by a rampant cotton marketing 2011-12, held up by fake fur and associated fabrics and then supported into 2017-2018 by a strong merino market. The extended period of high prices seems to have led to demand destruction, from which prices are now suffering.